The Santa Clara California Retirement Plan Transfer Agreement is a legal document that outlines the terms and conditions for transferring retirement plan funds in accordance with the contribution plan requirements of the Internal Revenue Service (IRS). This agreement ensures that the transfer of funds from one retirement plan to another within Santa Clara, California, complies with the IRS regulations and does not result in any penalties or tax liabilities for the parties involved. The Retirement Plan Transfer Agreement addresses various aspects of the transfer process, such as eligibility criteria, contribution limits, documentation requirements, and timelines. It stipulates the procedures and steps to be followed by both the transferring and receiving parties to ensure a smooth and compliant transfer of retirement plan funds. To meet the specific requirements set by the IRS, there are different types of Santa Clara California Retirement Plan Transfer Agreement: 1. Traditional Retirement Plan Transfer Agreement: This type of agreement applies to the transfer of funds from a traditional retirement plan, such as a 401(k) or 403(b), to another qualified retirement plan. It caters to individuals who wish to move their retirement savings from one employer-sponsored plan to another or from an employer-sponsored plan to an individual retirement account (IRA). 2. Roth Retirement Plan Transfer Agreement: This agreement is specific to the transfer of funds from a Roth retirement plan, such as a Roth 401(k) or Roth IRA, to another qualified retirement plan. It allows individuals to transfer their post-tax contributions and potential earnings to a new retirement plan without incurring any tax liabilities. 3. SEP or SIMPLE Retirement Plan Transfer Agreement: This agreement pertains to the transfer of funds from a Simplified Employee Pension (SEP) or Savings Incentive Match Plan for Employees (SIMPLE) retirement plan to another qualified retirement plan. It caters to small business owners or self-employed individuals who want to consolidate their retirement savings into a different plan that better suits their needs. The Santa Clara California Retirement Plan Transfer Agreement serves as a binding contract that safeguards the interests of all parties involved in the transfer process. It ensures compliance with the IRS regulations while ensuring a smooth transition of retirement assets, allowing individuals to effectively manage their retirement savings and adjust their investment strategy as needed.

Santa Clara California Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

How to fill out Santa Clara California Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

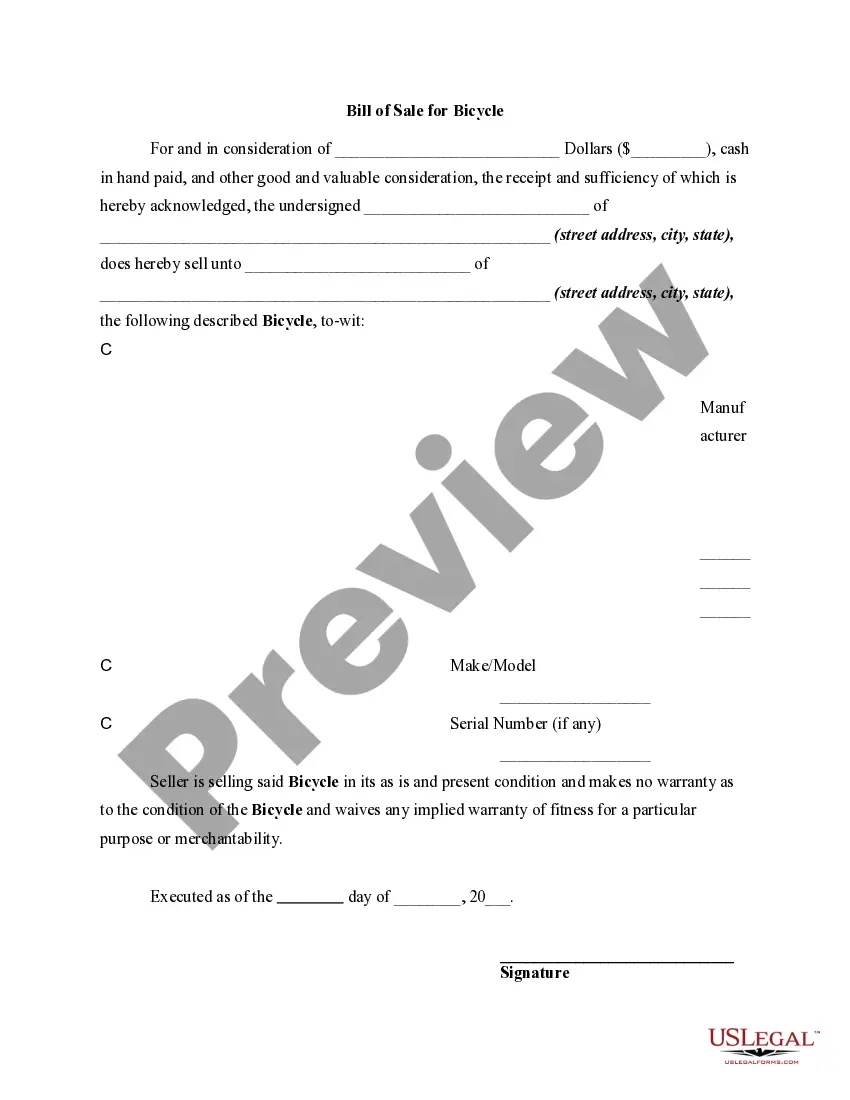

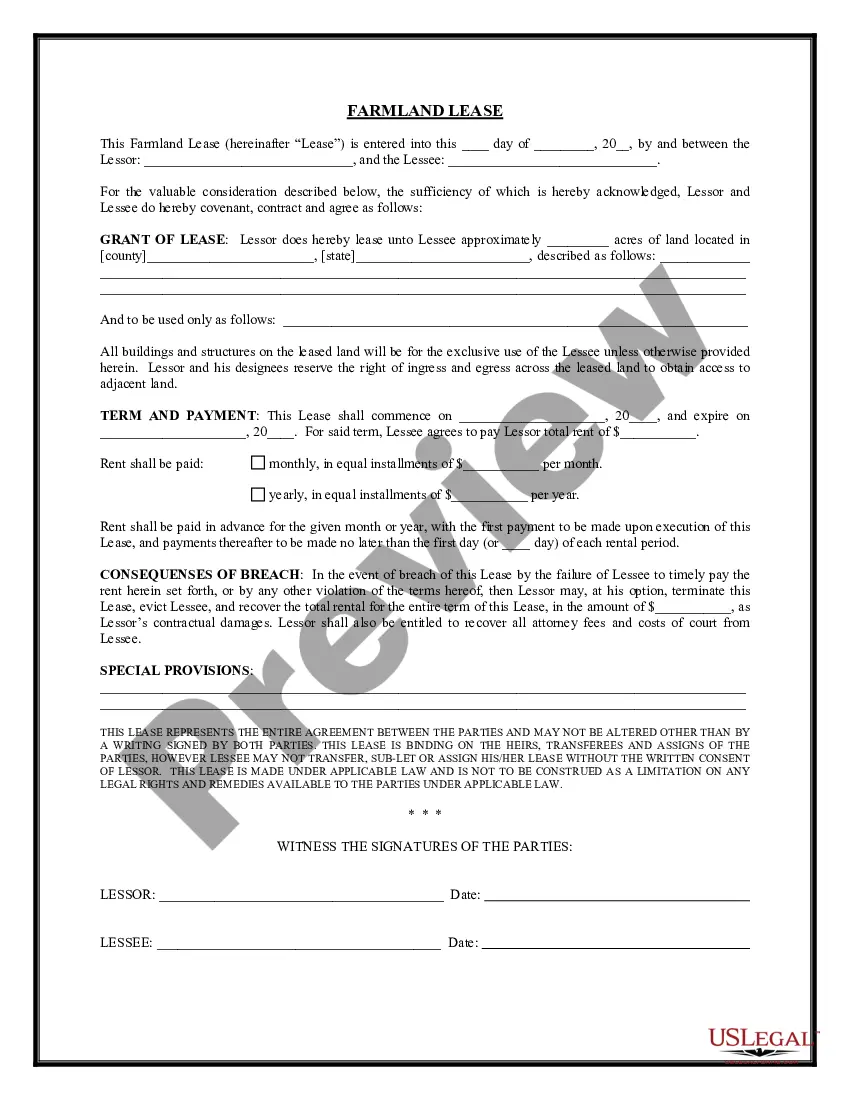

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Santa Clara Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Santa Clara Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

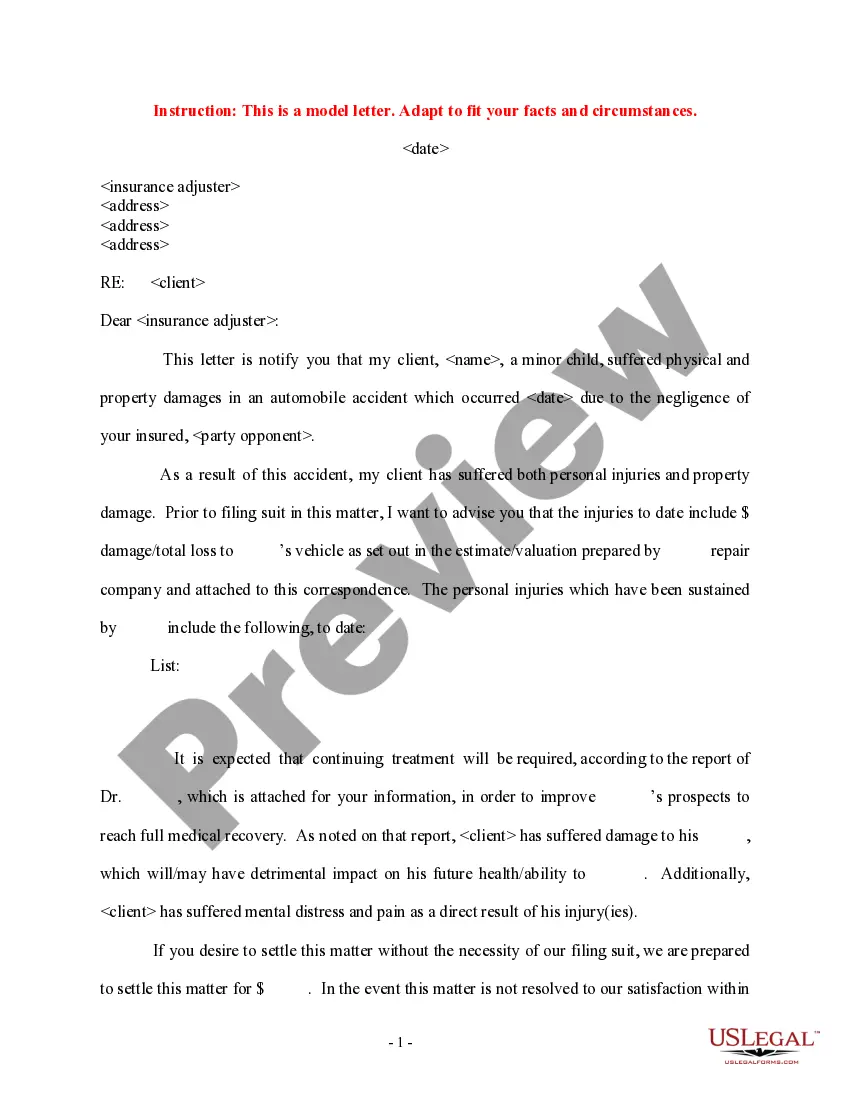

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.

The City of San Jose is pleased to offer CalPERS Classic Members the opportunity to convert their current Tier 2 service into Tier 1 for pension benefits.

Ways to find your CalPERS ID include: Log in to myCalPERS, select Find Your CalPERS ID in the Your Account tile under More Information. Refer to any correspondence from CalPERS, such as your Annual Member Statement. Speak with us by calling 888 CalPERS (or 888-225-7377) or TTY (877) 249-7442.

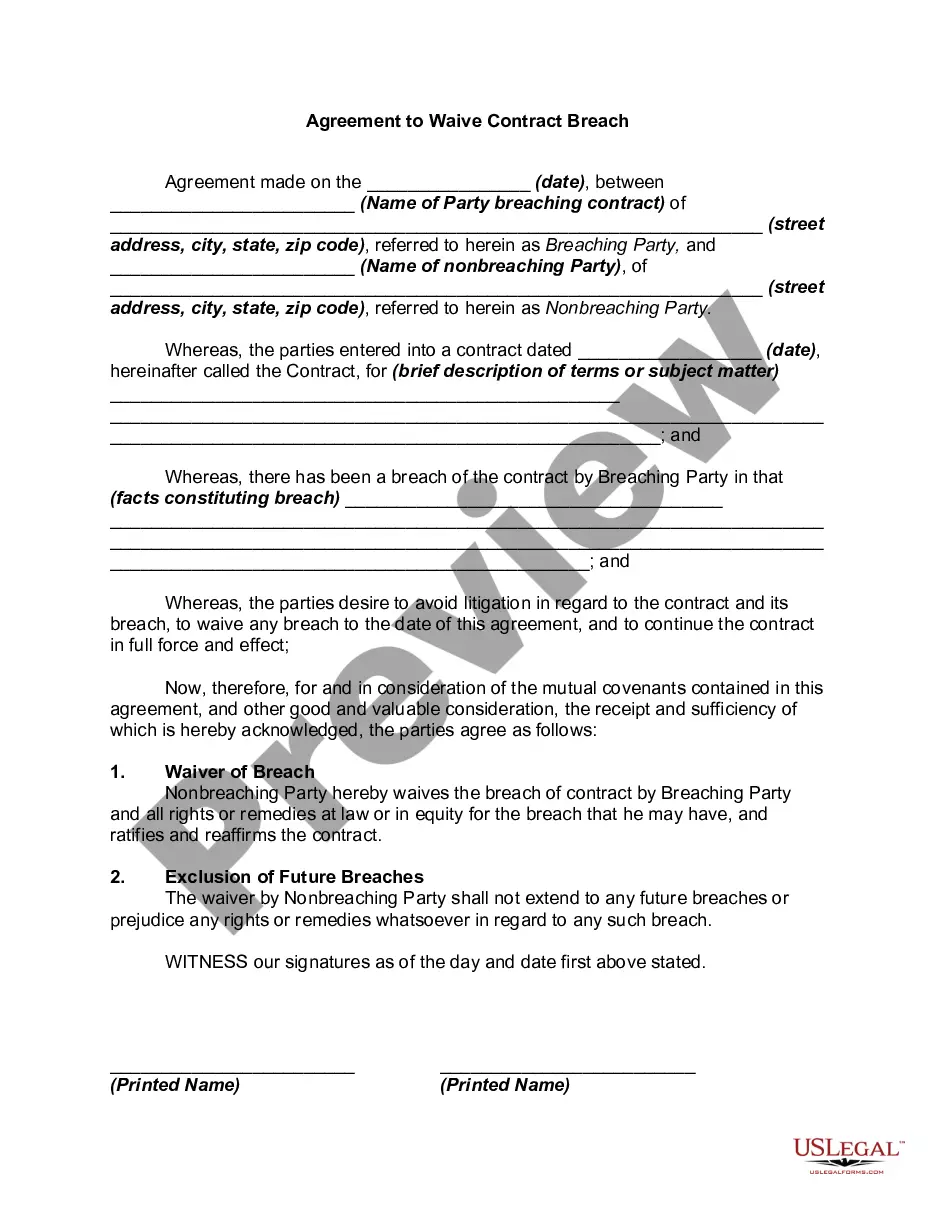

Reciprocity allows you to move from one retirement system to another without losing your benefits. CalPERS' reciprocal agreement with other California public retirement systems can allow you to coordinate your benefits between the two systems when you retire.

There is no formal reciprocity agreement established between CalPERS and the following systems: State Teachers' Retirement System (CalSTRS); 2022 Legislators' Retirement System (LRS); 2022 Judges' Retirement System (JRS); 2022 Judges' Retirement System II (JRS II).

CalPERS 457 Plan Participating Agencies Employer NameTypeAbc Unified School DistrictSchools, School Districts, Offices of EducationAlameda Corridor Transportation AuthorityTransportation/Transit DistrictsAlameda County Fire DepartmentFire Protection DistrictsAlameda County Law LibraryLibraries/Library Districts117 more rows ?

Public Employees' Retirement System (CalPERS) - Employee Services Agency - County of Santa Clara.

The County of Santa Clara provides employees with valuable benefits that help you plan for a secure future. Your retirement benefits include: Participation in the CalPERS defined benefit pension plan. Retiree medical coverage.

Can I belong to CalSTRS and CalPERS? You can keep your account with the old retirement system and have your new job under the new retirement system. In this case, you can retire from both systems at the same time for a concurrent retirement.

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.