The Clark Nevada Underwriting Agreement is a legally binding contract between Internet. Com Corp. and Internet World Media, Inc. that governs the sale and purchase of shares of common stock. This agreement outlines the terms and conditions under which Internet. World Media, Inc. agrees to purchase a specified number of shares of common stock from Internet. Com Corp. In this agreement, both parties agree to the terms related to the underwriting process and the sale of shares. These terms include the price per share, the total number of shares being sold, the closing date of the transaction, and the allocation of expenses between the parties. The agreement also outlines the responsibilities of each party. Internet. Com Corp., the seller, is responsible for ensuring the accuracy of the information provided to potential purchasers, obtaining any necessary regulatory approvals, and delivering the shares to Internet World Media, Inc. as per the agreed terms. On the other hand, Internet World Media, Inc., the buyer, is responsible for making the necessary payments and abiding by any restrictions or requirements imposed by the underwriters or regulatory bodies. Keywords: Clark Nevada Underwriting Agreement, Internet. Com Corp., Internet World Media, shares of common stock, sale and purchase, terms and conditions, underwriting process, price per share, closing date, allocation of expenses, responsibilities, accuracy of information, regulatory approvals, potential purchasers, delivery of shares, payments, restrictions, underwriters, regulatory bodies. Types of Clark Nevada Underwriting Agreements: 1. Firm Commitment Underwriting Agreement: In this type of agreement, Internet World Media, Inc. commits to the purchase of all the shares of common stock being offered by Internet. Com Corp. regardless of whether they are able to resell them to investors or not. 2. The Best Efforts Underwriting Agreement: In this type of agreement, Internet World Media, Inc. agrees to make its best efforts to sell the shares of common stock offered by Internet. Com Corp. to potential investors. However, there is no guarantee that all the shares will be sold, and the buyer does not have to purchase any unsold shares. 3. All-or-None Underwriting Agreement: In this type of agreement, Internet World Media, Inc. agrees to purchase all the shares of common stock offered by Internet. Com Corp. only if all the shares are sold to other investors. If any shares remain unsold, the agreement is terminated, and the purchase does not take place. 4. Standby Underwriting Agreement: In this type of agreement, Internet World Media, Inc. agrees to purchase any unsold shares of common stock offered by Internet. Com Corp. after the completion of a rights offering. This ensures that Internet. Com Corp. has a guaranteed buyer for any remaining shares. Keywords: Firm Commitment Underwriting Agreement, Best Efforts Underwriting Agreement, All-or-None Underwriting Agreement, Standby Underwriting Agreement, shares of common stock, resale to investors, underwriters, potential investors, guaranteed buyer, rights offering.

Clark Nevada Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock

Description

How to fill out Clark Nevada Underwriting Agreement Between Internet.Com Corp. And Internet World Media, Inc. Regarding The Sale And Purchase Of Shares Of Common Stock?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Clark Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any activities related to document execution straightforward.

Here's how you can purchase and download Clark Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock.

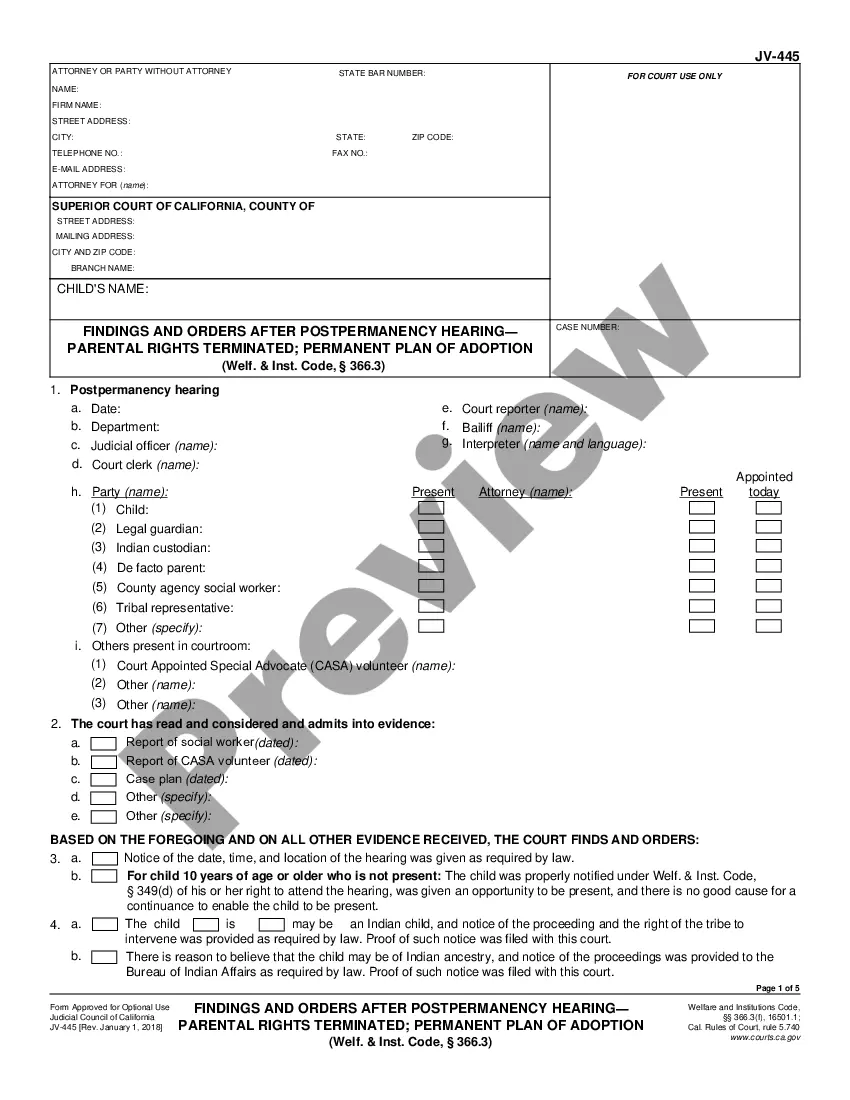

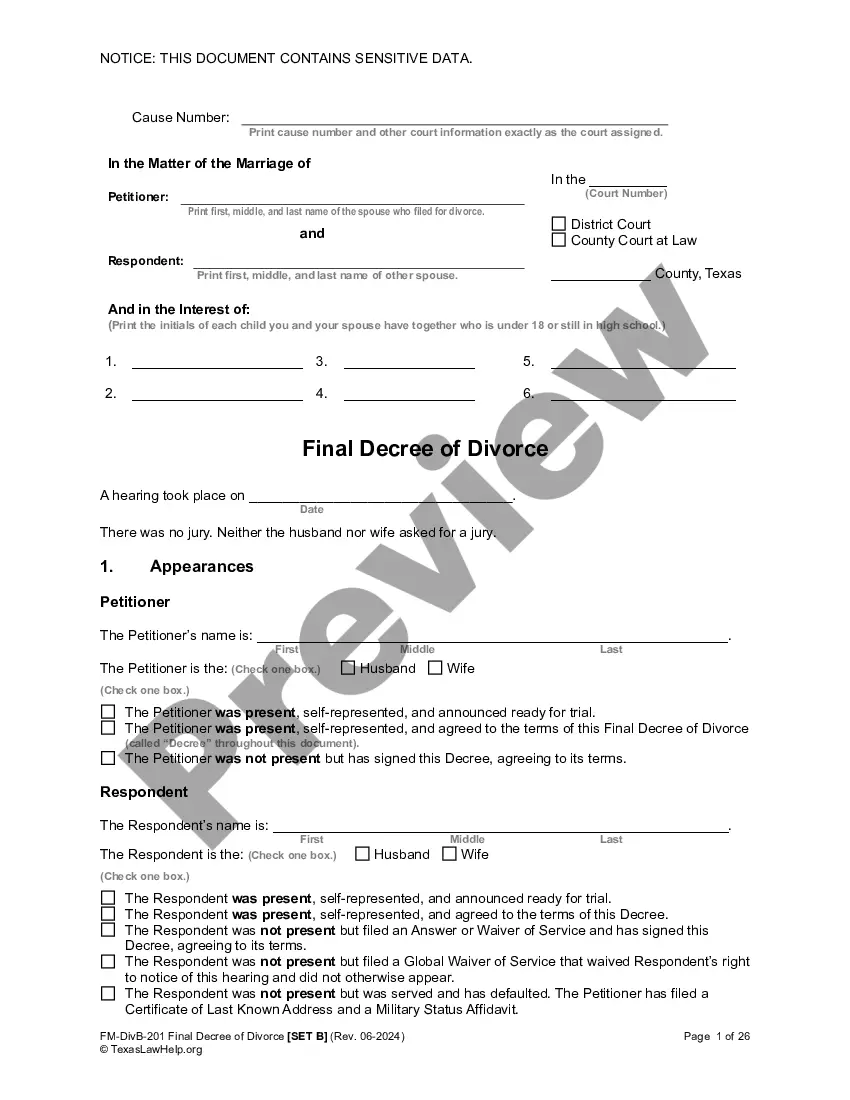

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Examine the related document templates or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Clark Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Clark Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you have to cope with an extremely difficult situation, we recommend using the services of an attorney to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!

Form popularity

FAQ

Broadly speaking, there are two types of underwriting arrangementsfirm commitment underwriting and best efforts underwriting. As the name suggests, in firm commitment underwriting, the banks definitively commit to purchase all the securities offered.

Types of underwriting Loan underwriting. Insurance underwriting. Securities underwriting. Forensic underwriting.

Objectives Of The Underwriting It guarantees the sale of securities at a given price. It facilitates the provision of money during the financial crisis of the company. The Underwriter helps the new company in its reorganization.

The agreement ensures everyone involved understands their responsibility in the process. The contract outlines the underwriting group's commitment to purchase the new securities issue, the agreed-upon price, the initial resale price, and the settlement date.

Types of underwriting Loan underwriting. Loan underwriting involves evaluating and calculating the risks of lending to potential borrowers.Insurance underwriting.Securities underwriting.Forensic underwriting.

There are three main types of commitment by the underwriter: firm commitment, best efforts, and all-or-none. In a firm commitment, the underwriter fully commits to the offering by buying the entire issue and taking financial responsibilities for any unsold shares.

Ans: Company enters into an underwriting agreement with the underwriters.

An underwriting agreement is a statutory necessity for Companies who have decided to increase their share capital by the issue of equity share. It is mandatory for the Company to file this agreement with the prospectus of public issue of shares/debentures with the Registrar of Companies.

1) Normal underwriting where the underwriter agrees to take up shares/debentures only when the issue is not subscribed by the public in full. 2) Firm underwriting - where an underwriter agrees to buy a certain number of shares/debentures in addition to the shares he has to take under the underwriting agreement.

The underwriting agreement contains an agreement by the underwriter(s) to purchase the offered securities from the issuer or other seller and to resell them to the public, the underwriting discount, representations and warranties of the parties, certain covenants, expense allocation and indemnification provisions.