The Chicago Illinois Stock Option Agreement of Quantum Effect Devices, Inc., is a legally binding document that outlines the terms and conditions for the issuance and exercise of stock options by Quantum Effect Devices, Inc. Keywords associated with this agreement may include "stock option agreement," "Chicago Illinois," "Quantum Effect Devices, Inc.," and "stock options." The Stock Option Agreement of Quantum Effect Devices, Inc. provides employees, consultants, or other eligible individuals the opportunity to purchase shares of Quantum Effect Devices, Inc.'s stock at a predetermined price, referred to as the exercise price. This agreement aims to incentivize individuals by allowing them to profit from the potential appreciation in Quantum Effect Devices, Inc.'s stock value over time. There may be different types of Stock Option Agreements offered by Quantum Effect Devices, Inc. in Chicago, Illinois. Some common types include Non-Qualified Stock Options (SOS) and Incentive Stock Options (SOS). 1. Non-Qualified Stock Options (SOS): These options are typically awarded to employees or consultants and are subject to less stringent requirements than Incentive Stock Options. SOS offer more flexibility in terms of granting, exercising, and taxation, but they are generally subject to ordinary income tax rates upon exercise. 2. Incentive Stock Options (SOS): SOS are designed specifically for employees and offer favorable tax treatment. To qualify for SOS, certain conditions must be met, such as granting the options at fair market value, limiting the total value of options, and imposing a holding period before selling the acquired stock. SOS can provide potential tax advantages by allowing individuals to pay capital gains tax rates instead of ordinary income tax rates. The Chicago Illinois Stock Option Agreement of Quantum Effect Devices, Inc. outlines the grant date, vesting schedule, exercise period, exercise price, and any restrictions or conditions applicable to the stock options issued. It also covers provisions related to the transferability of options, possible early exercise circumstances, and the impact of termination of employment or consultancy on vested and invested options. It is important for both parties involved, Quantum Effect Devices, Inc. and the option holder, to understand the terms and conditions outlined in the Stock Option Agreement. Seeking legal advice or consulting with professionals specialized in employee stock options can help ensure compliance with applicable laws and optimize the benefits for all parties.

Chicago Illinois Stock Option Agreement of Quantum Effect Devices, Inc.

Description

How to fill out Chicago Illinois Stock Option Agreement Of Quantum Effect Devices, Inc.?

If you need to find a trustworthy legal document supplier to find the Chicago Stock Option Agreement of Quantum Effect Devices, Inc., consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to find and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

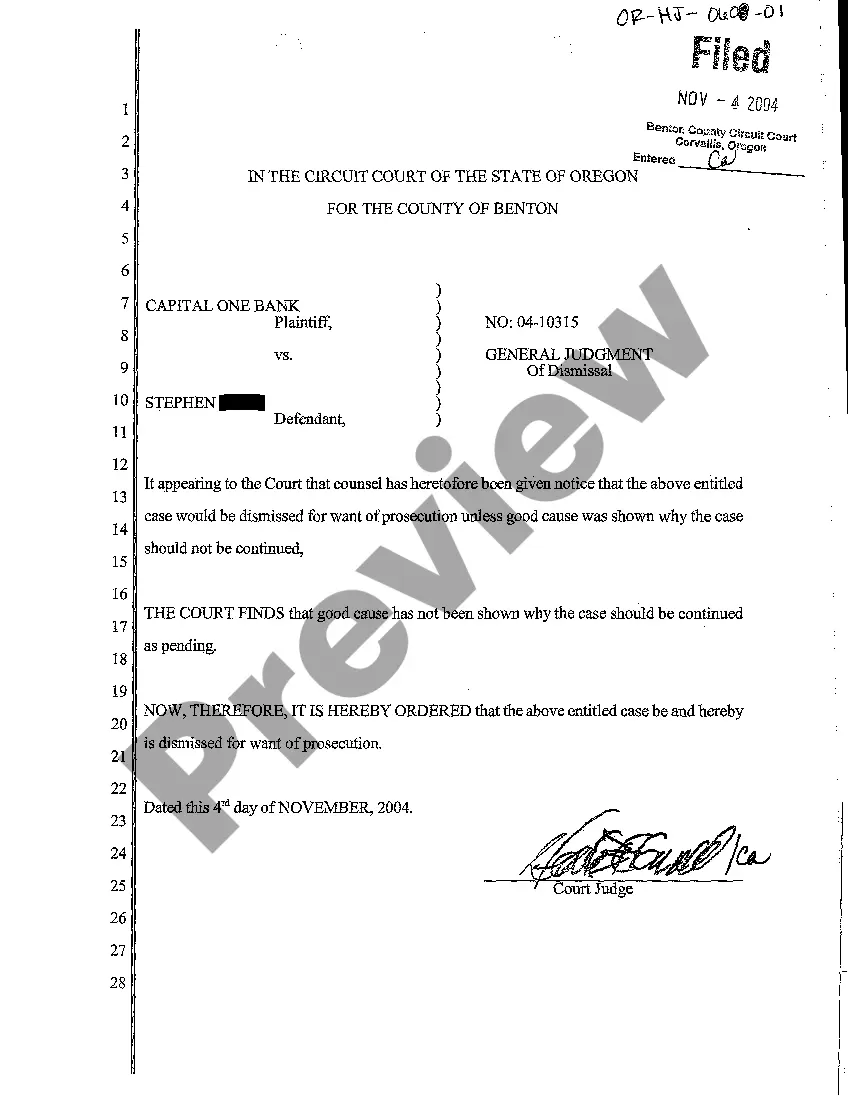

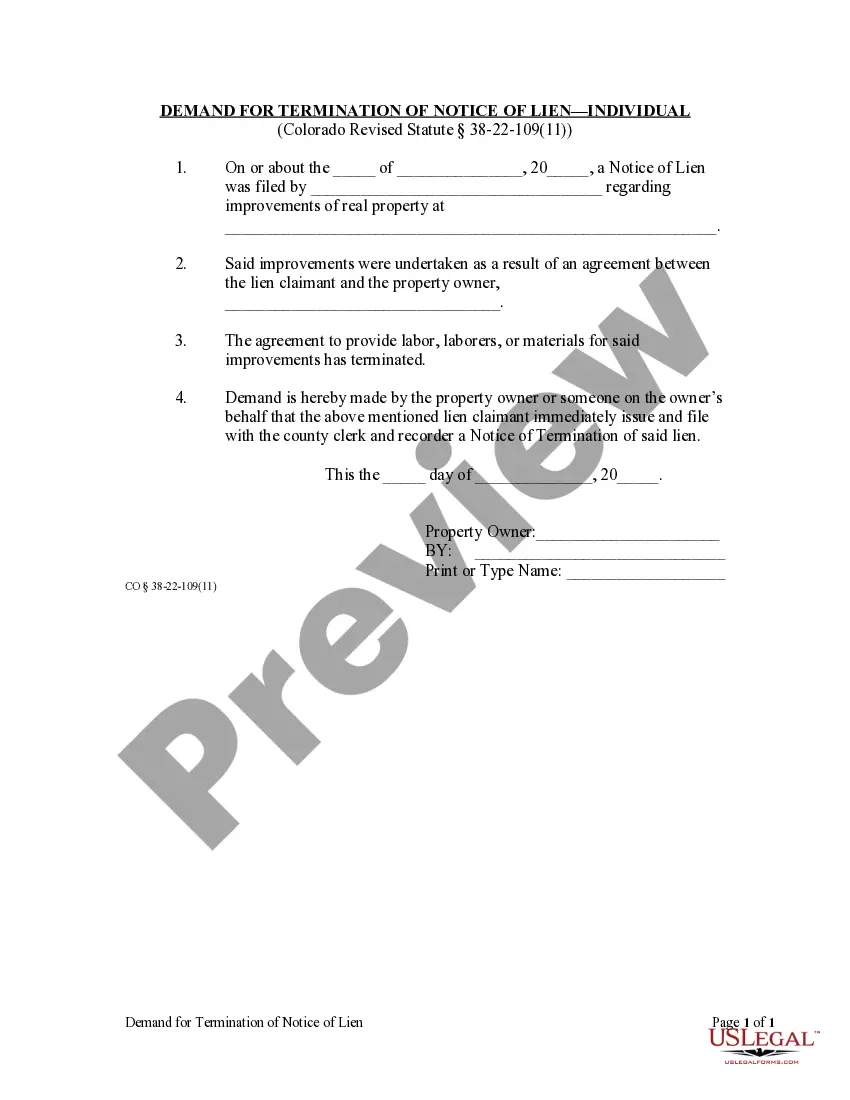

You can simply select to look for or browse Chicago Stock Option Agreement of Quantum Effect Devices, Inc., either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Chicago Stock Option Agreement of Quantum Effect Devices, Inc. template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Chicago Stock Option Agreement of Quantum Effect Devices, Inc. - all from the convenience of your home.

Join US Legal Forms now!