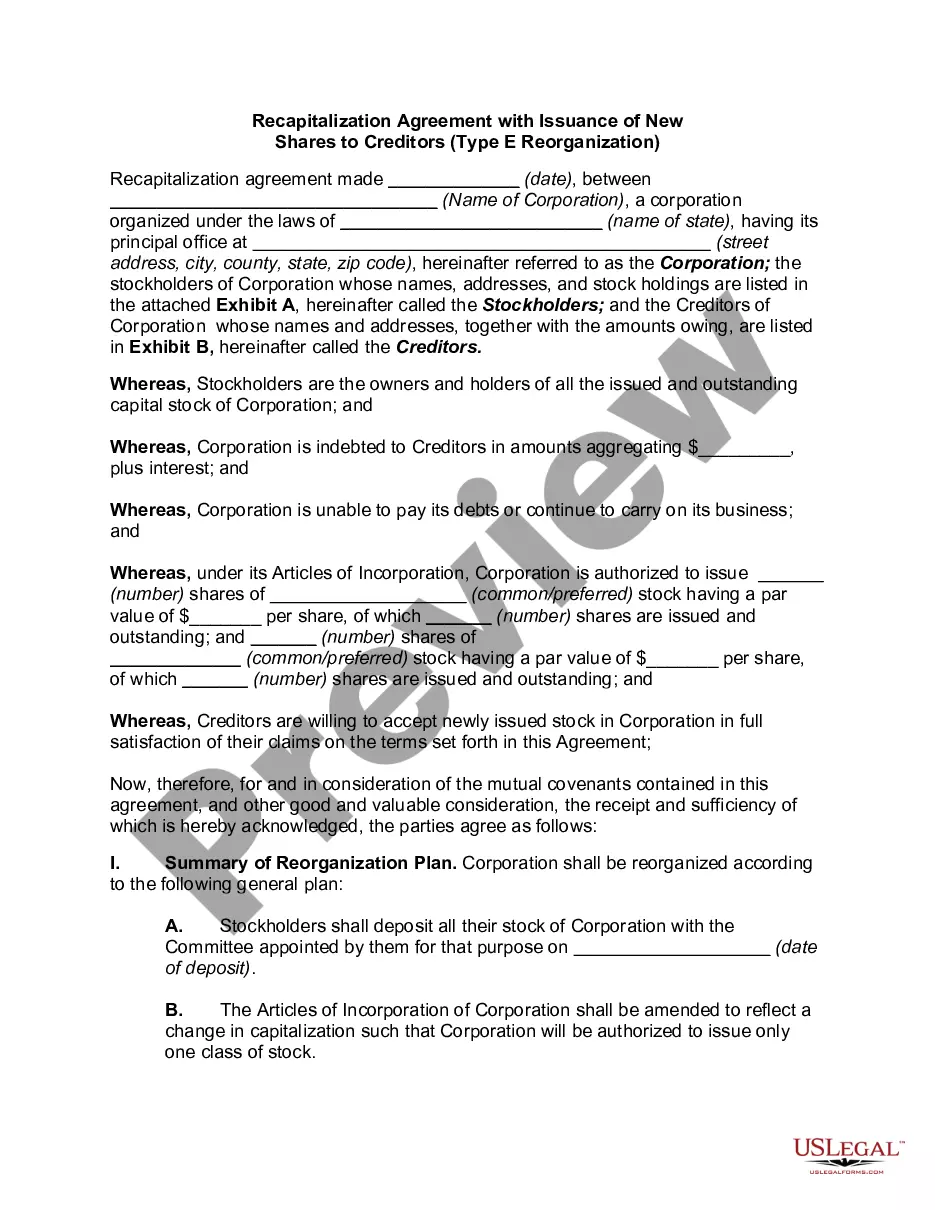

Allegheny Pennsylvania Pledge and Security Agreement is a legally binding document that outlines the terms and conditions surrounding the finance of acquiring shares of common stock. This agreement acts as a safeguard for the lender by providing a pledge and commitment from the borrower to secure the loan against the acquired shares. The primary purpose of this agreement is to protect the lender's investment and mitigate potential risks associated with the financing of the acquisition. By pledging the shares of common stock, the borrower assures the lender that they have a vested interest in maintaining the value and integrity of the acquired shares. This commitment serves as collateral, providing a level of security for the lender in case of default or non-payment. The Allegheny Pennsylvania Pledge and Security Agreement details various essential provisions, including: 1. Pledged Shares: The agreement identifies the specific shares of common stock that are being pledged as collateral, stating their quantity, class, and other relevant details. 2. Pledge Grant: It outlines the borrower's grant of a security interest in the pledged shares to the lender, assigning the rights to sell or dispose of the shares in the event of default. 3. Representations and Warranties: The agreement contains representations and warranties made by the borrower to assure the lender that they have the legal right to pledge the shares and that the shares are free from any encumbrances or claims. 4. Covenants: This section includes obligations and promises made by the borrower, such as maintaining the value of the pledged shares and promptly notifying the lender of any material changes or corporate actions affecting the shares. 5. Events of Default: It specifies the conditions under which the lender can declare a default, such as non-payment, breach of covenants, bankruptcy, or material adverse changes. The consequences of default, including the lender's right to sell or dispose of the pledged shares, are also addressed. 6. Terms and Conditions: The agreement covers other important aspects, such as governing law, dispute resolution, amendments, waivers, and the lender's rights and remedies in case of default. Depending on the specific details and requirements of the financing arrangement, there may be different types or variations of the Allegheny Pennsylvania Pledge and Security Agreement. Examples of these variations could include: 1. Restricted Pledge and Security Agreement: This type of agreement may impose additional restrictions on the borrower regarding the use or transfer of the pledged shares during the loan term. 2. Floating Pledge and Security Agreement: In some cases, the agreement may allow the borrower to pledge a fluctuating or changing number of shares as collateral. This is commonly used when the borrower intends to acquire more shares over time. 3. Cross-Collateralization Agreement: If the borrower has multiple loans or financing arrangements with the same lender, a cross-collateralization agreement may be used. This arrangement utilizes the pledged shares as collateral for multiple loans, providing additional security for the lender. It is essential for all parties involved in the finance of acquisition of shares of common stock to carefully review and understand the terms and conditions outlined in the Allegheny Pennsylvania Pledge and Security Agreement. Consulting legal and financial professionals is highly recommended ensuring compliance with applicable laws and to protect the interests of all stakeholders.

Allegheny Pennsylvania Pledge and Security Agreement regarding the finance of acquisition of shares of common stock

Description

How to fill out Allegheny Pennsylvania Pledge And Security Agreement Regarding The Finance Of Acquisition Of Shares Of Common Stock?

Draftwing documents, like Allegheny Pledge and Security Agreement regarding the finance of acquisition of shares of common stock, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Allegheny Pledge and Security Agreement regarding the finance of acquisition of shares of common stock form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Allegheny Pledge and Security Agreement regarding the finance of acquisition of shares of common stock:

- Make sure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Allegheny Pledge and Security Agreement regarding the finance of acquisition of shares of common stock isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!