Clark Nevada Distribution Agreement is a legal document outlining the terms and conditions of the continuous offering of the Trust's transferable shares of beneficial interest. This agreement establishes the framework for the distribution process, ensuring that all parties involved understand their rights and obligations. Keywords: Clark Nevada, Distribution Agreement, continuous offering, Trust's transferable shares, beneficial interest. As for the different types of Clark Nevada Distribution Agreements regarding the continuous offering of the Trust's transferable shares of beneficial interest, there may be variations based on specific circumstances or requirements. Some possible types of agreements include: 1. Clark Nevada Distribution Agreement for Initial Offering: This agreement lays out the terms for the initial offering of the Trust's transferable shares, including the pricing, minimum investment requirements, and other relevant provisions specific to the initial phase. 2. Clark Nevada Distribution Agreement for Follow-On Offering: This type of agreement focuses on subsequent offerings of the Trust's transferable shares following the initial offering. It may outline conditions such as minimum investment thresholds for existing shareholders, pricing, and any additional terms pertinent to follow-on offerings. 3. Clark Nevada Distribution Agreement for Specified Investor Offering: In certain situations, the trust might choose to have a distribution agreement specifically catering to a particular group of investors. This agreement may outline unique terms and conditions tailored to the specific needs and requirements of the specified investors. 4. Clark Nevada Distribution Agreement for Institutional Offering: When targeting institutional investors, such as banks, pension funds, or insurance companies, a distribution agreement may be formulated to accommodate their specific investment preferences, regulatory aspects, and any other relevant considerations. 5. Clark Nevada Distribution Agreement for Secondary Market Trading: In situations where the transferable shares of beneficial interest are traded on secondary markets, a specific agreement may be necessary to govern the continuous offering and sale of these shares on the open market. This agreement might include provisions related to market regulations, shareholder communications, and reporting obligations. It is important to consult legal professionals specializing in securities law and regulations to ensure the development and execution of a Clark Nevada Distribution Agreement that adheres to all applicable rules and safeguards the interests of the parties involved.

Clark Nevada Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

Description

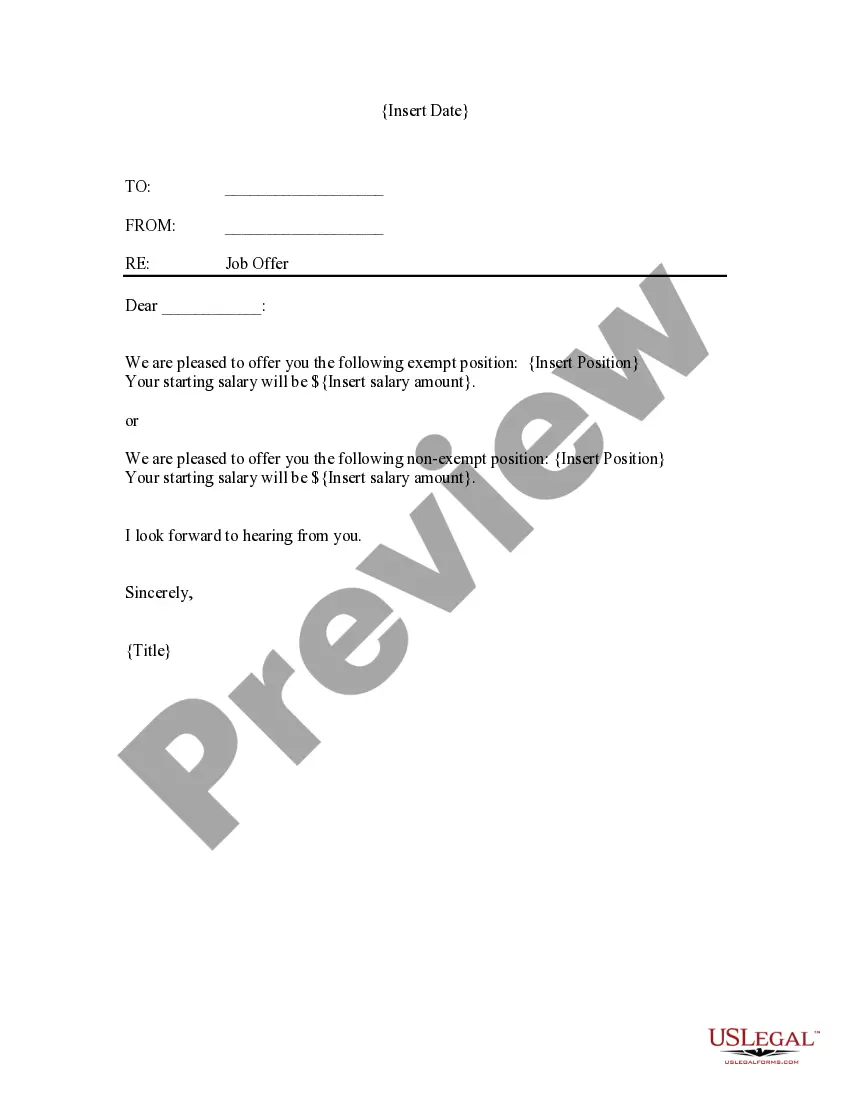

How to fill out Clark Nevada Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Creating forms, like Clark Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest, to take care of your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for different cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Clark Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Clark Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest:

- Make sure that your document is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Clark Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our website and get the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!