The Bronx New York Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan is a legal document that outlines the process of transferring retirement funds for Motorola employees who are retiring or changing their retirement plan. This agreement ensures a smooth transfer of retirement assets from the Motorola, Inc. Pension Plan to the Bronx New York Retirement Plan. The purpose of this agreement is to protect the interests of the Motorola employees and provide them with a secure and seamless transition of their retirement funds. It contains detailed provisions and terms that carefully outline the responsibilities and obligations of both parties involved in the transfer process. Key elements of the Bronx New York Retirement Plan Transfer Agreement may include: 1. Eligibility Criteria: This section elucidates the criteria that Motorola employees must fulfill to be eligible for transferring their retirement funds to the Bronx New York Retirement Plan. It may include factors such as age, tenure with the company, or specific retirement plan options available. 2. Transfer Process: The agreement outlines the step-by-step procedure for initiating and completing the retirement plan transfer. It may detail the documents required, the deadlines, and any special instructions essential for a successful transfer. 3. Vesting: Vesting refers to the process of ensuring employees have ownership rights to their retirement funds. This section specifies the vesting schedule and conditions for the transferred funds, ensuring that employees receive the appropriate portion of their retirement savings. 4. Investment Options: The Bronx New York Retirement Plan Transfer Agreement may provide details about the investment options available within the plan. It could include various choices like mutual funds, stocks, bonds, or other investment vehicles. 5. Portability: If there are different types of Bronx New York Retirement Plan Transfer Agreements for the Motorola, Inc. Pension Plan, this section would outline the portability options employees have, such as the ability to transfer the funds to another qualified retirement plan or an individual retirement account (IRA). 6. Tax Implications: This important segment addresses the tax considerations associated with the retirement plan transfer. It clarifies the tax implications, potential penalties, and any required tax reporting for the transferred funds. It is essential for Motorola employees to carefully review the Bronx New York Retirement Plan Transfer Agreement before making any decisions regarding their retirement plan. Furthermore, it is recommended to consult with financial advisors or legal professionals to fully understand the terms and provisions of the agreement. By doing so, employees can ensure a smooth and secure transfer of their retirement assets, ultimately securing their financial future in retirement.

Bronx New York Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan

Description

How to fill out Bronx New York Retirement Plan Transfer Agreement For The Motorola, Inc. Pension Plan?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Bronx Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Bronx Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan. Follow the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

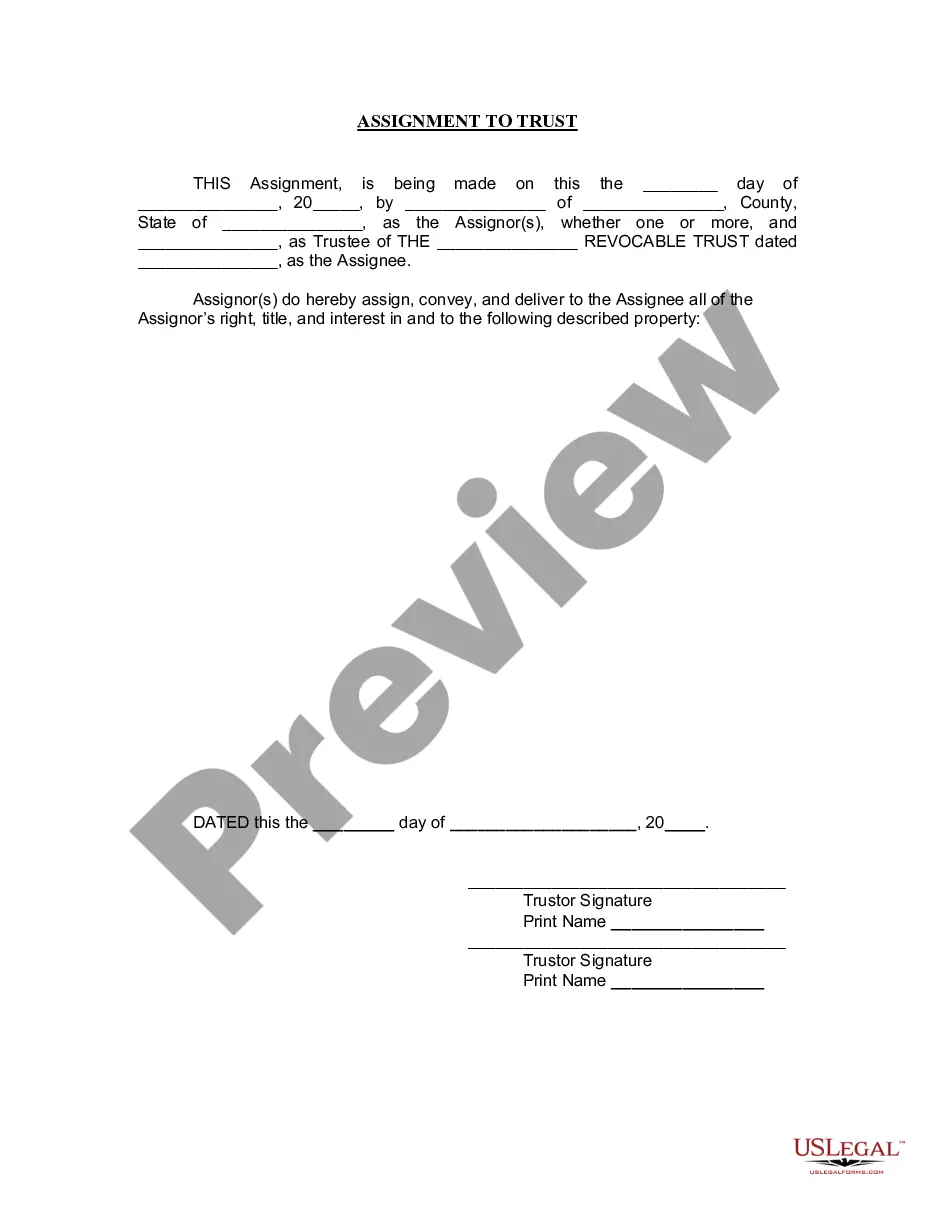

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

If you have a defined contribution pension where you've built up a pot of money, you can usually transfer this to another pension provider. This might be a new employer's workplace pension or a personal pension you've set up yourself such as a self-invested personal pension (SIPP).

The majority of pension transfers take two to three weeks in total to complete. Some can take around three months, or even longer depending on your provider. Before you transfer your pension, you should contact your existing pension scheme provider.

This type of transfer usually takes 6-8 weeks, but can take longer depending on your investments and provider. You stay invested during the transfer, so could make gains and losses. Usually you cannot trade until the transfer completes.

Contact your current pension provider and the provider you want to transfer to. You'll need to check if: your existing pension scheme allows you to transfer some or all of your pension pot. the scheme that you wish to transfer into will accept the transfer.

How do I transfer my private pension? The process is simple: You ask your current pension provider if they allow you to transfer. You look into and select a scheme; then ask that provider whether they accept your transfer.

To start the transfer process, you'll need to apply to the pension scheme that you want to transfer to. Some providers have an online transfer process, while others might still need you to complete and return an application form.

Unlike 401(k)s, pensions aren't portable. You can't move a traditional pension account to your new employer or into an IRA rollover when you leave a job. (A cash-balance plan, by contrast, allows you to take your money with you when you leave a job.)

Defined benefit (DB) transfers can take longer than defined contribution transfers around six months is average for these schemes. They can take longer because your pensions advisor is legally obliged to ensure that you fully understand the implications of leaving a defined benefit scheme.

If you retire at age 55 as an active member, you will receive 82% of your pension for your lifetime. If you retire at age 56 as an active member, you will receive 86% of your pension for your lifetime2026 and so on, according to the subsidized early retirement benefit.