The Riverside California Polaris 401(k) Retirement Savings Plan Trust Agreement is a legally binding document that outlines the details and provisions of the trust established between Polaris Industries, Inc. and Fidelity Management Trust Co. This agreement aims to facilitate the management and administration of the retirement savings plan for Polaris employees. The trust agreement stipulates the responsibilities and roles of both Polaris Industries, Inc. and Fidelity Management Trust Co. in maintaining and safeguarding the assets held within the trust. It establishes Fidelity as the appointed trustee, responsible for overseeing the investment options and ensuring compliance with legal regulations. The trust agreement encompasses several key areas, including investment options, contribution guidelines, distribution regulations, and administrative procedures. It outlines the options available to participants for investing their retirement savings, detailing the various funds and asset classes offered under the plan. This allows participants to make informed decisions concerning their investments based on their risk tolerance and financial goals. Additionally, the agreement specifies the contribution guidelines, including the eligibility criteria, contribution limits, and any additional employer matching or profit-sharing contributions provided by Polaris Industries. It ensures that all participants are treated fairly and that the plan remains compliant with IRS regulations. Furthermore, the trust agreement details the distribution rules and options available to participants upon reaching the applicable retirement age or meeting other qualifying events. It ensures that individuals can access their retirement savings in a manner that suits their financial needs while adhering to any tax implications associated with early withdrawals. The establishment of the Riverside California Polaris 401(k) Retirement Savings Plan Trust Agreement provides a secure and structured framework for the administration of the retirement savings plan. By partnering with Fidelity Management Trust Co., Polaris Industries aims to leverage their expertise in managing retirement assets and ensuring the long-term growth and security of participants' savings. Different types of Riverside California Polaris 401(k) Retirement Savings Plan Trust Agreements may include variations specific to the nature of the plan offered to employees. For example, there might be distinct agreements for different employee groups or varying provisions based on employment status. However, the key aspects mentioned above are essential components that would be included in all variations of the agreement.

Riverside California Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

How to fill out Riverside California Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Riverside Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Riverside Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

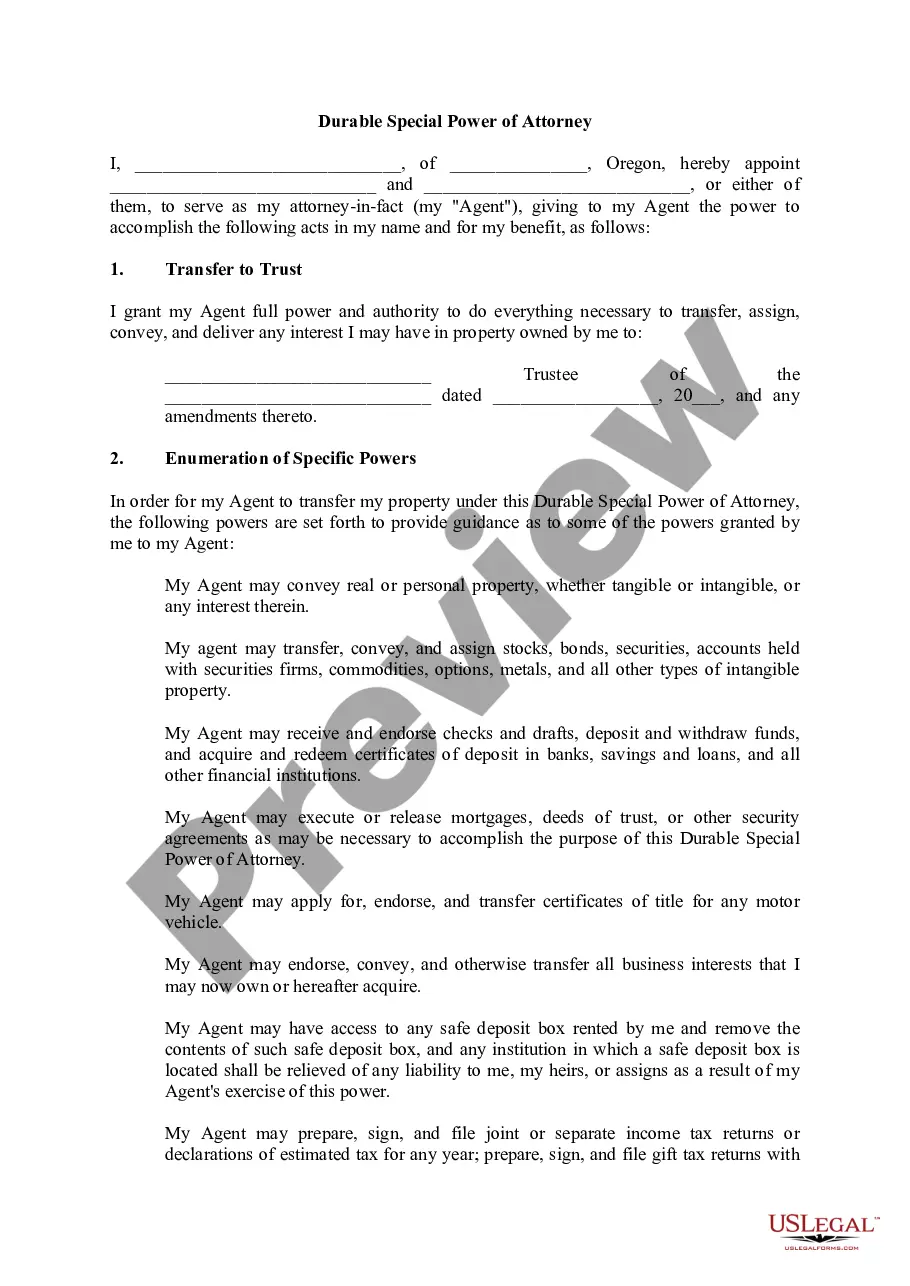

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!