Cook Illinois Distribution Agreement is a legal document that outlines the terms and conditions for the continuous offering of the Trust's transferable shares of beneficial interest. This agreement serves as a framework for the distribution and sale of these shares, ensuring compliance with applicable laws and regulations. The Cook Illinois Distribution Agreement includes provisions related to the offering process, disclosure requirements, and the rights and responsibilities of the parties involved. It specifies the methods and procedures for selling the transferable shares, including any limitations or restrictions on their transferability. Key elements discussed in the Cook Illinois Distribution Agreement may include the registration of the shares with the appropriate regulatory bodies, such as the Securities and Exchange Commission (SEC). It may outline the obligations of the trust to provide accurate and up-to-date information to prospective investors, including disclosure of the risks associated with investing in the trust. The agreement may also cover the compensation structure for distributors and their obligations in promoting and marketing the trust's transferable shares. It may specify the timeframe for the offering and provide provisions for terminating the agreement or modifying its terms if necessary. Different types of Cook Illinois Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest may include: 1. Initial Distribution Agreement: This agreement is relevant when the trust initially offers its transferable shares to the public. It outlines the procedures and requirements specific to the initial offering, ensuring compliance with regulatory frameworks. 2. Amended and Restated Distribution Agreement: This variation of the agreement occurs when substantial changes or modifications are made to the terms and conditions outlined in the original agreement. It may be necessary to address changing market conditions, regulatory requirements, or other factors impacting the offering. 3. Supplemental Distribution Agreement: In some cases, the trust may decide to offer additional shares to the public after the initial offering. The supplemental distribution agreement deals with the terms and conditions specific to these subsequent offerings, while still aligning with the original Cook Illinois Distribution Agreement. 4. Termination or Renewal Agreement: Over time, the trust may decide to terminate or renew the continuous offering of its transferable shares. These types of agreements focus on detailing the process and requirements for ending or extending the offering period. In summary, the Cook Illinois Distribution Agreement outlines the framework for offering and selling the trust's transferable shares of beneficial interest. It ensures compliance with regulations, addresses disclosure requirements, and outlines the rights and obligations of parties involved in the offering process.

Cook Illinois Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

Description

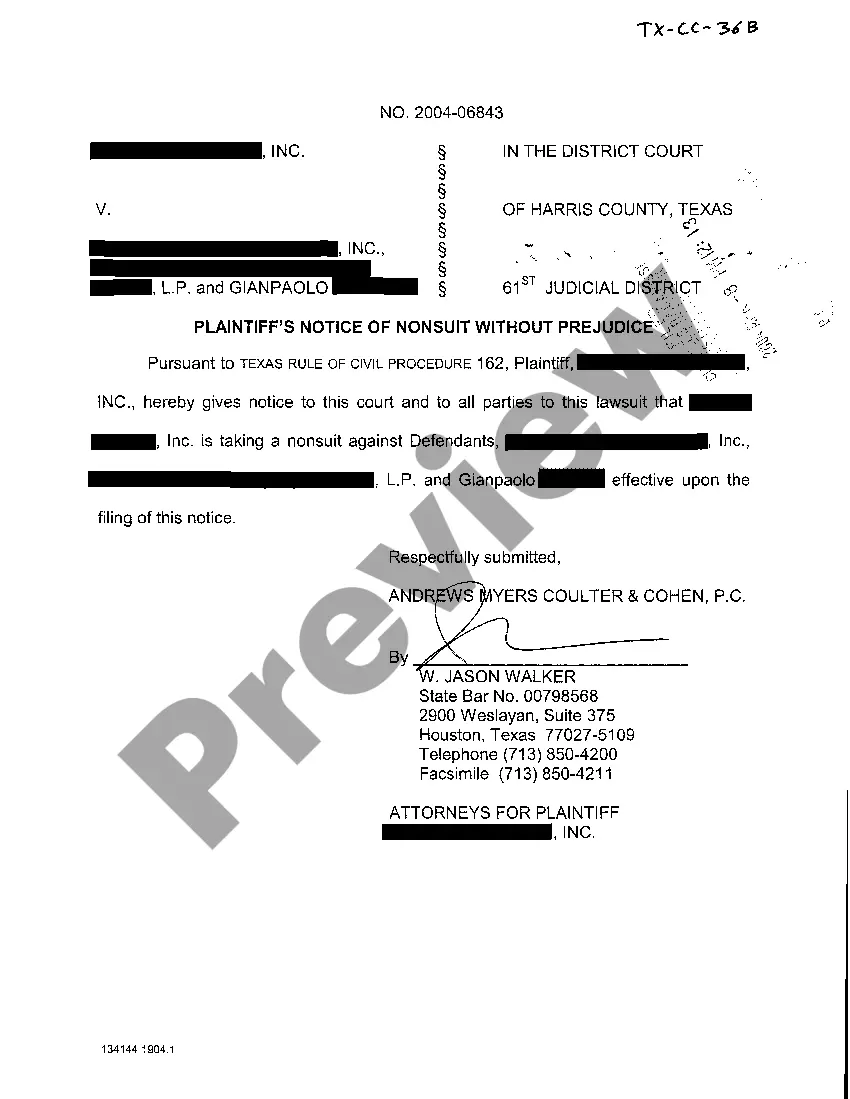

How to fill out Cook Illinois Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Cook Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Cook Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

A distribution agreement (Distribution Agreement) is a form of commercial contract where one party, the distributor (Distributor) is granted the right to distribute goods or services of another supplier (Supplier) to clients or customers usually in a distinct territory.

A distribution deal (also known as distribution contract or distribution agreement) is a legal agreement between one party and another, to handle distribution of a product. There are various forms of distribution deals. There are exclusive and non-exclusive distribution agreements.

There are four distribution agreement types including: Type 1. Exclusive distribution agreements. Type 2. Wholesale distribution agreements. Type 3. Distribution agreements for commissions. Type 4. Developer distribution agreements.

An equity distribution agreement is a contract typically used by a company that offers another party the ability to distribute shares through what's known as an at-the-market (or ATM) offering program.

Distribution agreements A Distribution Agreement is a contract in which the supplier grants the distributor the right to distribute the supplier's good or services to customers in a distinct territory.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

The key terms of a distribution agreement can vary on multiple factors including the: product to be distributed; appointment of the distributor; and. obligations that each party have relating to the marketing, sale and distribution of the product.

In short, a distribution agreement is essentially a contract between suppliers and distributors of a product. These agreements are also referred to as distributor agreements. Despite the name, they may involve other parties, such as manufacturers.