A Mecklenburg North Carolina Distribution Agreement is a legal contract that outlines the terms and conditions governing the continuous offering of a trust's transferable shares of beneficial interest. This agreement ensures transparency and compliance with relevant laws and regulations while providing a framework for distributing shares to interested parties. Here are some key details related to this agreement, along with relevant keywords: 1. Types of Distribution Agreements: — Standard Distribution Agreement: This type of agreement is a comprehensive document that covers all aspects of the distribution process, including pricing, timing, and other essential provisions. — Limited Distribution Agreement: In certain cases, a trust may opt for a limited distribution agreement that specifies restrictions on the number of shares being offered or limits it to specific qualified investors. — Exclusive Distribution Agreement: This agreement grants exclusive rights to a particular distribution partner, preventing other entities from engaging in the distribution of the trust's shares. 2. Parties Involved: — Trust: The legal entity responsible for managing and offering the transferable shares of beneficial interest. — Distributor: An authorized entity appointed by the trust to facilitate the continuous offering of shares to potential investors. 3. Continuous Offering: — The agreement outlines the duration of the offering period, specifying the start and end dates, during which the trust will continuously offer its transferable shares to interested investors. — It may also define the minimum and maximum number of shares to be offered during this period. 4. Transferable Shares: — Refers to the units or shares of beneficial interest in the trust that can be bought, sold, or transferred by investors. — The agreement may include provisions regarding the pricing mechanisms and any associated fees or commissions related to the purchase or sale of these shares. 5. Beneficial Interest: — Represents the ownership rights and privileges held by shareholders in the trust, including dividends, voting rights, and other benefits. — The agreement may specify the terms and conditions governing the distribution of dividends and any restrictions on the exercise of voting rights. 6. Compliance and Regulatory Matters: — The agreement ensures compliance with applicable federal and state securities laws, including registration requirements and disclosures to potential investors. — It may include provisions related to reporting obligations, financial statements, and any other necessary regulatory filings. By utilizing the relevant keywords and incorporating these details, the description provides a comprehensive overview of what a Mecklenburg North Carolina Distribution Agreement regarding the continuous offering of a trust's transferable shares of beneficial interest entails.

Mecklenburg North Carolina Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

Description

How to fill out Mecklenburg North Carolina Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Mecklenburg Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how to locate and download Mecklenburg Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest.

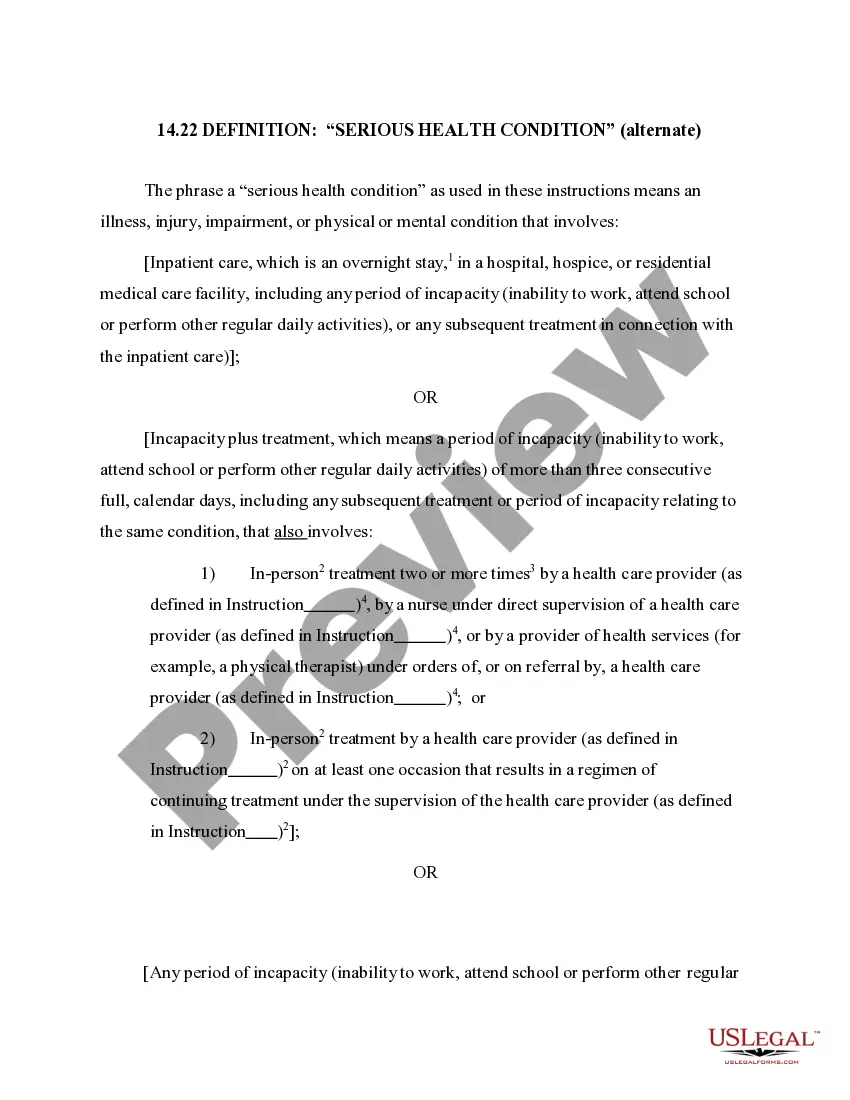

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the similar document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Mecklenburg Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Mecklenburg Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to cope with an exceptionally complicated case, we recommend using the services of an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!