A San Antonio Texas Plan of Merger and Reorganization is a legally binding agreement that outlines the process of combining two or more companies, BOX Acquisition Company X, Inc., BiznessOnline. Com, Inc., and Prime Communications Systems Inc., into a single entity. This strategic move aims to enhance their competitive position, maximize business synergies, and drive overall growth in the market. The Plan of Merger and Reorganization involves multiple steps, including an analysis of each company's financials, assets, liabilities, and operations. It outlines the terms of the merger, such as the exchange ratio of shares, the treatment of outstanding stock options, and the appointment of key management personnel. This particular merger and reorganization plan encompasses different types of San Antonio Texas Plan of Merger and Reorganization, including: 1. Vertical Merger: This type of merger involves companies operating within the same industry but at different stages of the supply chain. BOX Acquisition Company X, Inc., BiznessOnline. Com, Inc., and Prime Communications Systems Inc. might explore this option to gain control over their value chain, improve efficiency, and reduce costs. 2. Horizontal Merger: In this type of merger, companies operating in the same industry and offering similar products or services come together to form a more substantial entity. BOX Acquisition Company X, Inc., BiznessOnline. Com, Inc., and Prime Communications Systems Inc. could consider a horizontal merger to expand their market share, compete more effectively, and consolidate resources. 3. Conglomerate Merger: Alternatively, the three entities may pursue a conglomerate merger, which involves companies operating in unrelated industries. This type of merger allows the merging parties to diversify their business interests, access new markets, and leverage shared resources and knowledge. The San Antonio Texas Plan of Merger and Reorganization will also address various legal and regulatory requirements, including obtaining necessary approvals from shareholders, securing regulatory clearances, and complying with antitrust laws. It may detail the timeline for integration, the allocation of assets and liabilities, and any potential restructuring or layoffs. By executing a comprehensive and well-structured Plan of Merger and Reorganization, BOX Acquisition Company X, Inc., BiznessOnline. Com, Inc., and Prime Communications Systems Inc. aim to achieve strategic objectives, strengthen their market position, and create value for their shareholders while fostering growth and innovation in San Antonio, Texas.

San Antonio Texas Plan of Merger and Reorganization between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc.

Description

How to fill out San Antonio Texas Plan Of Merger And Reorganization Between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc.?

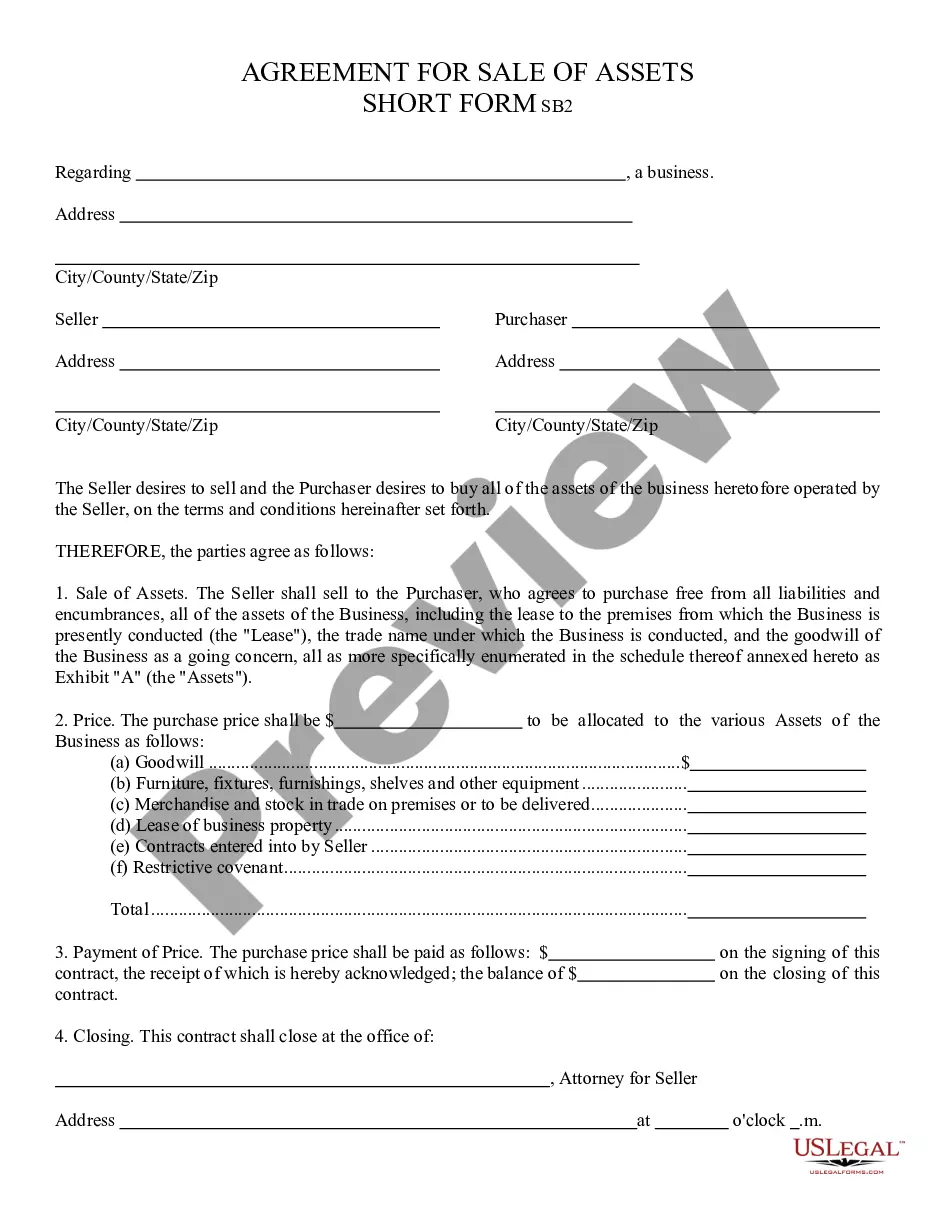

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio Plan of Merger and Reorganization between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc., it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the recent version of the San Antonio Plan of Merger and Reorganization between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Plan of Merger and Reorganization between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc.:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your San Antonio Plan of Merger and Reorganization between BOL Acquisition Company X, Inc., BiznessOnline.Com, Inc., Prime Communications Systems Inc. and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A merger, or acquisition, is when two companies combine to form one to take advantage of synergies. A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock.

Market estimates place a merger's timeframe for completion between six months to several years. In some instances, it may take only a few months to finalize the entire merger process. However, if there is a broad range of variables and approval hurdles, the merger process can be elongated to a much longer period.

In the first step, the buyer initiates a tender offer to acquire at least a majority of the outstanding target company's stock. In the second step, the buyer completes a back-end merger to acquire the balance of the target company's stock.

Common Sections in Agreements Of Merger THE MERGER. DISSENTING SHARES; PAYMENT FOR SHARES; OPTIONS. REPRESENTATIONS AND WARRANTIES. REPRESENTATIONS AND. COVENANTS. CONDITIONS TO CONSUMMATION OF THE MERGER. TERMINATION; AMENDMENT; WAIVER. MISCELLANEOUS.

The goal of the takeover by the acquirer is to achieve at least 51% ownership in the target company's stock. The strategies used in a hostile takeover can create additional demand for shares while creating an acrimonious battle for control of the target company.

Under the accounting rules if you acquire a controlling stake (typically over 50% of the shares outstanding) in another company you must consolidate 100% of the assets and liabilities, revenues and expenses even though you might not own 100%.

The merger and acquisition process includes all the steps involved in merging or acquiring a company, from start to finish. This includes all planning, research, due diligence, closing, and implementation activities, which we will discuss in depth in this article.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

SEC filings provide company merger and acquisition details. Both the acquirer and acquiree must file reports. Specific merger or acquisition terms must be disclosed in the company's 8-K report; 8-K reports must be filed within four days of the M & A.

All states require a statutory percentage of ownership before the short-form merger can be used. The majority of states require 90% but a minority of states require a larger or smaller percentage.