The King Washington Distribution Agreement is a comprehensive legal document that outlines the terms and conditions pertaining to the continuous offering of the Trust's transferable shares of beneficial interest. This agreement serves as a binding contract between the King Washington Trust and its investors, providing clear guidelines and provisions regarding the distribution process. Here, we will delve into the details and highlight the key aspects of this important agreement. Keywords: King Washington, Distribution Agreement, continuous offering, Trust, transferable shares, beneficial interest I. Overview of the King Washington Distribution Agreement The King Washington Distribution Agreement is designed to facilitate the ongoing offering of the Trust's transferable shares of beneficial interest to potential investors. This agreement serves as a foundation for maintaining a regulated and transparent distribution process, ensuring compliance with regulatory requirements and investor protection. II. Provisions within the King Washington Distribution Agreement 1. Continuous Offering: The agreement specifies that the Trust will continuously offer transferable shares of beneficial interest to potential investors, subject to certain conditions and regulatory restrictions. 2. Transferability of Shares: The agreement outlines the terms and conditions governing the transferability of shares of beneficial interest. It includes provisions related to restrictions on transfer, procedures for transferring shares, and the approval process, if any. 3. Offering Price and Redemption: The agreement establishes the offering price for the shares of beneficial interest and outlines procedures for potential investors to purchase or redeem these shares. It may also provide guidelines on fees or expenses associated with such transactions. 4. Investor Representations and Warranties: Investors are required to make certain representations and warranties regarding their eligibility, suitability, and compliance with applicable laws or regulations. The agreement defines these requirements to protect the Trust and maintain legal compliance. 5. Reporting Obligations: The agreement might include reporting obligations for the Trust, ensuring that investors receive regular and accurate updates on the performance and financial condition of the Trust. Such reporting obligations contribute to transparency and investor confidence. 6. Termination and Amendments: The agreement may contain provisions detailing the circumstances under which the Trust can terminate or alter the continuous offering of shares. This ensures flexibility in adapting to changing regulatory requirements or market dynamics. III. Types of King Washington Distribution Agreements While the details might vary depending on specific circumstances, there may be different types of King Washington Distribution Agreements: 1. Initial Distribution Agreement: This agreement sets out the terms and conditions for the initial offering of the Trust's transferable shares of beneficial interest to potential investors. 2. Renewal or Amended Distribution Agreement: As the Trust's continuous offering evolves over time, this agreement provides for any necessary revisions, updates, or renewals to the existing distribution agreement. This ensures compliance with changing market conditions, regulatory requirements, or investor demands. 3. Subsequent Distribution Agreement: If the Trust expands its investment offerings or introduces new classes of shares, a subsequent distribution agreement may be formulated to address specific requirements related to these changes. In conclusion, the King Washington Distribution Agreement is a critical legal document that governs the continuous offering of the Trust's transferable shares of beneficial interest. It lays out provisions for the distribution process, investor responsibilities, reporting obligations, and mechanisms for adapting to changing circumstances. Different types of agreements may exist to cater to specific situations, such as initial, renewed/amended, or subsequent distribution agreements.

King Washington Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

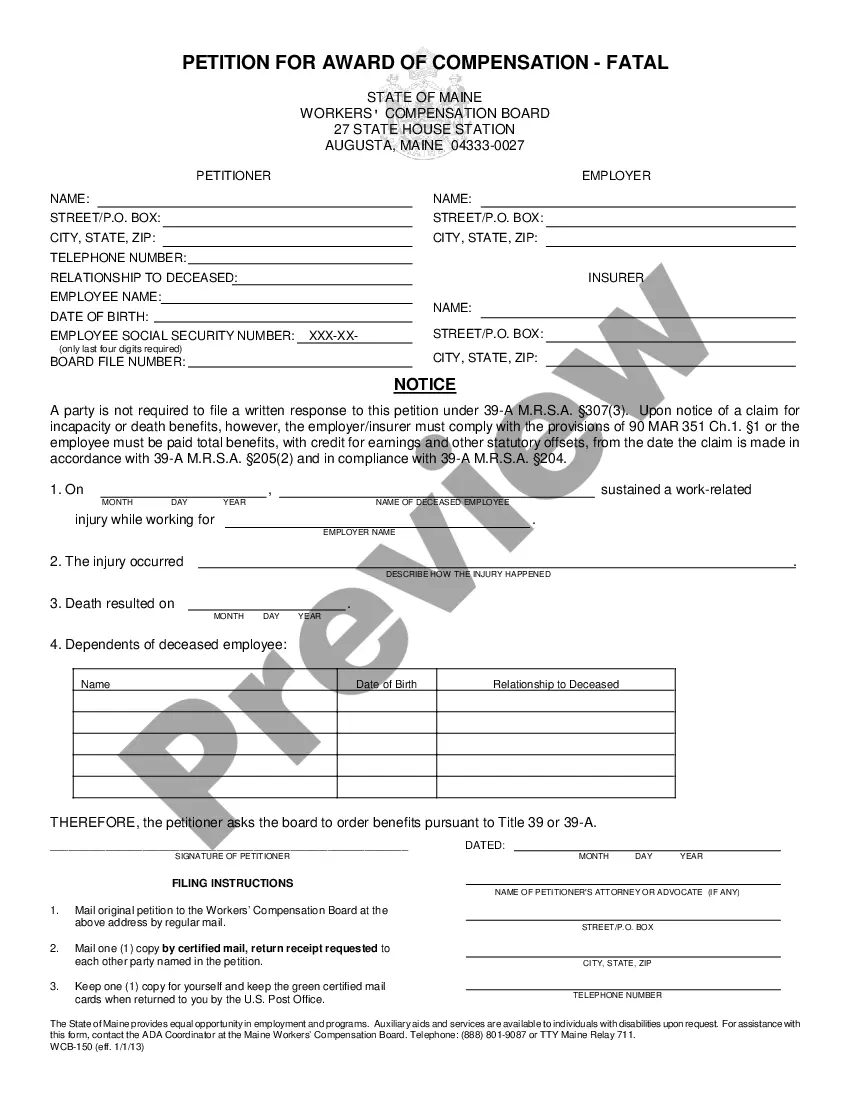

Description

How to fill out King Washington Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the King Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the current version of the King Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the King Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your King Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!