The Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement is a legally binding document that outlines the establishment of a trust between Polaris Industries, Inc. and Fidelity Management Trust Co. This agreement is designed to provide employees of Polaris Industries, Inc. with a comprehensive retirement savings plan. The trust agreement serves as a vehicle through which employees can set aside a portion of their compensation to contribute to their retirement savings. Contributions are made on a pre-tax basis, meaning they are deducted from an employee's salary before taxes are taken out. This provides employees with a tax advantage as their savings grow over time. The establishment of this trust agreement is a significant step in ensuring the financial security of Polaris Industries, Inc. employees. By partnering with Fidelity Management Trust Co., Polaris Industries, Inc. is able to offer its employees access to a range of investment options to help build their retirement nest egg. These investment options include mutual funds, stocks, bonds, and other asset classes. One of the unique features of the Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement is the ability for employees to contribute to the plan through salary deductions. This allows employees to automate their savings and makes it easier for them to consistently invest over time. Additionally, the trust agreement allows for employer contributions to further boost employees' retirement savings. The trust agreement also outlines the rules and regulations surrounding the withdrawal of funds from the 401(k) plan. Employees are typically eligible to start withdrawing funds from the plan after reaching a certain age, usually 59 and a half. However, there may be exceptions in cases of financial hardship or for other specific circumstances. It is important to note that individuals who participate in the Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement should consult with a financial advisor or tax professional to fully understand the implications and benefits of the plan. Overall, the establishment of the Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement demonstrates Polaris Industries, Inc.'s commitment to providing its employees with a reliable and effective retirement savings option. By partnering with Fidelity Management Trust Co., employees can take advantage of a diverse range of investment opportunities to help secure a comfortable retirement. There are no specific types of Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding the establishment of trust mentioned in the prompt.

Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

How to fill out Wayne Michigan Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

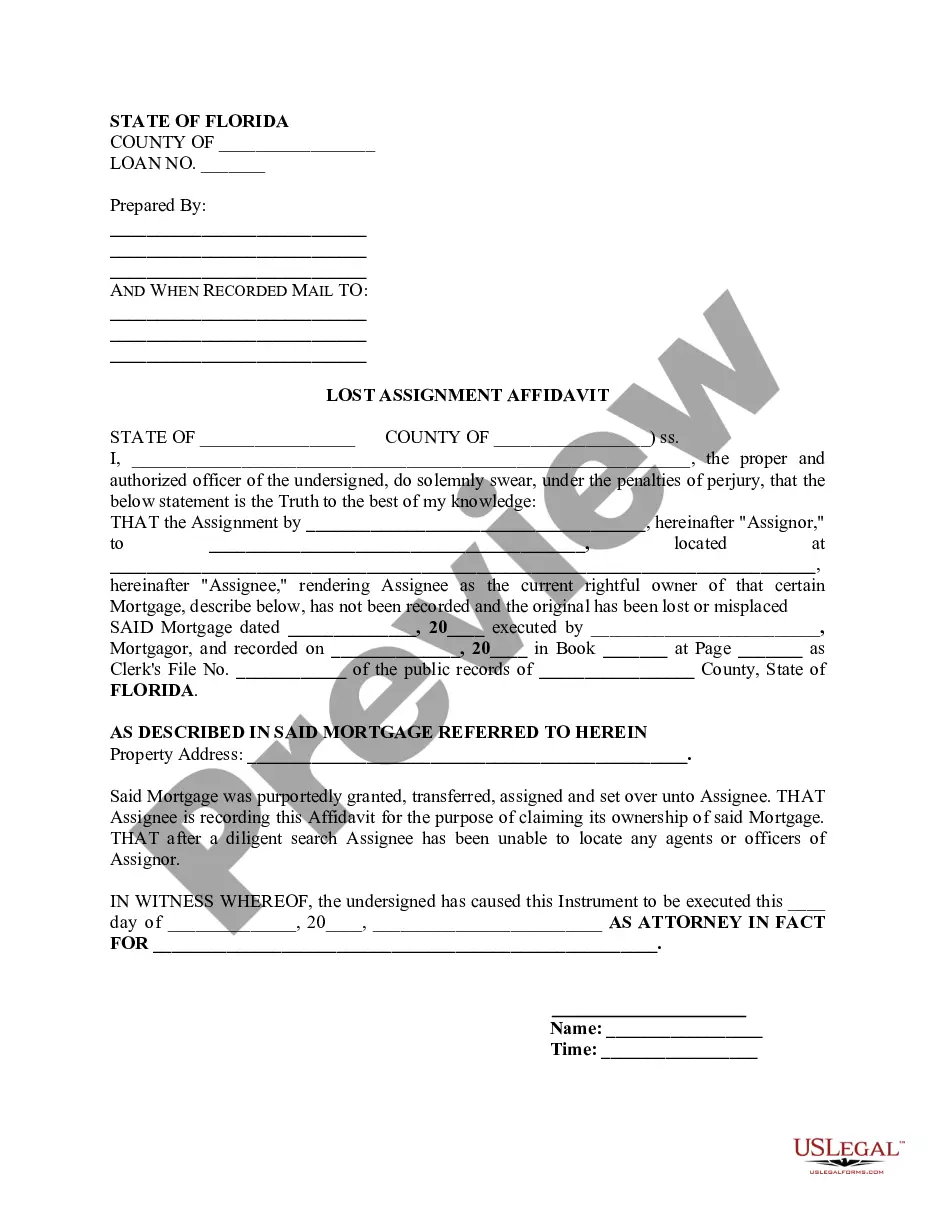

Are you looking to quickly create a legally-binding Wayne Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust or maybe any other document to handle your personal or corporate affairs? You can select one of the two options: hire a professional to write a legal paper for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant document templates, including Wayne Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the Wayne Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were looking for by using the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Wayne Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!