Chicago Illinois Underwriting Agreement is a legal document that outlines the terms and conditions between Internet. Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock. This agreement plays a crucial role in facilitating the stock offering process and ensuring a fair and transparent transaction. It serves as a binding contract that governs the rights and obligations of both parties involved. Keywords: Chicago Illinois Underwriting Agreement, Internet. Com Corp., Internet World Media, sale and purchase, shares of common stock. There are different types of Chicago Illinois Underwriting Agreements that can be employed between Internet. Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock. Some notable types include: 1. Firm Commitment Underwriting Agreement: This type of agreement is the most common and straightforward. It stipulates that the underwriter guarantees the purchase of all shares being offered, regardless of whether they can be sold to investors or not. The underwriter assumes the risk associated with the unsold shares. 2. The Best Efforts Underwriting Agreement: In this type of agreement, the underwriter commits to making its best efforts to sell as many shares of common stock as possible, but there is no guarantee that all shares will be sold. The underwriter does not assume the risk of unsold shares. 3. All or None Underwriting Agreement: This agreement requires that all shares offered must be sold; otherwise, the entire offering will be canceled. It provides a higher level of certainty for the issuer that the entire offering will be completed. 4. Standby Underwriting Agreement: This type of agreement is commonly used for rights offerings or when there is a need to raise additional capital. The underwriter commits to purchasing any remaining shares of common stock not subscribed by existing shareholders. It is essential for both Internet. Com Corp. and Internet World Media, Inc. to carefully consider the type of underwriting agreement that best suits their needs and goals. Each type has its own advantages and risks, and the selection should align with the companies' financial objectives and market conditions.

Chicago Illinois Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock

Description

How to fill out Chicago Illinois Underwriting Agreement Between Internet.Com Corp. And Internet World Media, Inc. Regarding The Sale And Purchase Of Shares Of Common Stock?

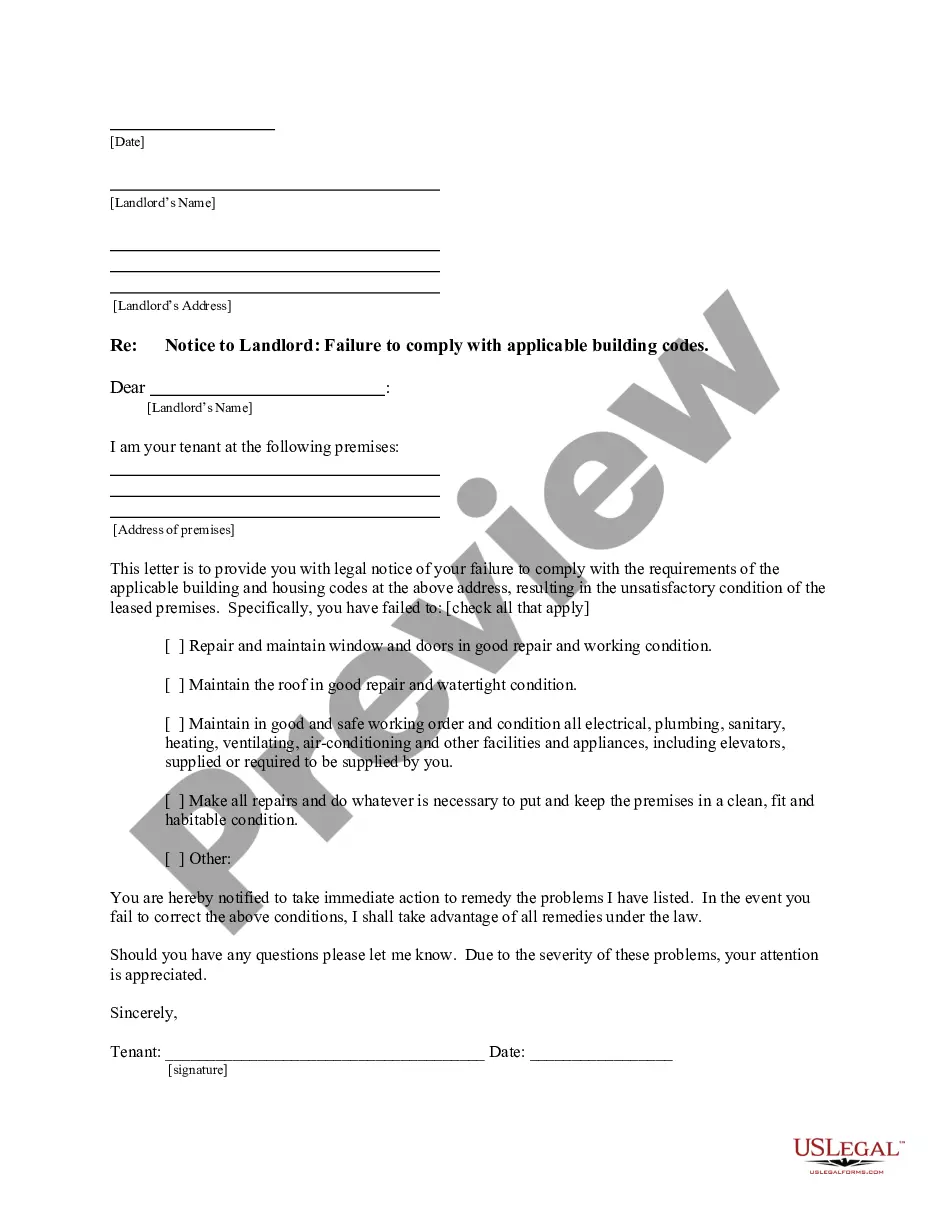

Do you need to quickly draft a legally-binding Chicago Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock or maybe any other form to manage your own or business affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Chicago Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Chicago Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Chicago Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!