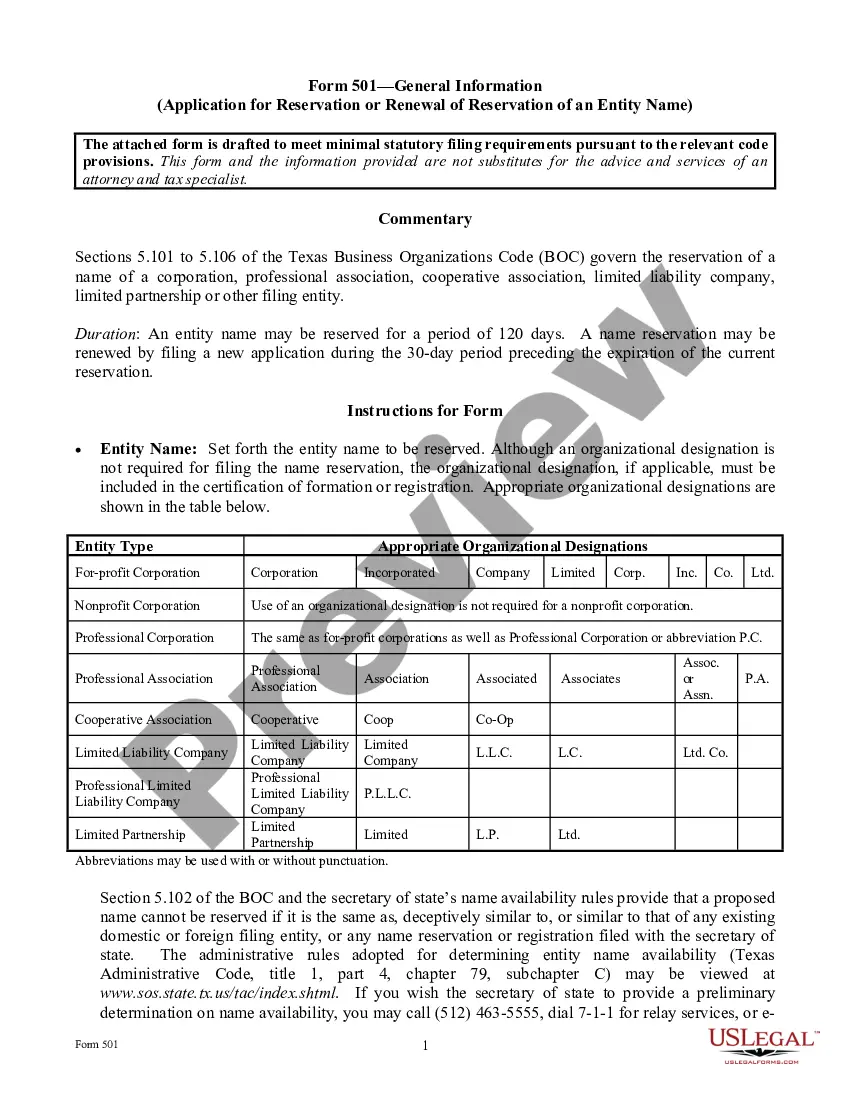

Dallas Texas Investment Management Agreement refers to the contract or agreement between an individual or organization, typically a client or investor residing in Dallas, Texas, and Morgan Stanley Dean Witter Advisors, Inc. The agreement outlines the terms and conditions under which Morgan Stanley Dean Witter Advisors, Inc. will provide management and investment advisory services to the client. The primary purpose of this agreement is to establish a legally binding relationship between the client and Morgan Stanley Dean Witter Advisors, Inc. It aims to clearly define the responsibilities, roles, and objectives of both parties involved in managing and advising investment portfolios. The Dallas Texas Investment Management Agreement is crucial for investors seeking professional guidance and assistance in managing their investments. By entering into such an agreement, clients can rely on the expertise and experience of Morgan Stanley Dean Witter Advisors, Inc., a renowned financial services firm. Keywords: Dallas Texas, investment management agreement, employment, Morgan Stanley Dean Witter Advisors, Inc., management services, investment advisory services, contract, terms and conditions, client, investor, legally binding, relationship, responsibilities, roles, objectives, portfolios, professional guidance, expertise, financial services. Different types of Dallas Texas Investment Management Agreements may exist based on specific client preferences or the complexity of the investment portfolio. Each variant of the agreement could include additional provisions or modifications tailored to meet the unique needs of the client. Some of these variations might include: 1. Individual Investment Management Agreement: This type of agreement is suited for individual investors in Dallas, Texas, seeking personalized investment management and advisory services from Morgan Stanley Dean Witter Advisors, Inc. 2. Institutional Investment Management Agreement: Designed for institutional clients, such as pension funds, endowments, or corporations based in Dallas, Texas, this agreement caters to the specific requirements and investment strategies of these organizations. 3. High-Net-Worth Investment Management Agreement: Geared towards high-net-worth individuals residing in Dallas, Texas, this agreement focuses on comprehensive wealth management services, including estate planning, tax optimization, and customized investment strategies. 4. Alternative Investments Management Agreement: For clients interested in alternative or non-traditional investment options, this agreement might address the management of investments like hedge funds, private equity, real estate, or venture capital. Regardless of the type of Dallas Texas Investment Management Agreement, the main objective remains the same — to establish a partnership between the client and Morgan Stanley Dean Witter Advisors, Inc., ensuring effective management and advisory services.

Dallas Texas Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services

Description

How to fill out Dallas Texas Investment Management Agreement Regarding The Employment Of Morgan Stanley Dean Witter Advisors, Inc. To Render Management And Investment Advisory Services?

If you need to get a trustworthy legal paperwork supplier to get the Dallas Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to get and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Dallas Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services, either by a keyword or by the state/county the document is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Dallas Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or execute the Dallas Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

From our origins as a small Wall Street partnership to becoming a global firm of more than 60,000 employees today, Morgan Stanley has been committed to clients and communities for 85 years.

Morgan Stanley total number of employees in 2020 was 68,000, a 12.53% increase from 2019. Morgan Stanley total number of employees in 2019 was 60,431, a 0.14% increase from 2018. Morgan Stanley total number of employees in 2018 was 60,348, a 4.71% increase from 2017.

Underpinning all that we do are five core values. From our origins as a small Wall Street partnership to becoming a global firm of more than 60,000 employees today, Morgan Stanley has been committed to clients and communities for 85 years.

Although Morgan Stanley has higher total revenues, Goldman is not far behind. Goldman is highly dependent on Investment Banking & Securities Trading segments, whereas Morgan Stanley is more reliant on its Wealth & Asset Management business. Goldman Sachs has a higher return on assets than that of its peer.

For Dean Witter's customers, the merger could mean many new investment choices from Morgan Stanley's stock-and-bond factory, from new stock offerings that it manages for big corporations to the most exotic bonds from developing nations.

1989 Going Public In 1986, the firm goes public to raise capital for further growth.

Depending upon your account, Morgan Stanley Online and Morgan Stanley Mobile permit trading of Stocks, Exchange-Traded Funds, Options and Mutual Funds. 3 Options trading is subject to appropriate Options Agreement with firm.

In 1997, Morgan Stanley Group, Inc. and Dean Witter Discover merged to form one of the largest global financial services firms: Morgan Stanley Dean Witter & Discover Co.. The combined firm later dropped the "Discover Co." name in 1998 and further the "Dean Witter" name in 2001.

RANK61. Banks had a great 2021, and Morgan Stanley was no exception. The bank posted record net revenues (up 23%) and net income (up 37%) for the year, and its wealth management division added $1 trillion to client assets.

The main areas of business for the firm today are institutional securities, wealth management and investment management....Morgan Stanley. Morgan Stanley's office at 1585 Broadway on Times Square, New York CityTypePublicTraded asNYSE: MS S&P 100 component S&P 500 componentIndustryFinancial services19 more rows