The Mecklenburg North Carolina Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company is a legal document that outlines the changes and modifications made to an existing trust agreement governing the relationship between the two parties. This amendment aims to provide a detailed description of the alterations made to the original trust agreement, ensuring clarity and accountability for both Polaris Industries, Inc. and Fidelity Management Trust Company. The Mecklenburg North Carolina Second Amendment to Trust Agreement may have different types, depending on the specific amendments made. Some common types could include amendments related to: 1. Beneficiary Designations: This type of amendment may involve adding, removing, or changing beneficiaries who will receive the benefits and assets of the trust. 2. Distribution Provisions: This type of amendment may modify the rules and conditions for distributing assets from the trust to beneficiaries, including changes to timing, amount, or method of distribution. 3. Trustee Appointment: This type of amendment may alter the provisions pertaining to the appointment, removal, or replacement of trustees responsible for managing and administering the trust. 4. Asset Allocation: This type of amendment may revise the allocation and investment strategy for the assets held within the trust, ensuring alignment with the current financial objectives and market conditions. 5. Tax Treatment: This type of amendment may address tax-related matters, such as changes in tax planning strategies, incorporation of new tax laws, or optimization of tax benefits for the trust and its beneficiaries. 6. Terms and Conditions: This type of amendment may modify any other terms and conditions of the original trust agreement that may require adjustment based on changing circumstances or evolving legal and financial considerations. In summary, the Mecklenburg North Carolina Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company encompasses various types of amendments that aim to tailor the trust agreement to better suit the needs and objectives of both parties involved. These amendments can range from beneficiary designations and distribution provisions to trustee appointments, asset allocation, tax treatment, and other terms and conditions.

Mecklenburg North Carolina Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

How to fill out Mecklenburg North Carolina Second Amendment To Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

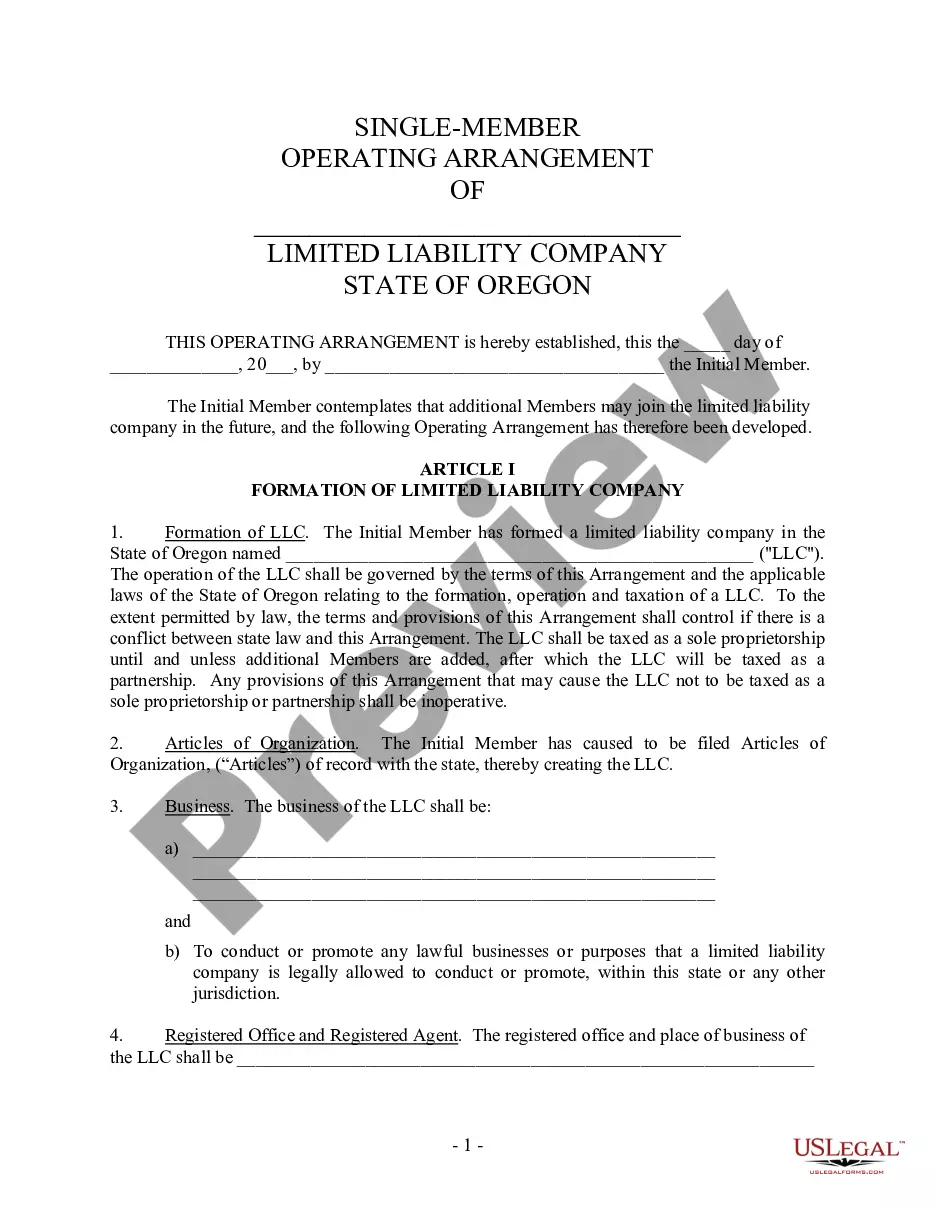

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Mecklenburg Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Mecklenburg Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!