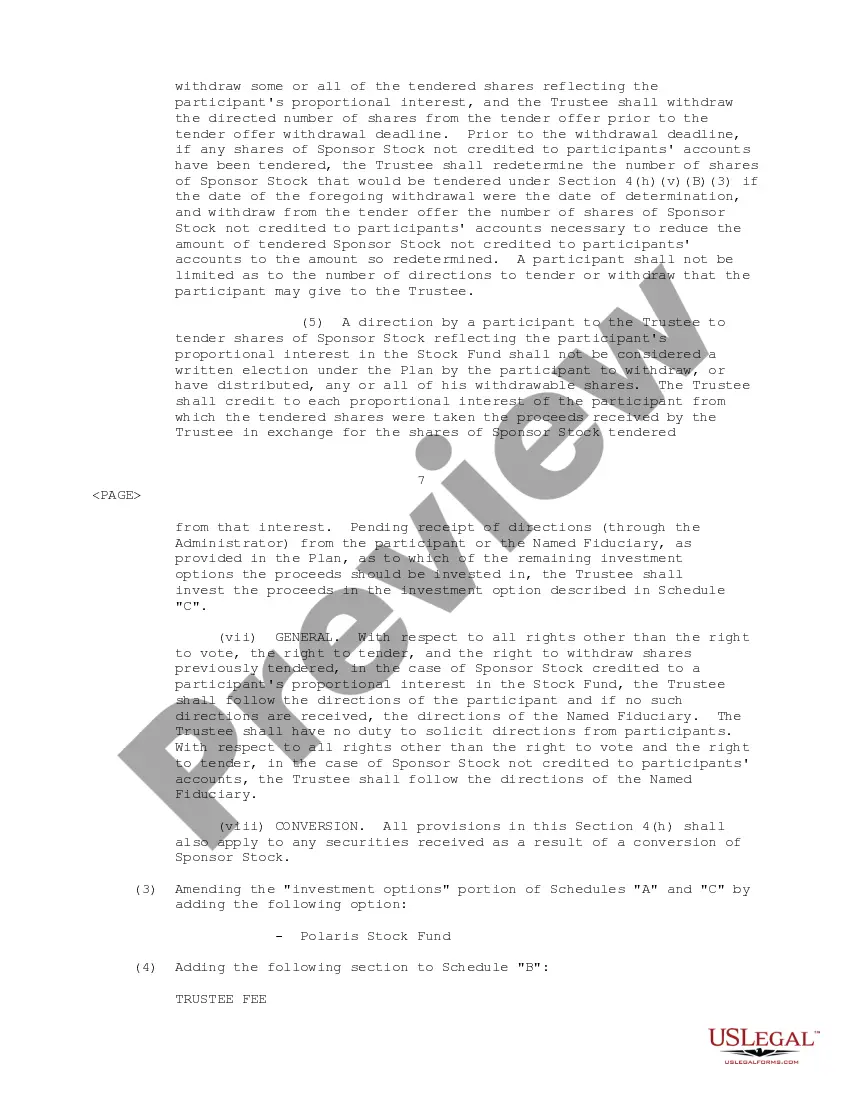

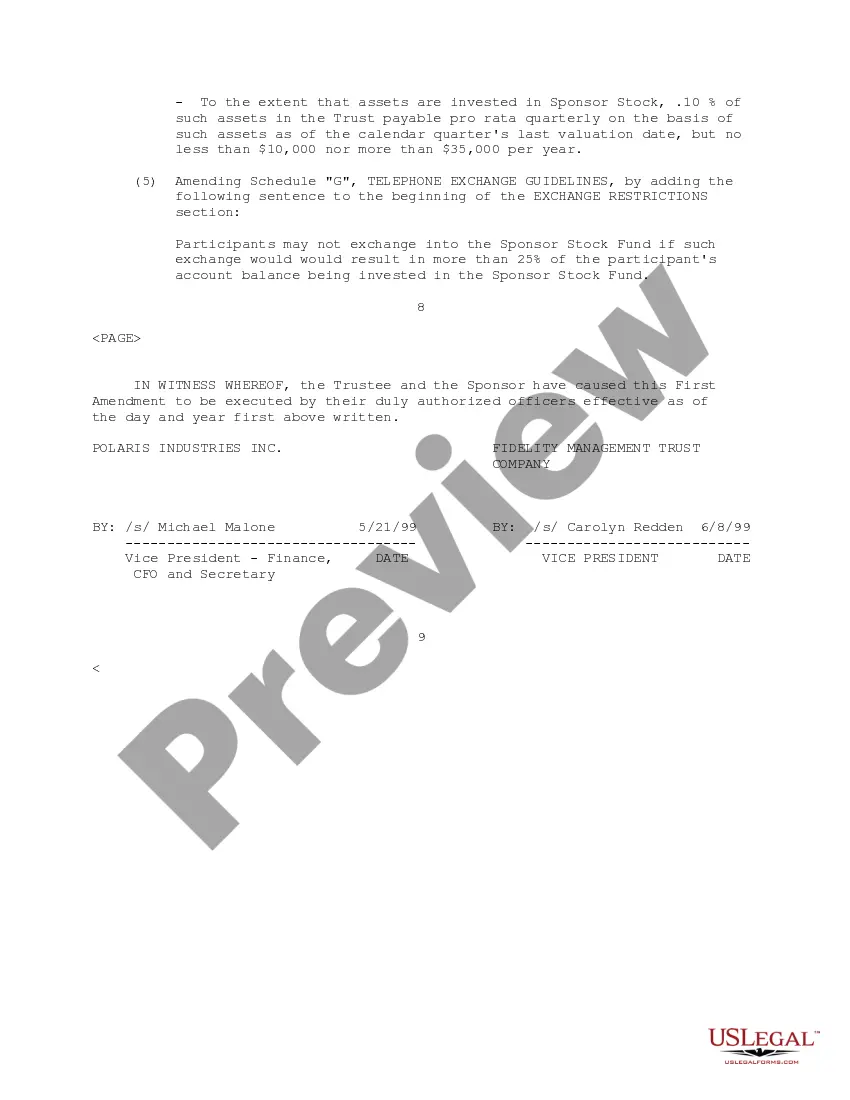

Queens New York Amendment to Trust Agreement refers to a specific type of legal document that outlines changes or modifications made to an existing trust agreement in the context of Queens, New York. This type of amendment is applicable to the trust agreement between Polaris Industries, Inc. (the granter) and Fidelity Management Trust Company (the trustee). Keywords: Queens New York, Amendment to Trust Agreement, Polaris Industries, Inc., Fidelity Management Trust Company. This amendment to the trust agreement serves as a supplementary document that allows the parties involved to adapt the terms and provisions of the original trust agreement to address specific circumstances or to update it in accordance with changing laws or regulations pertaining to Queens, New York. Types of Queens New York Amendment to Trust Agreement: 1. Administrative Amendment: This type of amendment focuses on administrative changes pertaining to the trust agreement, such as information updates, trustee replacements, or minor adjustments that do not alter the core provisions of the agreement. 2. Beneficiary Amendment: Sometimes, amendments are necessary to modify the rights, privileges, or responsibilities of the trust beneficiaries. A beneficiary amendment may involve changes to the distribution schedule, clarifications on beneficiary rights, or alterations to any other beneficiary-related provisions. 3. Financial Amendment: Financial amendments primarily address the management of trust assets and investment strategies. These changes may be required to adapt to the evolving financial landscape or to comply with regulations specific to Queens, New York. Financial amendments may impact the selection of investment vehicles, risk tolerance, or diversification strategies within the trust. 4. Legal Amendment: Legal amendments are designed to align the trust agreement with the legal requirements, statutes, and regulations of Queens, New York. They may encompass changes related to tax laws, estate planning regulations, or any other legal implications specific to the jurisdiction. When executing a Queens New York Amendment to Trust Agreement, it is vital for both parties to consult legal professionals experienced in trust law in Queens, New York. This helps ensure that the amendment is properly drafted, executed, and adheres to all legal considerations relevant in the jurisdiction. By actively staying informed on applicable laws, both Polaris Industries, Inc. and Fidelity Management Trust Company can effectively adapt their trust agreement to meet their current needs while maintaining compliance with Queens, New York regulations.

Queens New York Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

How to fill out Queens New York Amendment To Trust Agreement Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

If you need to find a trustworthy legal form provider to find the Queens Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Queens Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Queens Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Queens Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company - all from the comfort of your home.

Join US Legal Forms now!