An Oakland Michigan Underwriting Agreement is a legal contract between Internet. Com Corp. and Internet World Media, Inc. that governs the sale and purchase of shares of common stock. This agreement outlines the terms and conditions agreed upon by both parties regarding the underwriting of the stock offering. Underwriting refers to the process of guaranteeing a certain amount of money to be raised from the sale of the shares in a public offering. Keywords: Oakland Michigan, underwriting agreement, Internet. Com Corp., Internet World Media, sale and purchase, common stock, legal contract, terms and conditions, stock offering, underwriting process, public offering. There may be different types of Oakland Michigan Underwriting Agreements between Internet. Com Corp. and Internet World Media, Inc. depending on the specific circumstances or requirements of the stock offering. Examples of different types of agreements regarding the sale and purchase of shares of common stock include: 1. Firm Commitment Underwriting Agreement: This type of agreement involves the underwriter guaranteeing the sale of a specific number of shares at a fixed price. The underwriter agrees to purchase any unsold shares and assumes the risk of any unsold shares being sold at a lower price. 2. The Best Efforts Underwriting Agreement: With this type of agreement, the underwriter commits to making their best efforts to sell the shares but does not guarantee the sale of all the shares. The underwriter does not take on the risk of unsold shares, and any unsold shares stay with the issuer. 3. All-or-None Underwriting Agreement: This agreement states that all the shares offered must be sold, or the offering will be canceled. The underwriter must ensure that the entire offering is purchased, and if not, the agreement is terminated. 4. Mini-maxi Underwriting Agreement: This type of agreement specifies both a minimum and maximum number of shares that need to be sold for the offering to be executed. The underwriter is obligated to sell the minimum number of shares, but can continue to sell up to the maximum number if demand allows. 5. Standby Underwriting Agreement: In this agreement, the underwriter agrees to purchase any remaining shares not subscribed to by existing shareholders in a rights offering. This ensures that the issuer receives the necessary funding for the offering. It is important to note that the specific terms and conditions, including any additional clauses or provisions, will vary depending on the agreement negotiated between Internet. Com Corp. and Internet World Media, Inc. in their Oakland Michigan Underwriting Agreement.

Oakland Michigan Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock

Description

How to fill out Oakland Michigan Underwriting Agreement Between Internet.Com Corp. And Internet World Media, Inc. Regarding The Sale And Purchase Of Shares Of Common Stock?

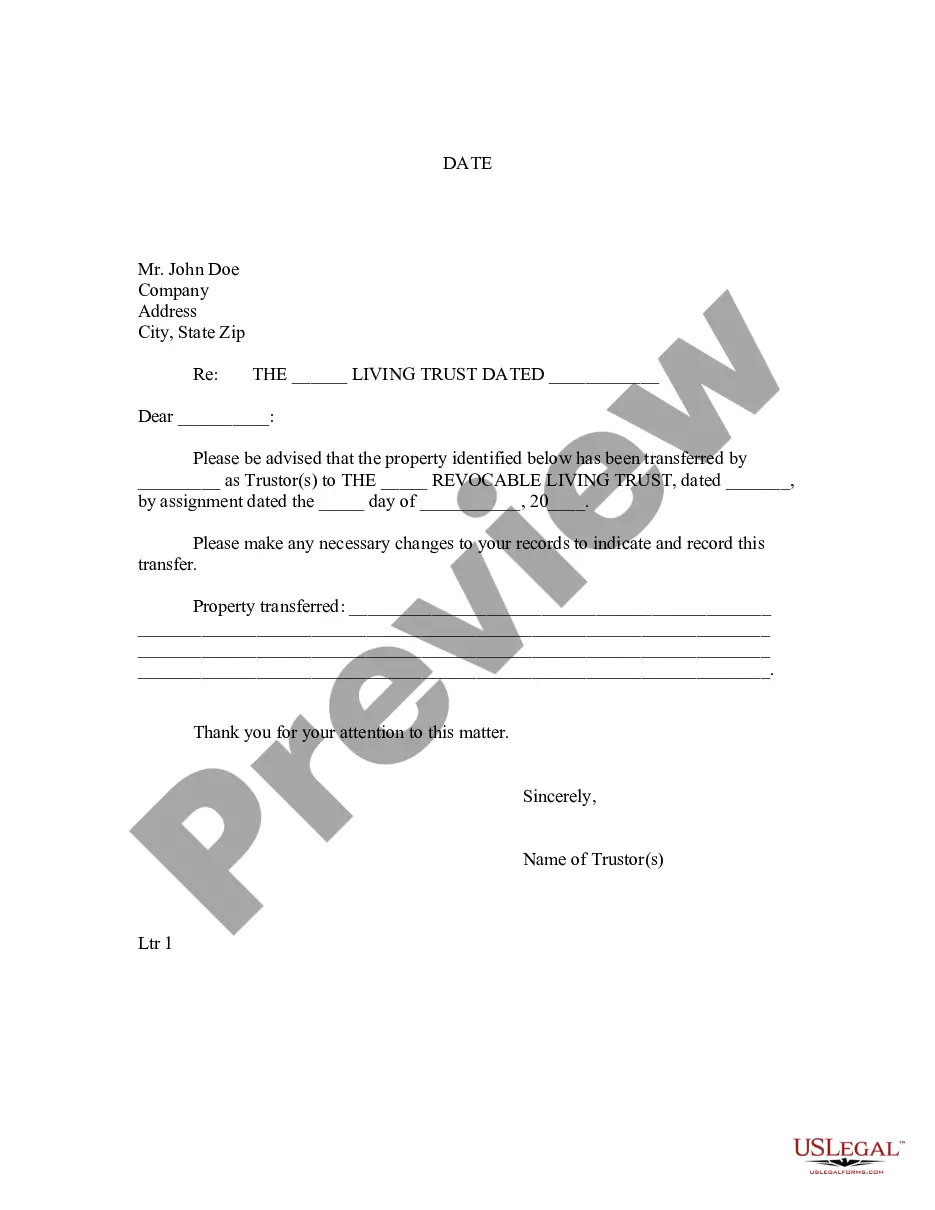

Draftwing paperwork, like Oakland Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock, to take care of your legal matters is a tough and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Oakland Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Oakland Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock:

- Make sure that your document is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Oakland Underwriting Agreement between Internet.Com Corp. and Internet World Media, Inc. regarding the sale and purchase of shares of common stock isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!