Oakland Michigan Pledge and Security Agreement is a legal document that outlines the terms and conditions surrounding the financing of the acquisition of shares of common stock in Oakland, Michigan. This agreement serves as a commitment and security measure for the repayment of the loan or funding provided for the purchase of these shares. The Oakland Michigan Pledge and Security Agreement outlines the rights and obligations of both the lender and the borrower in this transaction. It includes provisions related to the collateral provided as security, typically the acquired shares themselves. The agreement specifies the terms of the loan, including the interest rate, repayment schedule, and any applicable fees or penalties. Keywords: Oakland, Michigan, Pledge and Security Agreement, finance, acquisition, shares, common stock. Different types of Oakland Michigan Pledge and Security Agreements regarding the finance of acquisition of shares of common stock may include: 1. Full Pledge and Security Agreement: This type of agreement involves pledging the acquired shares as collateral towards the loan. It provides comprehensive security for the lender and may include additional terms and conditions such as restrictions on the transfer of shares during the loan term. 2. Partial Pledge and Security Agreement: In this case, only a portion of the acquired shares is pledged as collateral. This allows the borrower to retain some level of ownership and control over the remaining shares while providing security to the lender. 3. Floating Lien Agreement: This type of agreement allows the borrower to pledge not only the acquired shares but also other assets, such as machinery, equipment, or real estate, as collateral. The lender has a claim on these assets in case of default, providing additional security for the loan. 4. Limited Recourse Agreement: This agreement limits the lender's recourse to specific assets, usually the acquired shares, in the event of default. It provides certain protection for the borrower's other assets, reducing their overall liability. These are some potential types of Oakland Michigan Pledge and Security Agreements that may be used in the finance of acquiring shares of common stock. However, it's important to note that the specific terms and conditions may vary based on the involved parties, the size of the acquisition, and other factors. Consulting with legal professionals is advised for creating or understanding the exact terms of these agreements.

Oakland Michigan Pledge and Security Agreement regarding the finance of acquisition of shares of common stock

Description

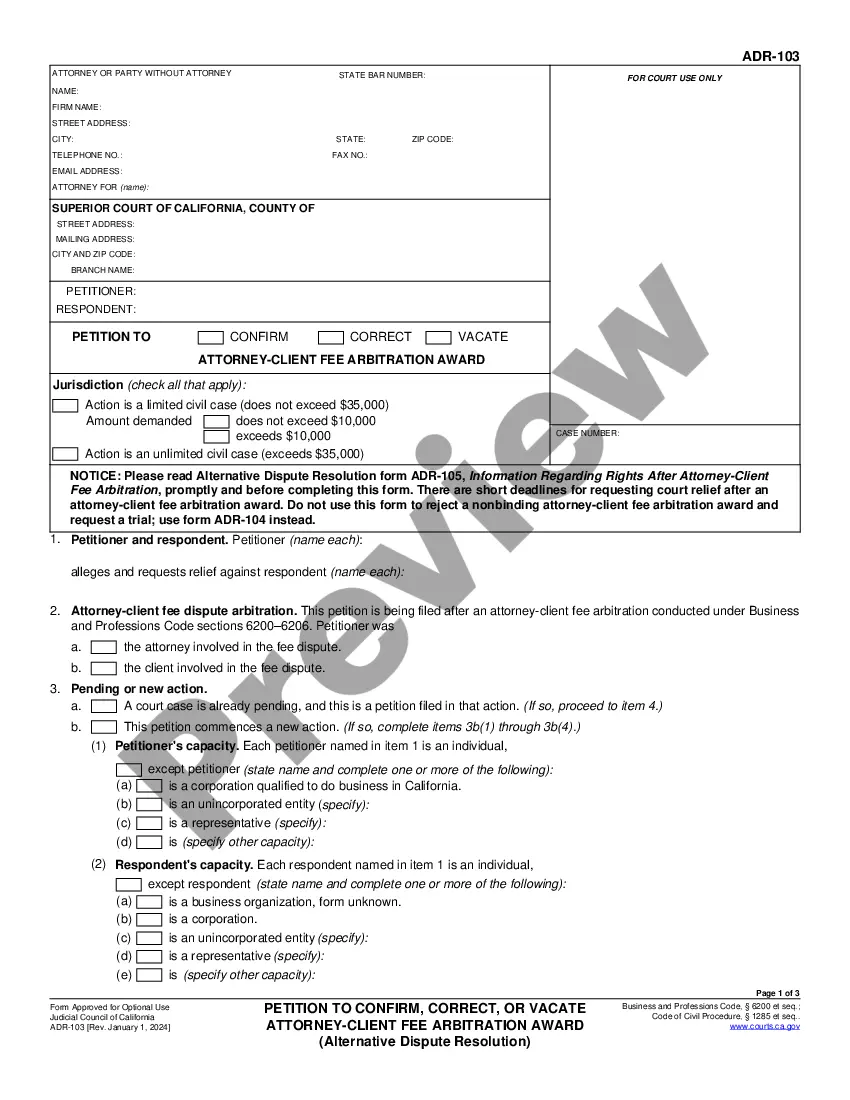

How to fill out Oakland Michigan Pledge And Security Agreement Regarding The Finance Of Acquisition Of Shares Of Common Stock?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Oakland Pledge and Security Agreement regarding the finance of acquisition of shares of common stock, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Oakland Pledge and Security Agreement regarding the finance of acquisition of shares of common stock from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Oakland Pledge and Security Agreement regarding the finance of acquisition of shares of common stock:

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A Stock Pledge is the transfer of stocks against a debt. It is an agreement. The debtor pledges the stocks as an asset against the amount of money taken from a lender and promises to return the amount. The debtor pledges the stocks as a security against the debt.

How to pledge stocks and mutual funds for collateral margins - YouTube YouTube Start of suggested clip End of suggested clip Segment. So now let's suppose you want to take a one lakh rupee derivative. Position only 50 000 canMoreSegment. So now let's suppose you want to take a one lakh rupee derivative. Position only 50 000 can be used from the money you got by placing the collateral. The other 50 000 has to come from cash.

In simple words, pledging of shares means taking loans against the shares that one holds. Shares are considered assets. Pledging of shares is a way for the promoters of a company to get loans to meet their business or personal requirements by keeping their shares as collateral to lenders.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

Promoters can pledge their shares to avoid losing trade opportunities due to low cash margins. They can get a loan after haircut deduction. The collateral margin received from these pledged shares can be used for equity trading, futures, and options writing.

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

Pledging simply means taking loans against the shares that one holds. Shares are considered a type of asset. They act as a collateral against loans. Any individual or institution that holds shares can pledge them.

Pledging simply means taking loans against the shares that one holds. Shares are considered a type of asset. They act as a collateral against loans. Any individual or institution that holds shares can pledge them.

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail a loan.

Stock-Secured Loans With a stock-based loan, you pledge shares of stock as collateral against the repayment of the loan. Typically you do not make payments until the loan is due in two to three years and any dividends paid on the shares go toward the interest and principal of the loan.

More info

In this way Abbott is a pioneer of the medical information-sharing revolution. Abbott now holds a patent.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.