Palm Beach Florida Distribution Agreement is a legally binding contract that governs the ongoing offering of transferable shares of beneficial interest in a Trust. This agreement outlines the terms and conditions under which the Trust's shares will be distributed and sold to interested parties. It ensures a transparent and regulated process for the continuous offering of these shares. The Palm Beach Florida Distribution Agreement consists of various clauses and provisions, each essential for successful share distribution. Firstly, it includes provisions for the registration of the shares with the appropriate regulatory authorities, ensuring compliance with applicable laws and regulations. This helps to establish the legitimacy and transparency of the offering. Additionally, the agreement outlines the terms of the offering, including the pricing structure, minimum investment requirements, and any associated fees or expenses. These details ensure that potential investors have a clear understanding of the financial commitment and expectations associated with purchasing these transferable shares. Furthermore, the agreement may incorporate provisions related to the marketing and promotion of the Trust's shares. This can include guidelines for the use of marketing materials, restrictions on advertising claims, and compliance with securities laws governing the solicitation of investors. Depending on the nature of the Trust and its objectives, there may be different types of Palm Beach Florida Distribution Agreements. These can include: 1. Initial Offering Distribution Agreement: This agreement pertains to the initial distribution of transferable shares of beneficial interest in the Trust. It establishes the terms and conditions for the first offering. 2. Supplemental Offering Distribution Agreement: In case the Trust decides to conduct subsequent offerings or issue additional shares, a supplemental agreement may be used. This agreement builds upon the initial offering agreement, providing updated terms and conditions for the continuous offering. 3. Redemption Distribution Agreement: If the Trust offers a redemption program allowing shareholders to sell their investment back to the Trust, a redemption distribution agreement may be implemented. This agreement governs the share redemption process, specifying the terms, conditions, and procedures involved. In summary, the Palm Beach Florida Distribution Agreement ensures the ongoing and regulated offering of transferable shares of beneficial interest in a Trust. It incorporates provisions related to registration, pricing, marketing, and compliance, providing a clear framework for the continuous offering of these shares.

Palm Beach Florida Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

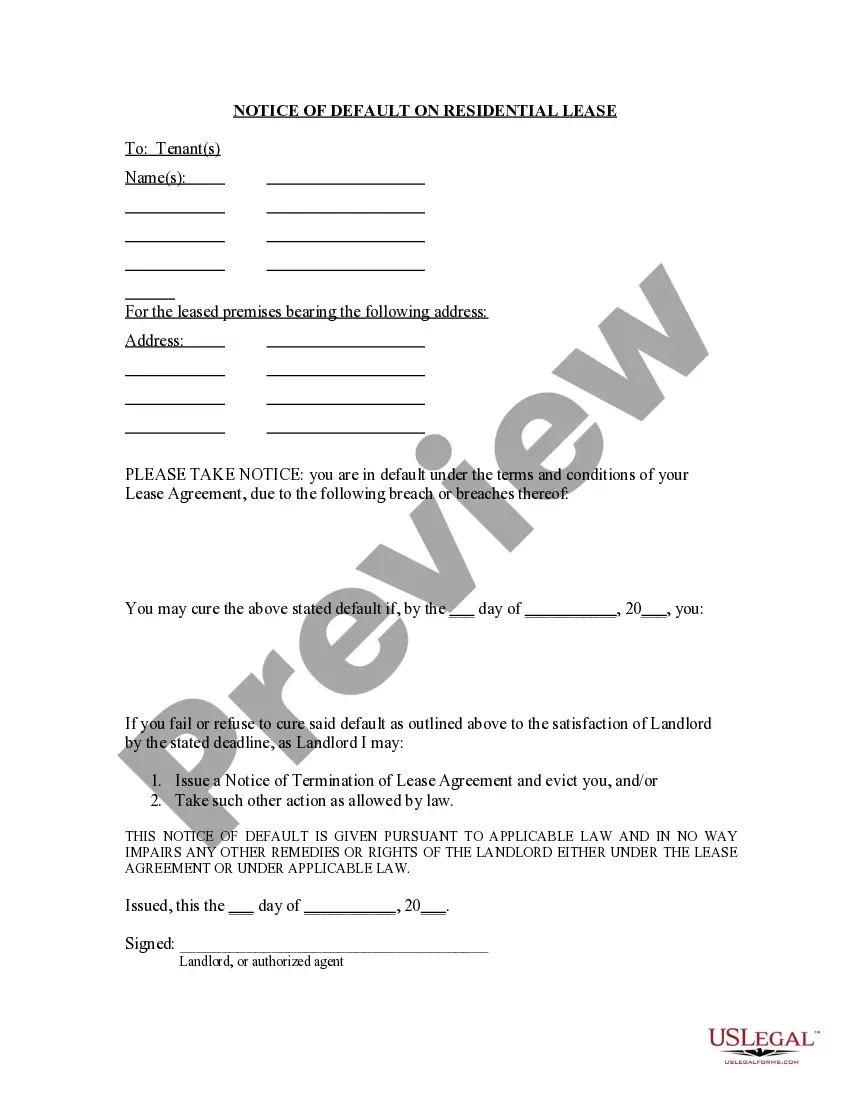

Description

How to fill out Palm Beach Florida Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

Are you looking to quickly create a legally-binding Palm Beach Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest or maybe any other form to manage your own or business matters? You can select one of the two options: contact a professional to write a legal document for you or create it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Palm Beach Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, carefully verify if the Palm Beach Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were seeking by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Palm Beach Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!