The Cuyahoga Ohio Acquisition Agreement is a legal contract between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd, outlining the details of exchanging company stock. This agreement serves as a means for these companies to consolidate their resources, assets, and operations to enhance their market position and strategic goals. In this Acquisition Agreement, Orient Packaging Holdings Ltd is the acquiring company, while Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd are the target companies being acquired. The exchange of company stock allows Orient Packaging Holdings Ltd to gain ownership and control over the target companies' assets, subsidiary firms, intellectual property rights, customer base, and financial resources. By entering into this Agreement, the parties aim to leverage their combined expertise, experience, and market presence to achieve economies of scale, increased efficiency, and improved competitiveness in the relevant industry. The mutual benefits of this exchange of stock include broader market reach, diversified product portfolios, access to new markets, and enhanced profitability. Furthermore, the Agreement may specify various types of Cuyahoga Ohio Acquisition Agreements, each catering to distinct circumstances and objectives. Some potential variations of this agreement type could include: 1. Strategic Merger Agreement: This agreement focuses on combining the strengths and resources of the involved companies to create a new entity that is stronger and more capable than each individual entity alone. It may involve the formation of a new legal entity or the integration of the target companies into the acquiring company. 2. Asset Purchase Agreement: In an asset purchase agreement, the acquiring company selects specific assets or divisions of the target companies that align with their strategic objectives. This agreement may exclude the assumption of certain liabilities or obligations, allowing for a more targeted acquisition. 3. Stock Swap Agreement: This agreement involves the mutual exchange of company stocks between the acquiring company and the target companies. It allows for the parties to become shareholders in each other's firms, sharing ownership and potential benefits or risks associated with the stocks. 4. Joint Venture Agreement: In a joint venture agreement, the involved parties form a new legal entity, distinct from their respective organizations, to undertake a specific project or pursue a strategic objective collectively. This agreement allows for shared resources, risks, and profits between the companies. Overall, the Cuyahoga Ohio Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd reflects the intent to consolidate their operations and resources through exchanging company stock. The particular type of agreement will be determined by the parties involved, aligning with their goals, preferences, and legal requirements.

Cuyahoga Ohio Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock

Description

How to fill out Cuyahoga Ohio Acquisition Agreement Between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. And Everford Comsec Ltd Regarding Exchange Of Company Stock?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Cuyahoga Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Cuyahoga Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Cuyahoga Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock:

- Ensure you have opened the proper page with your localised form.

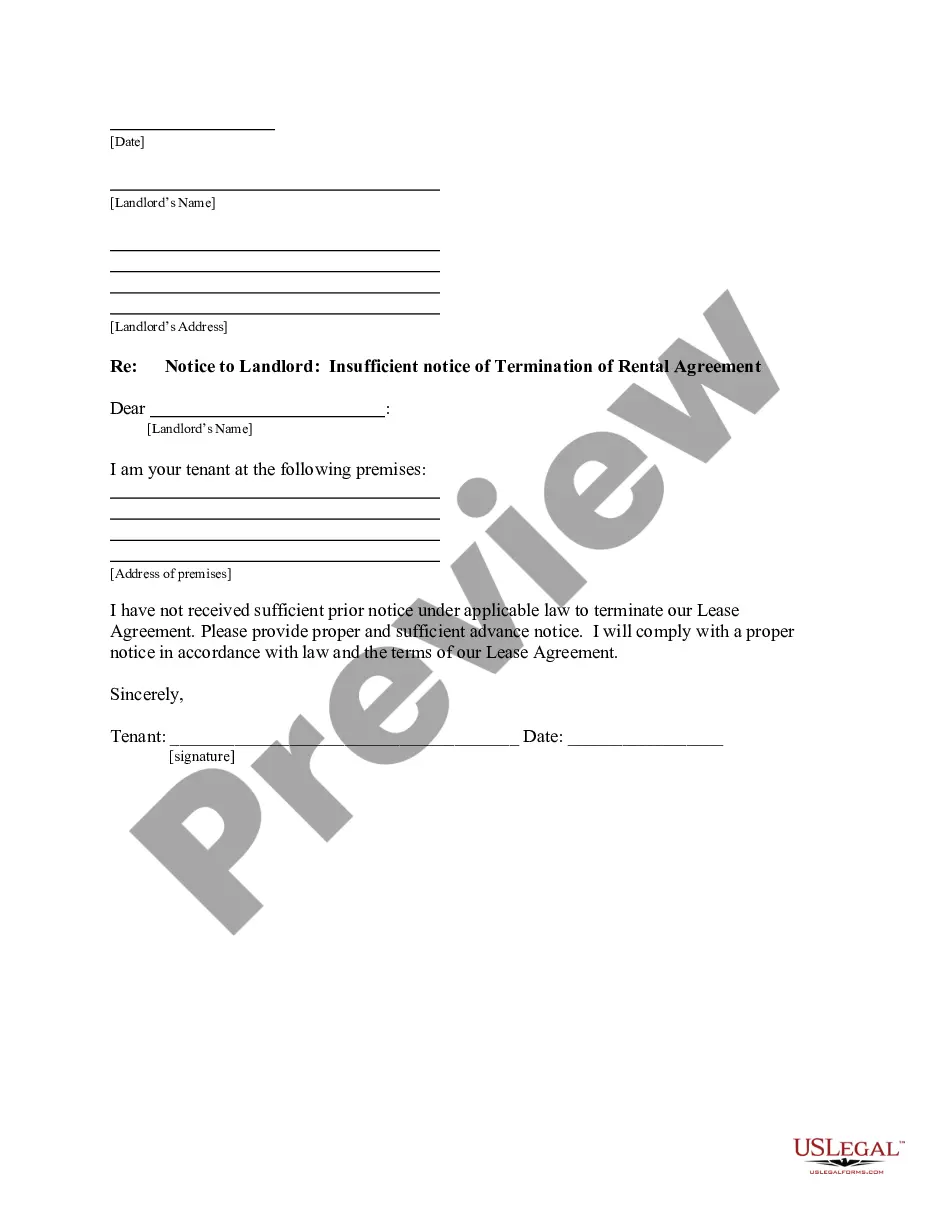

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Cuyahoga Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!