The Hennepin Minnesota Bylaws of Bankers Trust Corporation serve as a comprehensive set of regulations and guidelines that govern the operations and decision-making processes of Bankers Trust Corporation within Hennepin County, Minnesota. These bylaws are designed to ensure transparency, accountability, and compliance with local laws and industry standards. The Hennepin Minnesota Bylaws outline the organizational structure of Bankers Trust Corporation, including the roles and responsibilities of its officers, directors, and shareholders. They also provide insight into the corporation's formation, purpose, and powers granted under Minnesota state law. One key aspect covered in the bylaws is the establishment of committees, such as the Audit Committee, Finance Committee, and Risk Management Committee. These committees play crucial roles in overseeing the corporation's financial reporting, internal controls, and risk management practices. The Hennepin Minnesota Bylaws further detail the procedures for conducting Board of Directors and shareholder meetings, including the requirements for notice, quorum, and voting rights. They also address matters related to the election and removal of directors, as well as the appointment and removal of officers. In addition to the general bylaws, there may be specific bylaws tailored for different subsidiaries or divisions of Bankers Trust Corporation operating within Hennepin County. These specialized bylaws might outline unique roles, responsibilities, and operating procedures specific to each subsidiary or division, while still adhering to the overarching principles outlined in the general bylaws. The Hennepin Minnesota Bylaws of Bankers Trust Corporation, therefore, encompass a wide range of topics crucial to the effective and ethical operation of the corporation within Hennepin County. These bylaws ensure compliance with legal requirements, provide clarity on decision-making processes, and promote transparency and accountability at all levels of the organization.

Hennepin Minnesota Bylaws of Bankers Trust Corporation

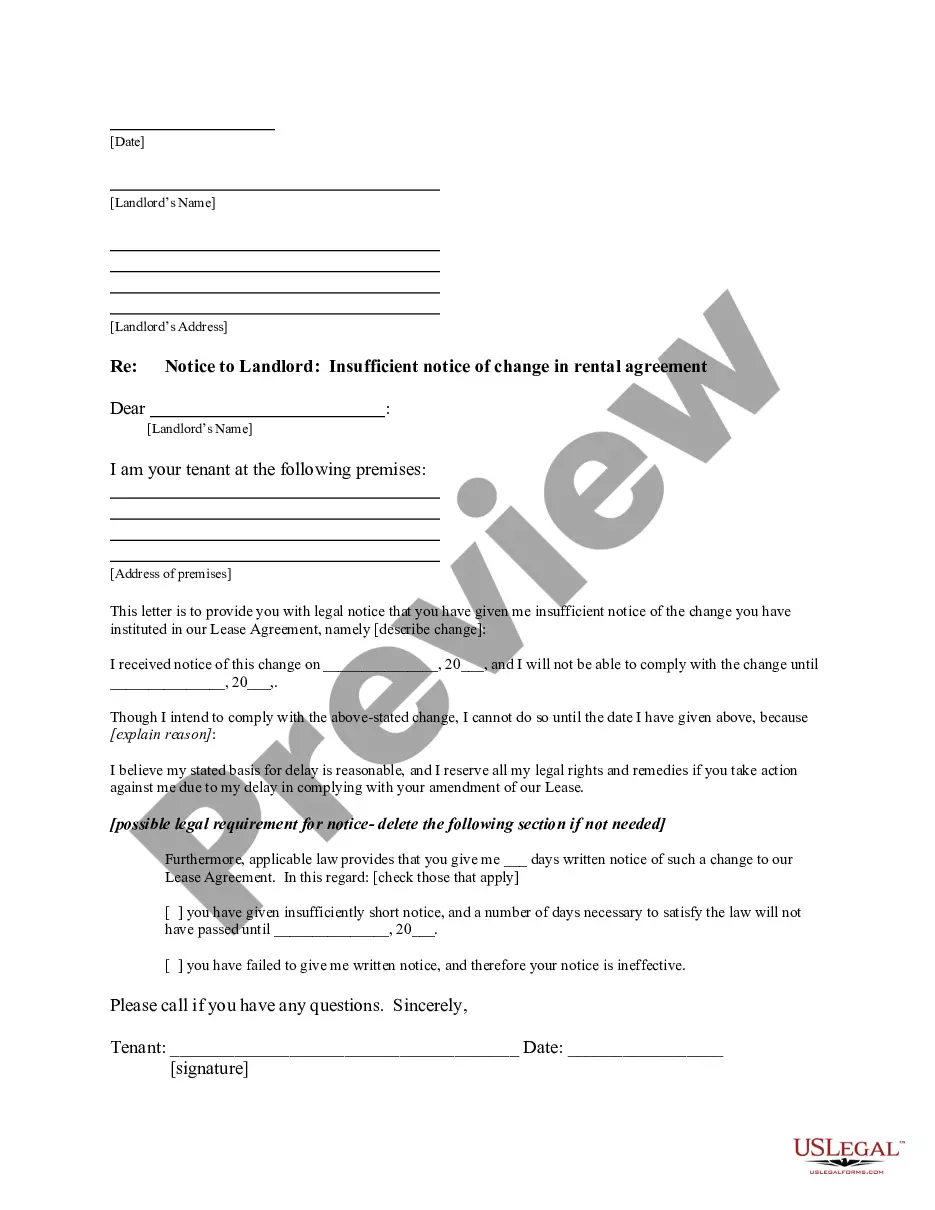

Description

How to fill out Hennepin Minnesota Bylaws Of Bankers Trust Corporation?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Hennepin Bylaws of Bankers Trust Corporation.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Hennepin Bylaws of Bankers Trust Corporation will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Hennepin Bylaws of Bankers Trust Corporation:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Hennepin Bylaws of Bankers Trust Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!