The Houston Texas Polaris 401(k) Retirement Savings Plan Trust Agreement is a legally binding agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. The purpose of this agreement is to establish a trust that will serve as the framework for managing and administering the retirement savings plan for Polaris employees. The trust agreement outlines the specific terms and conditions that govern the establishment, operation, and management of the 401(k) retirement plan. It ensures that both Polaris Industries, Inc. and Fidelity Management Trust Co. fulfill their respective roles and responsibilities in maintaining and safeguarding the plan assets. Key provisions outlined in the trust agreement include: 1. Establishment of Trust: The agreement establishes the trust as a separate legal entity and outlines its purpose, objectives, and scope of authority. It identifies Fidelity Management Trust Co. as the trustee responsible for overseeing the administration of the plan and managing the investment assets on behalf of plan participants. 2. Investment Management: The trust agreement delineates the roles and responsibilities of Fidelity Management Trust Co. as the investment manager. It sets guidelines for the selection, monitoring, and documentation of investment options offered within the 401(k) plan, ensuring compliance with applicable laws and regulations. 3. Contribution and Vesting: The trust agreement defines the contribution methods, eligibility criteria, and vesting schedules for employees participating in the 401(k) plan. It specifies the employer's matching contribution policy and any other employer-contributed funds. 4. Participant Rights and Benefits: The agreement outlines the rights, obligations, and benefits afforded to plan participants, including the availability of investment education resources, access to account information, and options for distribution and rollover of funds. 5. Plan Governance and Amendments: The trust agreement defines the procedures for plan governance and outlines the mechanisms for making plan amendments, including provisions for notifying participants of any changes. Different types of Houston Texas Polaris 401(k) Retirement Savings Plan Trust Agreements may exist depending on the specific needs and requirements of Polaris Industries and Fidelity Management Trust Co. These types may include variations in plan provisions, investment options, employer contributions, and participant benefits. It is crucial to review the individual trust agreement to understand the unique terms and conditions governing that particular plan.

Houston Texas Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

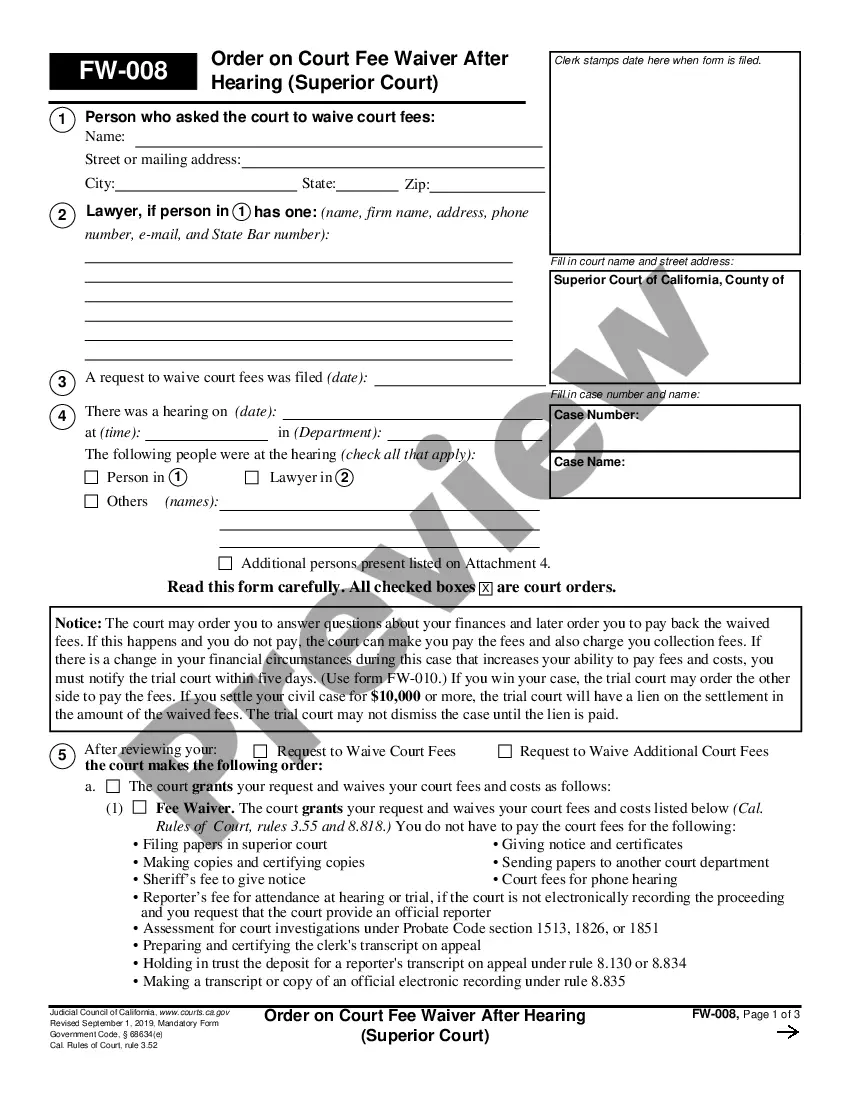

How to fill out Houston Texas Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Houston Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Houston Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Receive Copies of Old Statements Fidelity can mail copies of old account statements to your address of record at no charge. Request copies by Sending an E-mail to Fidelity, specifying the account number, month, and year for the duplicate statement(s) you would like to receive.

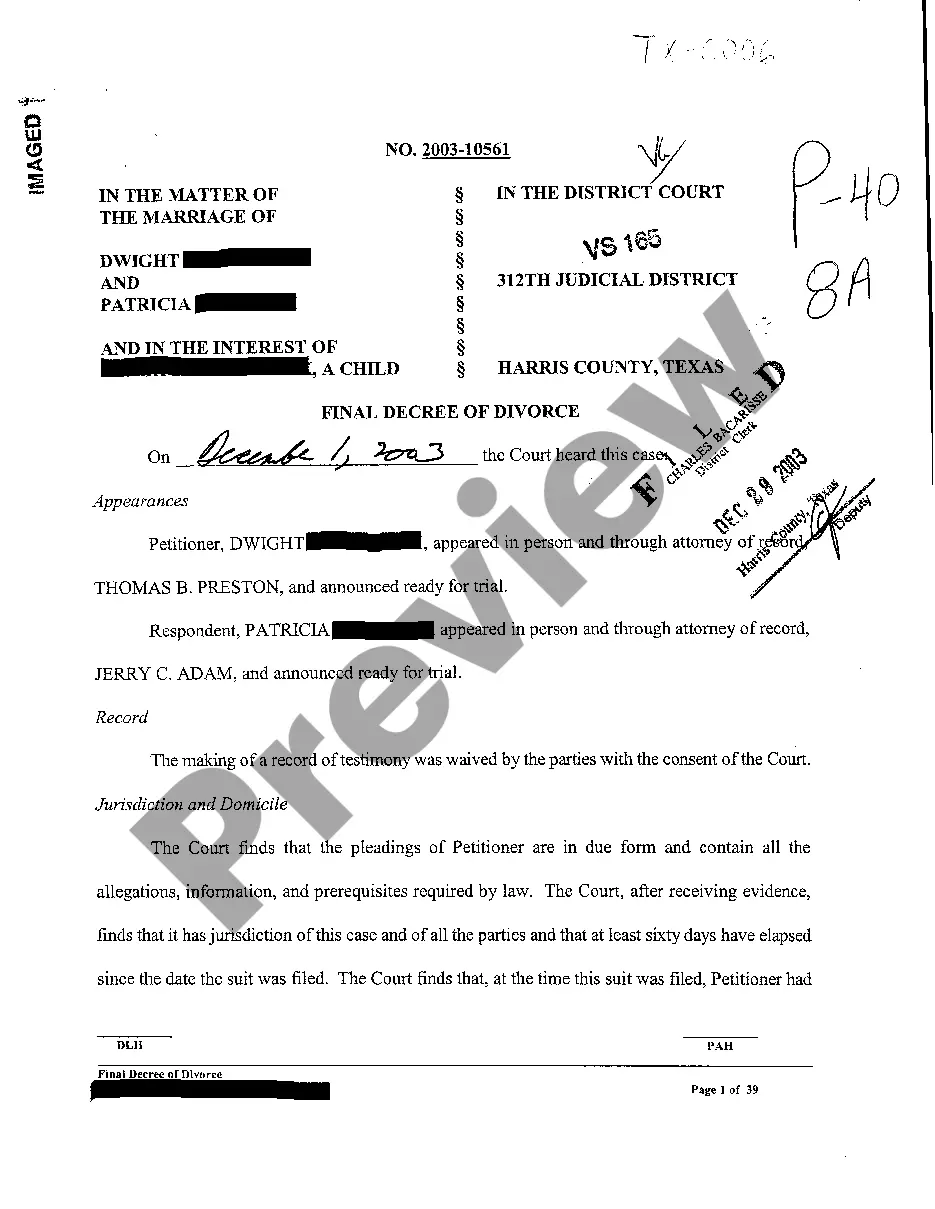

A 401(k) plan document governs a retirement plan's features and day-to-day operations. Your plan document identifies what kind of plan it is, how it works, and what special features it has to customize it to your business' needs and goals.

Arrange a trust fund for the plan's assets ? A plan's assets must be held in trust to assure that assets are used solely to benefit the participants and their beneficiaries. The trust must have at least one trustee to handle contributions, plan investments, and distributions to and from the 401(k) plan.

Go to Fidelity.com/se401k or call 800-544-5373. The Plan consists of the Basic Plan Document, this Adoption Agreement as completed, and the separate Trust Agreement.

To download the information, click Download at the top of the page. Choose a location and name for the . CSV file, and click Save.

By law, all 401k savings must be held in a trust account, separate from the assets of your employer, so that you and your employer, and your respective creditors, can't get your money prematurely. The rules stipulating the use of a trust are contained in the Employee Retirement Income Security Act (ERISA).

You can view the last 10, 30, 60, or 90 days of transaction history for annuity accounts. For account history prior to the last 90 days, call a Fidelity representative at 800-634-9361.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

Monthly and quarterly account statements, and prospectuses/reports are also available to view as web pages. To view a monthly or quarterly account statement, click the HTML link next to the document you want to view. To view a prospectuses or report, click the date link associated with the document you want to view.

The simplest and most direct way to check up on an old 401(k) plan is to contact the human resources department or the 401(k) administrator at the company where you used to work. Be prepared to state your dates of employment and Social Security number so that plan records can be checked.