A Bexar Texas Underwriting Agreement between Internet. Com Corp. and Internet World Media, Inc. serves as a legally binding contract that outlines the terms and conditions for the sale and purchase of shares of common stock between the two companies. This agreement plays a crucial role in the process of underwriting stock offerings, ensuring the smooth execution of the transaction and safeguarding the interests of both parties involved. The Bexar Texas Underwriting Agreement between Internet. Com Corp. and Internet World Media, Inc. typically includes several key elements and provisions. Firstly, it outlines the details of the offering, such as the number of shares being offered and the price per share. It also specifies the underwriting terms, such as the commission or fees payable to the underwriters, the timeline for the offering, and any potential discounts or concessions given to the underwriters. Furthermore, the agreement includes representations and warranties made by Internet. Com Corp. to Internet World Media, Inc., ensuring the accuracy and completeness of the information provided. This helps to build trust between the parties and provides a foundation for transparency throughout the offering process. The Bexar Texas Underwriting Agreement may also include a lock-up period, which restricts the underwriters from selling their purchased shares for a specified period after the offering. This provision intends to prevent sudden fluctuations in the market due to an overload of shares hitting the market at once. If there are different types of Bexar Texas Underwriting Agreements between Internet. Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock, they could be named based on distinct characteristics. For instance, they could be categorized as Initial Public Offering (IPO) Underwriting Agreements, Follow-on Offering Underwriting Agreements, or Private Placement Underwriting Agreements. Each type would have its own specific terms and conditions tailored to the particular circumstances and requirements of the offering.

Bexar Texas Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock

Description

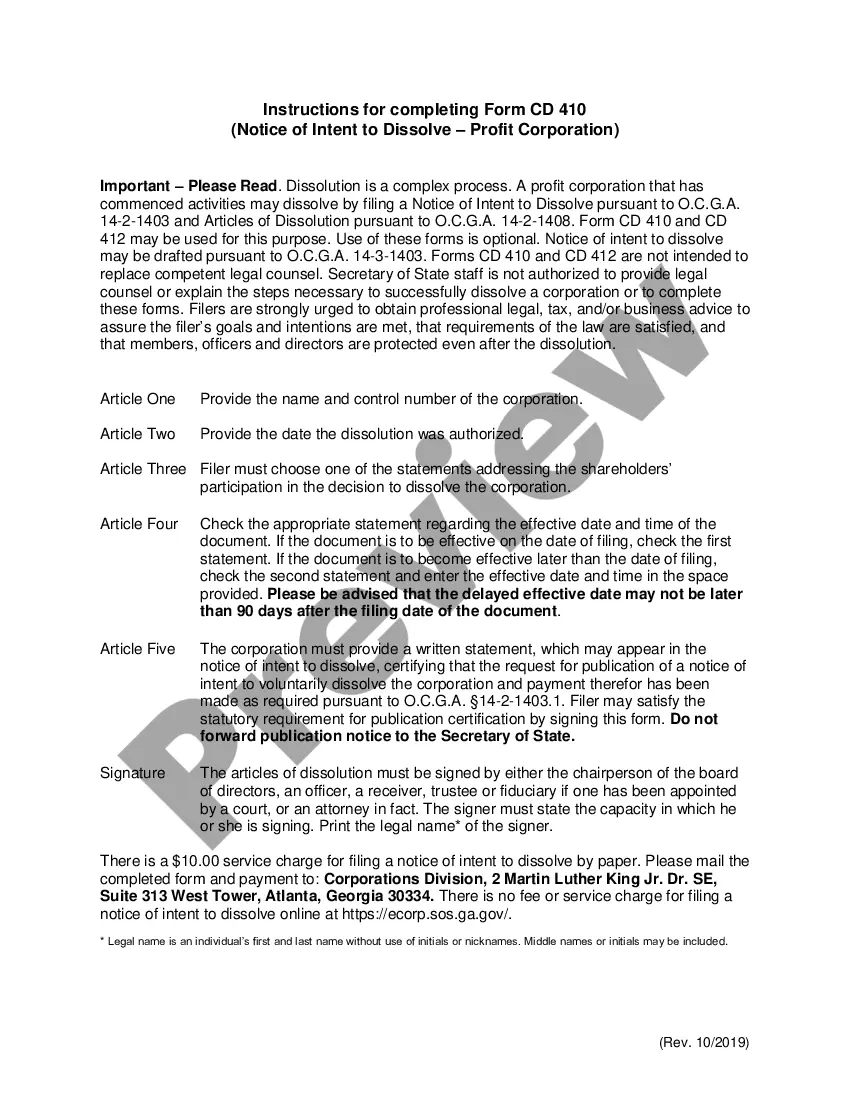

How to fill out Bexar Texas Underwriting Agreement Between Internet.Com Corp. And Internet World Media, Inc. Regarding The Sale And Purchase Of Shares Of Common Stock?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Bexar Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Bexar Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

A registration statement is a filing with the SEC making required disclosures in connection with the registration of a security, a securities offering or an investment company under federal securities laws.

An underwriting agreement is a contract between the group of banks, on the one hand, and the company issuing securities, on the other hand. The bank syndicate is the group of banks handling the transaction.

Registration statements have two principal parts. In the prospectus, your company must clearly describe important information about its business operations, financial condition, results of operations, risk factors, and management. The prospectus must also include audited financial statements.

2) Firm underwriting - where an underwriter agrees to buy a certain number of shares/debentures in addition to the shares he has to take under the underwriting agreement.

There are three main types of commitment by the underwriter: firm commitment, best efforts, and all-or-none. In a firm commitment, the underwriter fully commits to the offering by buying the entire issue and taking financial responsibilities for any unsold shares.

The underwriting agreement contains the details of the transaction, including the underwriting group's commitment to purchase the new securities issue, the agreed-upon price, the initial resale price, and the settlement date. A best-efforts underwriting agreement is mainly used in the sales of high-risk securities.

A registration statement is a document providing qualitative and quantitative information to investors that issuers must file with the Securities and Exchange Commission (SEC) in order to publicly offer securities.

A registration statement is a document containing important financial disclosures that a company publishes before going public and offering securities (like common stocks, preferred stocks, or bonds) to public investors.

Registration is the process by which a company files required documents with the Securities and Exchange Commission (SEC), detailing the particulars of a proposed public offering. The registration typically has two parts: the prospectus and private filings.