Hillsborough Florida Pledge and Security Agreement regarding the finance of acquisition of shares of common stock

Description

How to fill out Hillsborough Florida Pledge And Security Agreement Regarding The Finance Of Acquisition Of Shares Of Common Stock?

Creating forms, like Hillsborough Pledge and Security Agreement regarding the finance of acquisition of shares of common stock, to take care of your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Hillsborough Pledge and Security Agreement regarding the finance of acquisition of shares of common stock template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Hillsborough Pledge and Security Agreement regarding the finance of acquisition of shares of common stock:

- Make sure that your form is specific to your state/county since the rules for writing legal documents may differ from one state another.

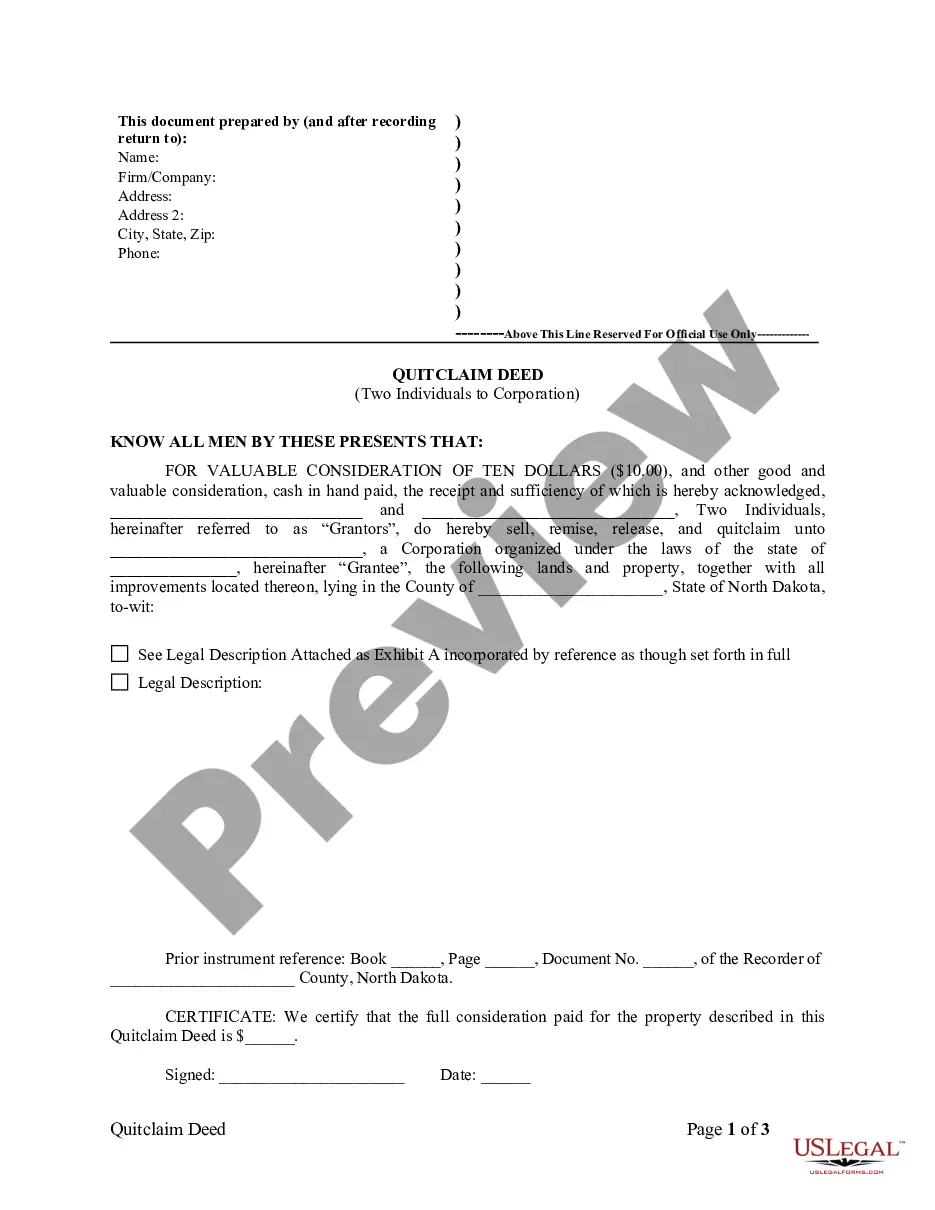

- Discover more information about the form by previewing it or going through a brief description. If the Hillsborough Pledge and Security Agreement regarding the finance of acquisition of shares of common stock isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

In simple words, pledging of shares means taking loans against the shares that one holds. Shares are considered assets. Pledging of shares is a way for the promoters of a company to get loans to meet their business or personal requirements by keeping their shares as collateral to lenders.

In the holdings table, hover the cursor on the stock you want to pledge and click on 'options' and select pledge for margins . Once you do, you will get a pop-up, which will show how much margins you will be eligible for. The cost of pledging will be 20b930 + GST per scrip irrespective of the quantity pledged.

19 In a pledge, the delivery of stock to the pledgee con- stitutes the dispostion of an interest in a security since the delivery gives the pledgee a perfected security interest in the stock." Under the literal statutory analysis, therefore, a pledge constitutes a "sale" of a security.

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

How does the pledging of shares work? Promoters can pledge their shares to avoid losing trade opportunities due to low cash margins. They can get a loan after haircut deduction. The collateral margin received from these pledged shares can be used for equity trading, futures, and options writing.

Stock-Secured Loans With a stock-based loan, you pledge shares of stock as collateral against the repayment of the loan. Typically you do not make payments until the loan is due in two to three years and any dividends paid on the shares go toward the interest and principal of the loan.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

Pledged Collateral Definition The borrower pledges assets or property to the lender to guarantee or secure the loan. Pledging assets, also referred to as hypothecation, does not transfer ownership of the property to the creditor, but gives the creditor a non-possessory interest in the property.

To take out a stock collateral loan, the borrower transfers ownership to the lender who owns the stock during the life of the loan. The amount they will lend the borrower depends on the quality of stock being put up for collateral. The borrower agrees to pay a fixed interest rate and the lender gives them the money.