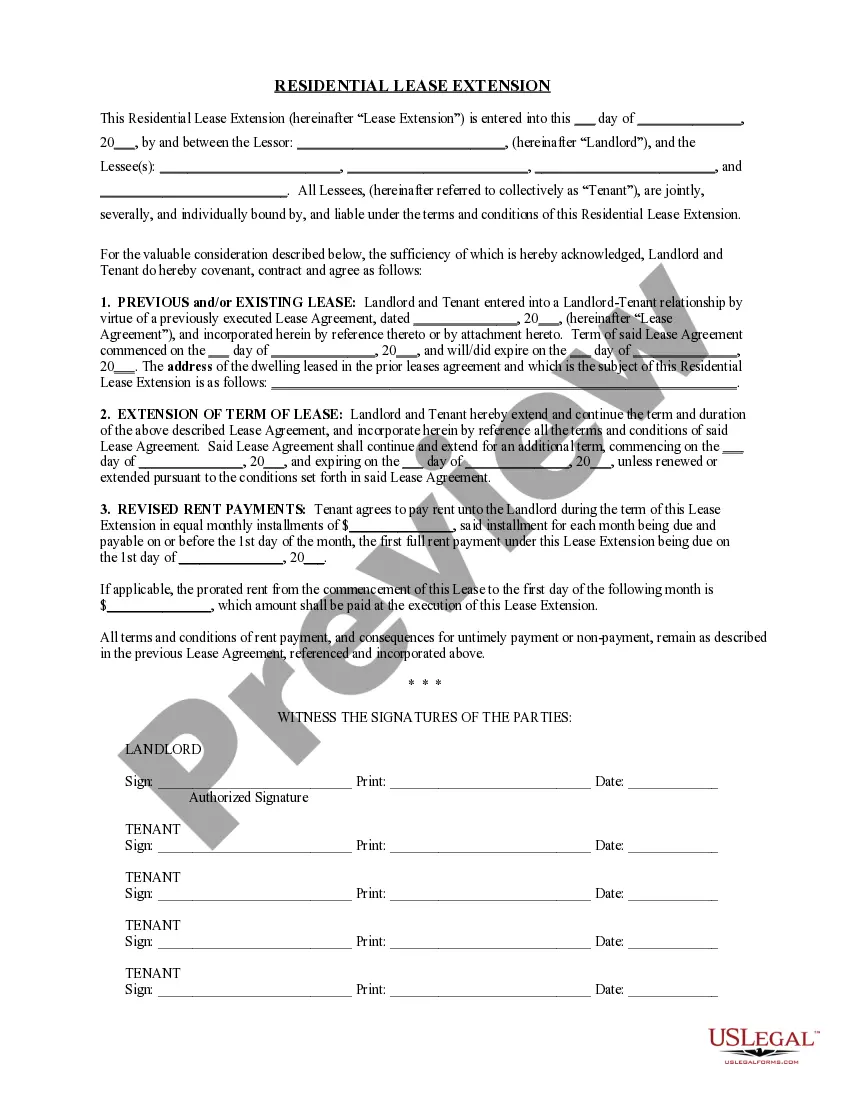

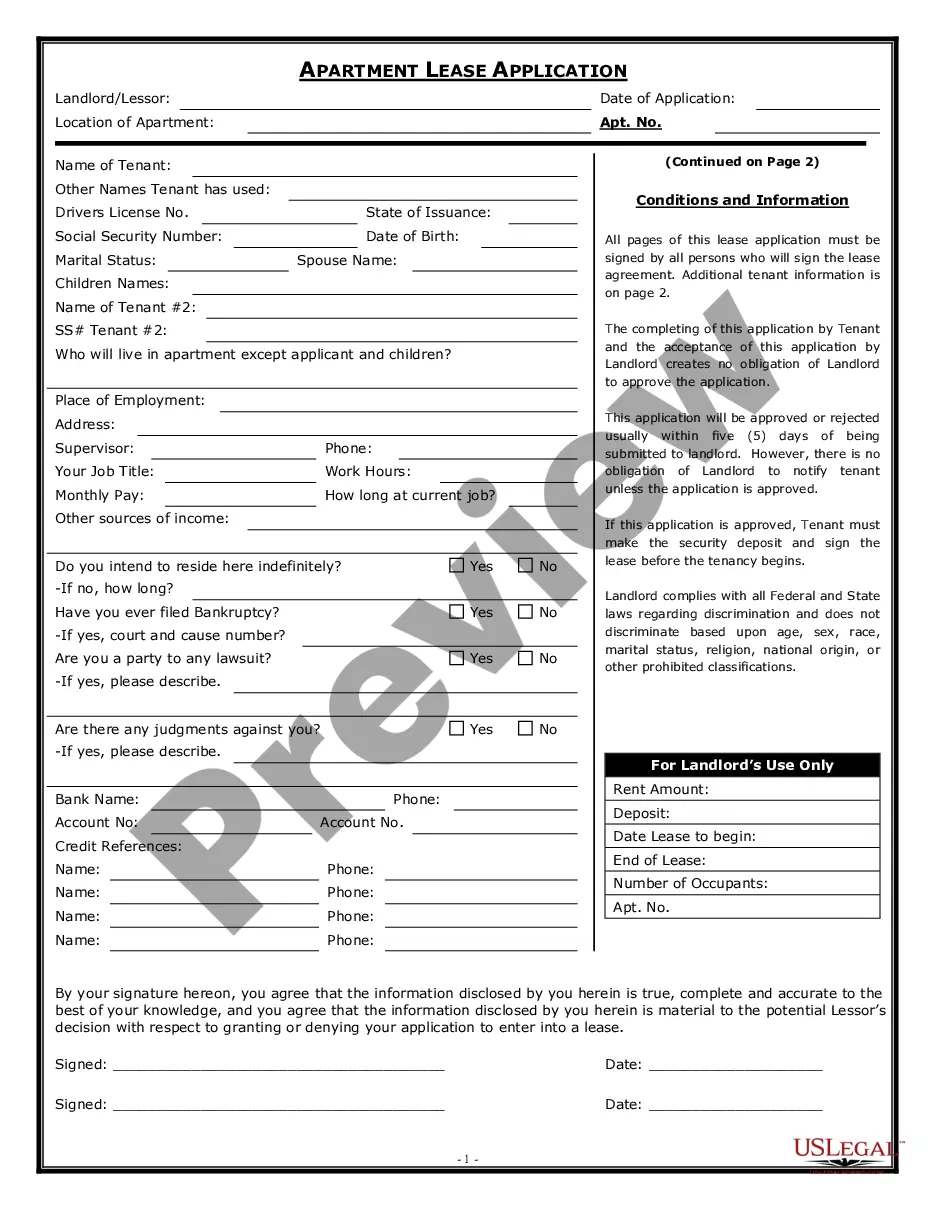

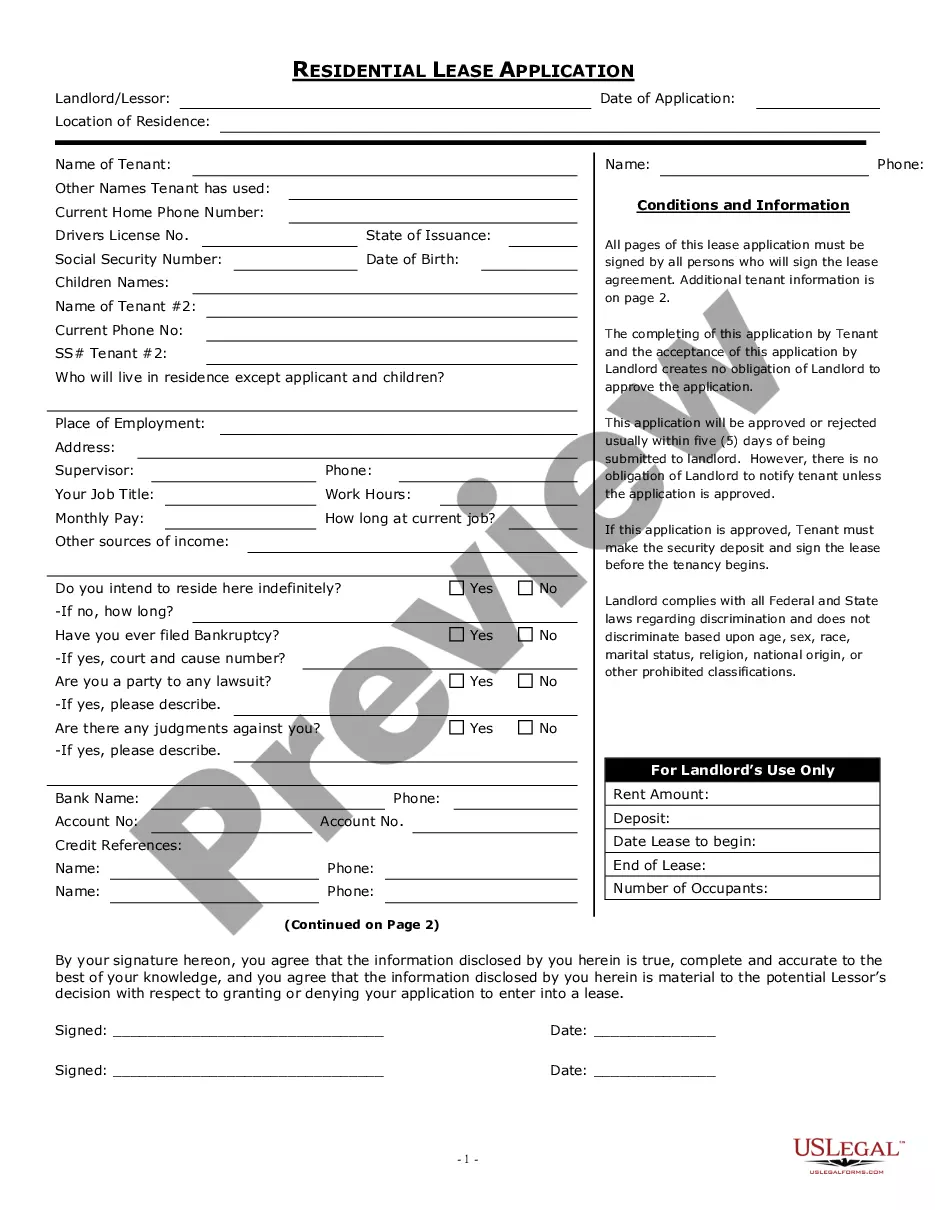

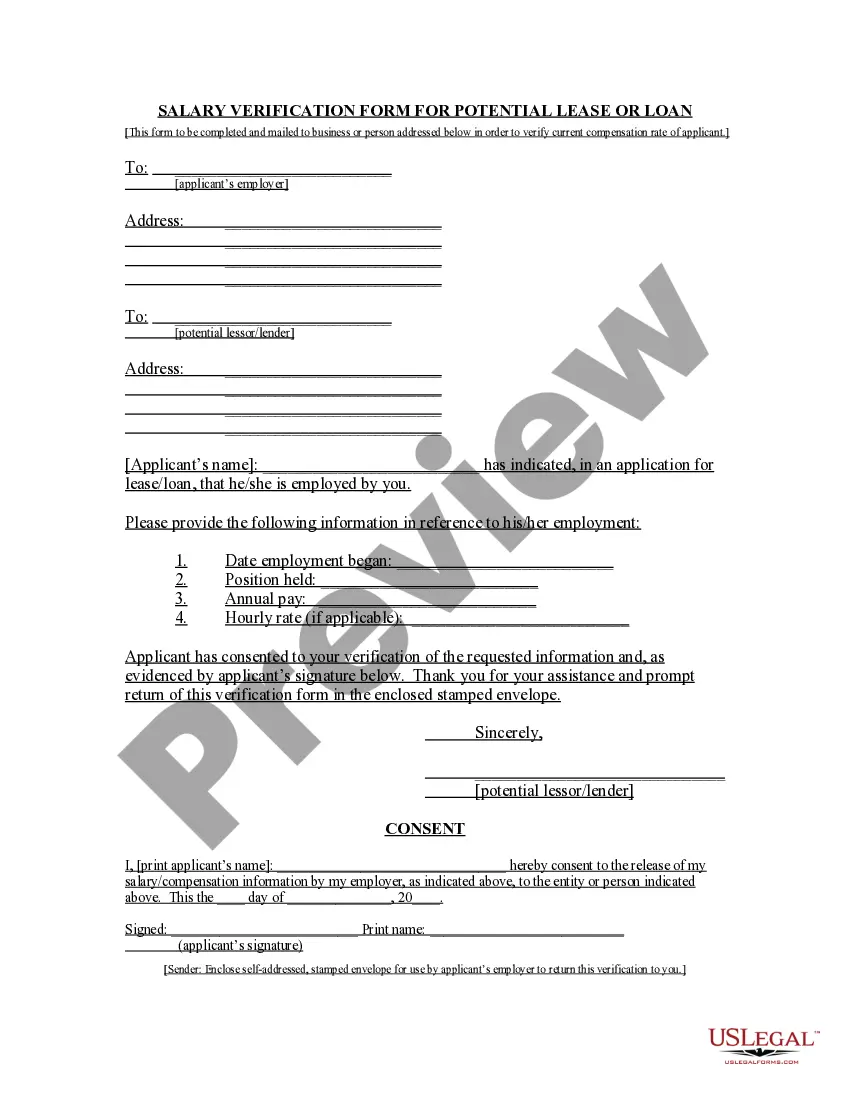

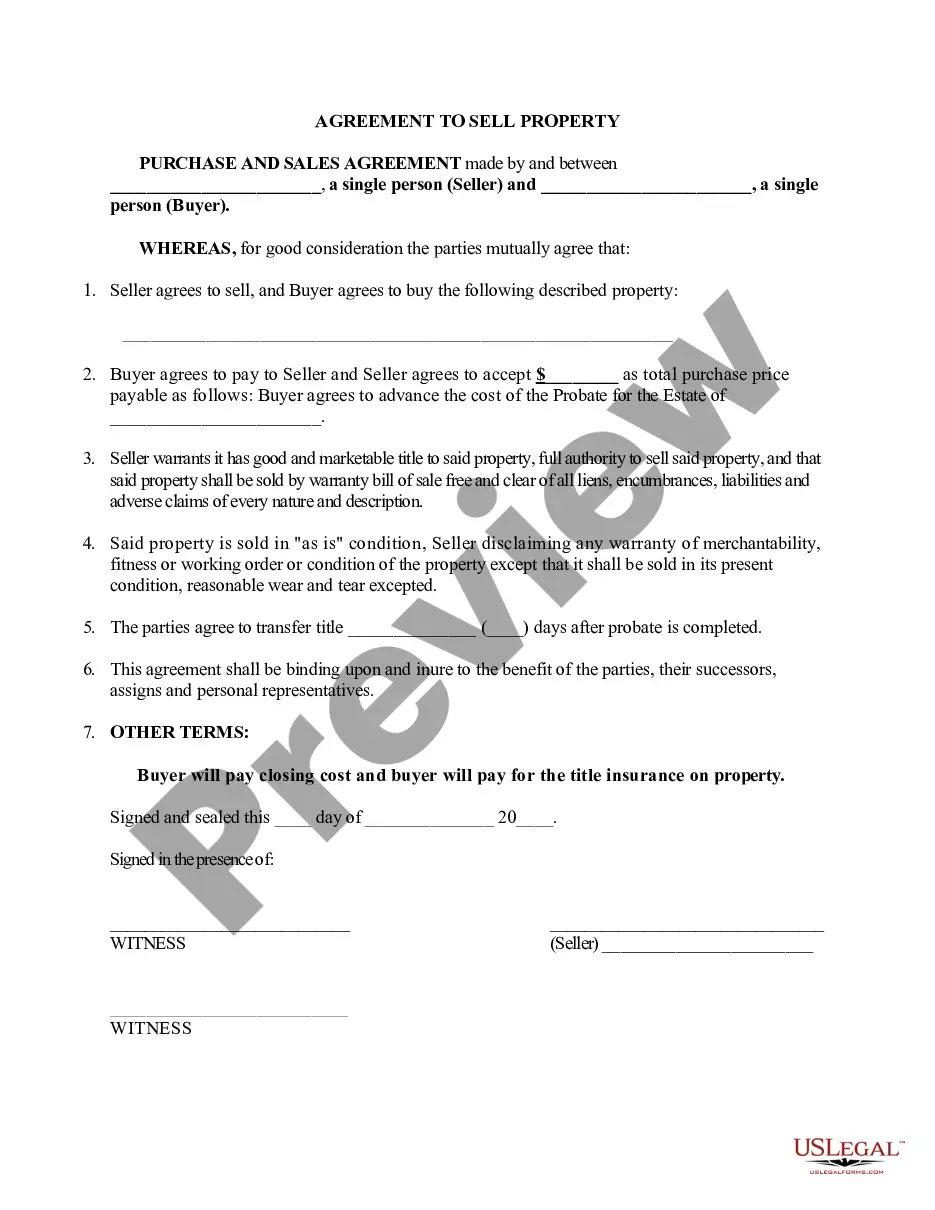

Riverside California is a vibrant city located in the Inland Empire region. In terms of property agreements, there are several types that exist within the Riverside area. One common type of property agreement is the Riverside California Residential Lease Agreement. This agreement is designed for individuals or families looking to rent a residential property. It outlines the terms and conditions of the lease, including rent amount, lease duration, security deposit, and any additional clauses or restrictions. Another type of property agreement is the Riverside California Commercial Lease Agreement. This agreement is specifically tailored for businesses seeking to lease a commercial property for various purposes such as retail, office space, or industrial use. It covers elements such as rent structure, maintenance responsibilities, permitted use, and any specific provisions related to the business type. Additionally, there is the Riverside California Purchase Agreement. This agreement is utilized when a buyer intends to purchase a property from a seller. It specifies the terms of the sale, including the purchase price, financing terms, contingencies, and closing timelines. This agreement is crucial in defining the rights and responsibilities of both parties during the property transaction process. Furthermore, there are also Riverside California Property Management Agreements. These agreements are signed between property owners and property management companies. They outline the scope of services to be provided by the property management company and cover aspects such as rent collection, property maintenance, tenant screening, and financial reporting. The Riverside California Property Agreement encompasses these various types of agreements, each serving different purposes in the realm of property transactions, rentals, and management within the Riverside area. It is essential for all parties involved to carefully review and understand these agreements to ensure a smooth and legally compliant property arrangement.

Riverside California Property Agreement

Description

How to fill out Riverside California Property Agreement?

Drafting papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Riverside Property Agreement without professional help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Riverside Property Agreement by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Riverside Property Agreement:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

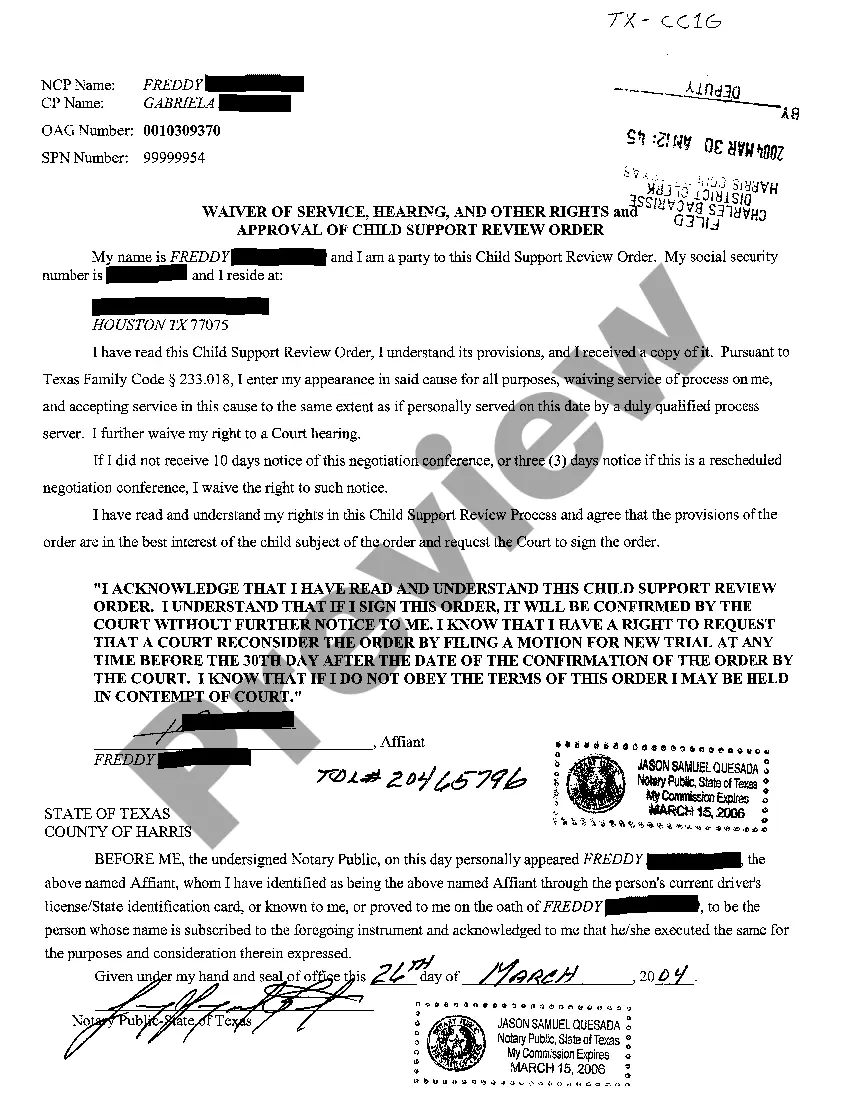

You may purchase copies of recorded documents (official records) online, by mail, or by coming into one of our public services locations. We offer two types of copies, regular and certified. Certification of the document makes the document as good as an original.

What is Documentary Transfer Tax? A tax collected when an interest in real property is conveyed. Collected by the County Recorder at the time of recording. A Transfer Tax Declaration must appear on each deed. There is a County tax and in some cases, a City tax.

The tax rate is $0.55 for each $500 or fraction thereof when the consideration or value of the interest or property conveyed, exclusive of the value of any lien or encumbrance remaining at the time of sale, exceeds $100. Within the City of Riverside the tax rate is $1.10 per $500.

It requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice, except those expressly exempted from payment of recording fees, per each transaction per parcel of real property, not to exceed $225 per single transaction.

You may request copies of recorded real property documents online, in person, or by mail. As of January 1, 2018, the fee for a copy of a recorded document is: $2.00 for the first page and $0.05 for each additional page, per document copy.

Recording Requirements The property must be located in Riverside County.The document must be authorized or required by law to be recorded.The document must be submitted with the proper fees and taxes.The document must be in compliance with state and local laws.

Upon taking effect, the recorder's office will impose a fee of $75.00 to be paid when recording every real estate instrument, paper, or notice required or permitted by law to be recorded, per each single transaction per single parcel of real property, not to exceed $225.00.

Anyone may search for and purchase copies of real estate records in the files of the county recorder. All records may be freely viewed in person and copies may be purchased at the offices of the Los Angeles County Registrar-Recorder/County Clerk. Copies may also be purchased online, by mail, and by fax.

The Recorder's office is responsible for providing constructive notice of private acts and creating and maintaining custody of permanent records for all documents filed and recorded in Riverside County.