Kings New York Distribution Agreement refers to a contractual arrangement that pertains to the continuous offering of the Trust's transferable shares of beneficial interest. This agreement outlines the terms and conditions under which these shares can be transferred and the manner in which the offering process takes place. It provides a legal framework for the distribution of these shares and ensures compliance with relevant regulations. The Kings New York Distribution Agreement is designed to facilitate the ongoing availability and accessibility of the Trust's transferable shares to potential investors. It establishes guidelines for the promotion, sale, and transfer of these shares, setting forth the procedures that must be followed by all parties involved, including the trust itself, underwriters, and investors. Key elements covered in the Kings New York Distribution Agreement include the mechanism for pricing the transferable shares, the allocation of shares to investors, the disclosure requirements, and the duration of the offering. It also outlines the responsibilities and obligations of each party, such as reporting requirements, marketing efforts, and the payment of any associated fees or commissions. Different types of Kings New York Distribution Agreement regarding the continuous offering of the Trust's transferable shares may exist, which vary based on specific parameters and features. Some potential examples of these variations could include: 1. Regular Distribution Agreement: This type of agreement involves the continuous offering of transferable shares of beneficial interest in the Trust, in accordance with predetermined terms and conditions. 2. Exclusive Distribution Agreement: In this scenario, the Trust grants exclusive rights to a specific underwriter or financial institution to distribute and offer the transferable shares, restricting other entities from participating in the offering. 3. Limited-Time Distribution Agreement: This type of agreement establishes a fixed period during which the continuous offering takes place, expiring at a specific date or upon achieving predetermined subscription targets. 4. Customized Distribution Agreement: In certain cases, the Trust may engage in negotiations with specific underwriters or investors to customize the terms of the agreement, tailoring it to meet specific requirements or objectives. Please note that these examples are purely hypothetical, and the actual types of Kings New York Distribution Agreements may differ based on the intricacies of the Trust, the underwriters involved, and other relevant factors. It is essential to review the specific agreement in question for accurate and detailed information on its content and provisions.

Kings New York Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

Description

How to fill out Kings New York Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Drafting papers for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Kings Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Kings Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Kings Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest:

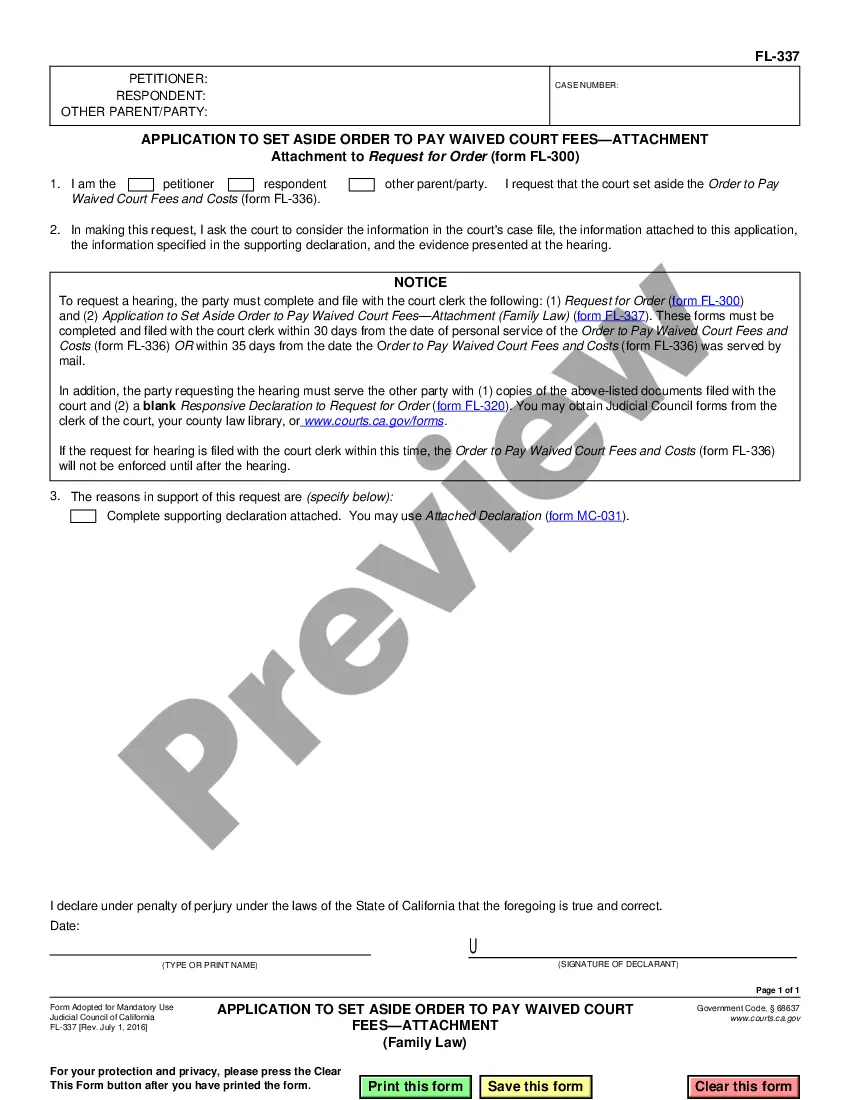

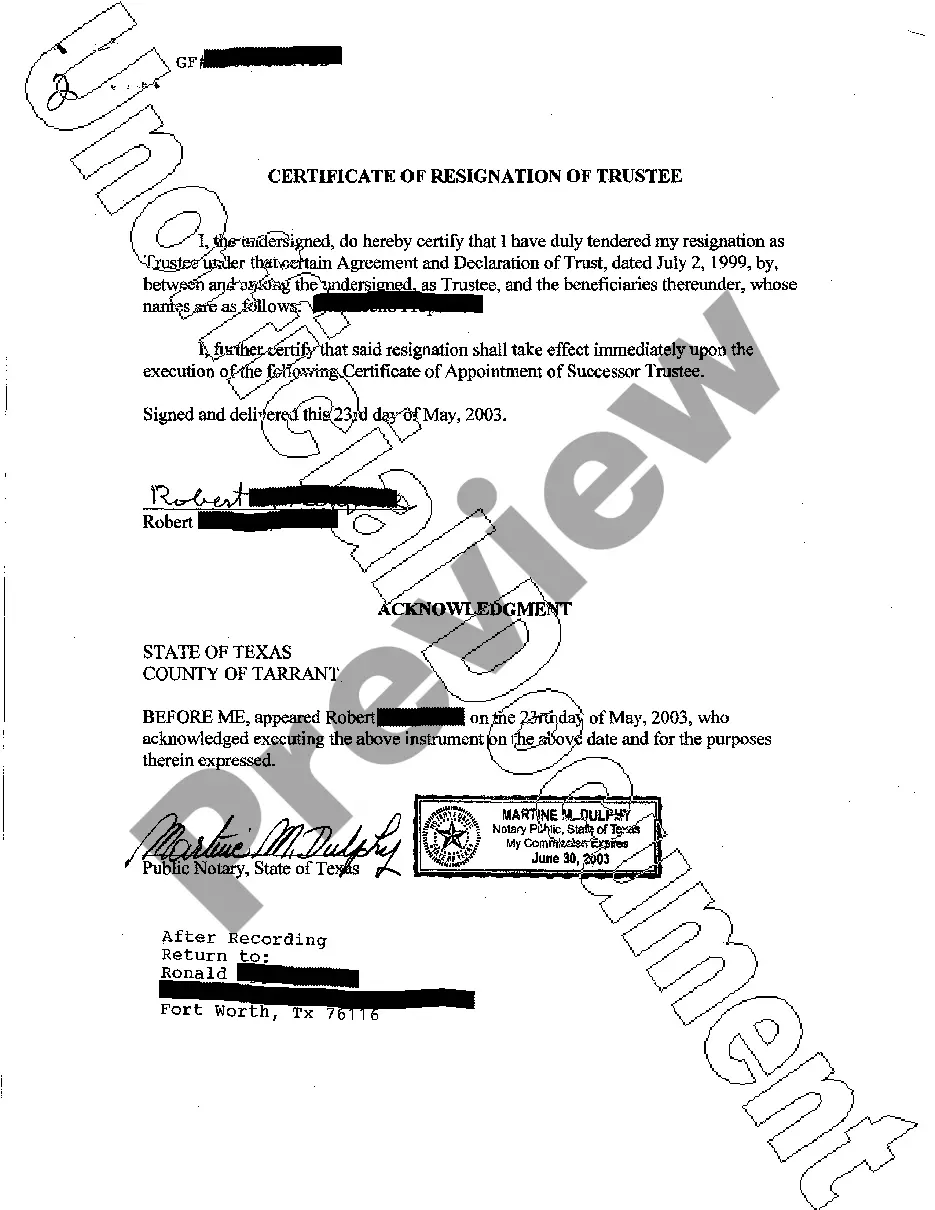

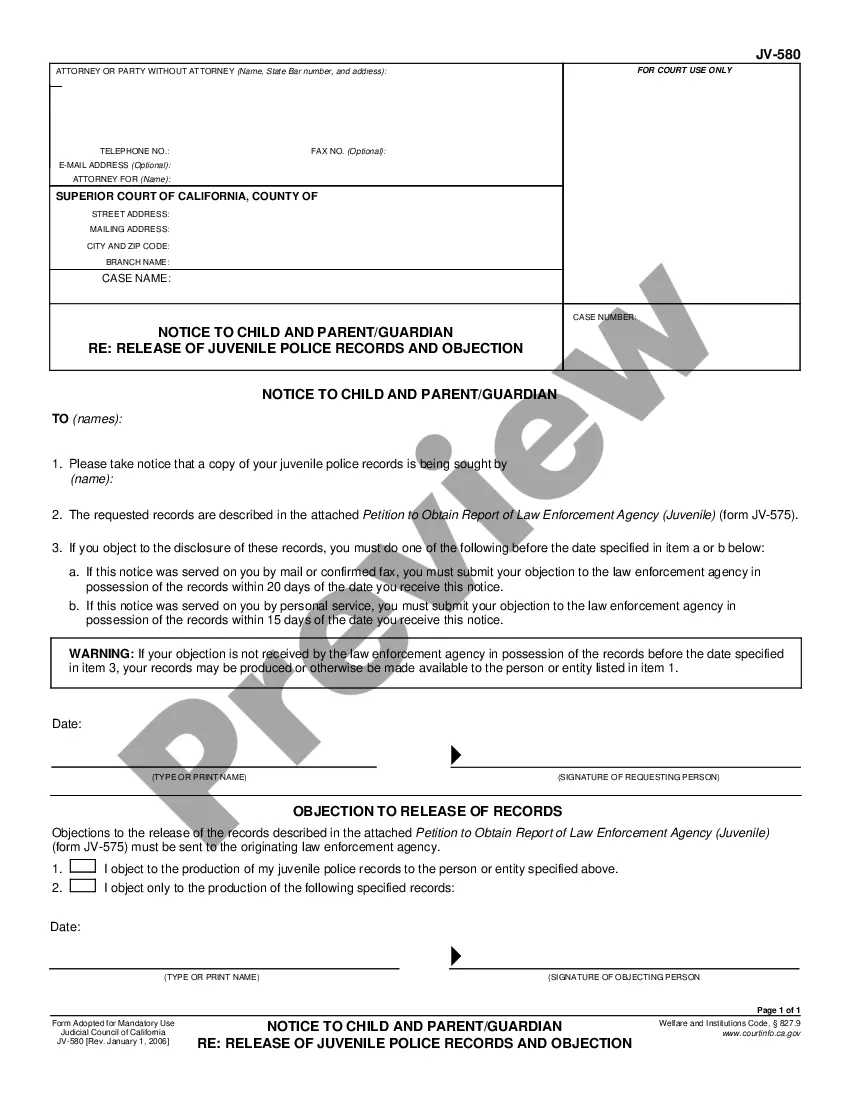

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Identifying the parties and stating, in the introduction, that the agreement is for resale of the supplier company's product. Describing the territory where the distributor can sell. Whether the contract is an exclusive agreement or whether the distributor is only one of multiple distributors in the region.

Copy. Sub-Distributor means any Third Party or any Affiliate of Distributor that has entered into a written agreement with Distributor for the distribution of Products anywhere in the Territory.

Below is a basic distribution agreement checklist to help you get started: Names and addresses of both parties. Sale terms and conditions. Contract effective dates. Marketing and intellectual property rights. Defects and returns provisions. Severance terms. Returned goods credits and costs. Exclusivity from competing products.

Six Rules for Negotiating a Better Distribution Agreement Balance. Balance in a distribution agreement ensures that neither party holds unfair power over the other.Due Diligence.Annual Termination and Semiautomatic Renewal.Comparison with Proven Industry Agreements.Four Eyes versus Two Eyes.Cause and Convenience.

Subdistribution (countable and uncountable, plural subdistributions) (statistics, countable) A subset of a distribution. (business, uncountable) The practice of purchasing goods from a distributor and selling them on to retailers.

Distribution Agreement Checklist Specify the duration of the relationship including methods of ending the relationship and fair compensation on termination. Reserve your right to repurchase the distributor's inventory of products at cost, in order to facilitate a change in distributors.

Exclusive dealing or requirements contracts between manufacturers and retailers are common and are generally lawful.

A distributor agreement, also known as a distribution agreement, is a contract between channel partners that stipulates the responsibilities of both parties.

Distribution agreements, also called wholesale distribution agreements, are contracts between a distributor and manufacturer. They allow the distributor to sell, market, and profit from the sales of a manufacturer's or wholesaler's product in bulk.

Distribution agreements define the terms and conditions under which a distributor may sell products provided by a supplier. Such an agreement may be for a limited term, and be further restricted by territory and distribution channel.