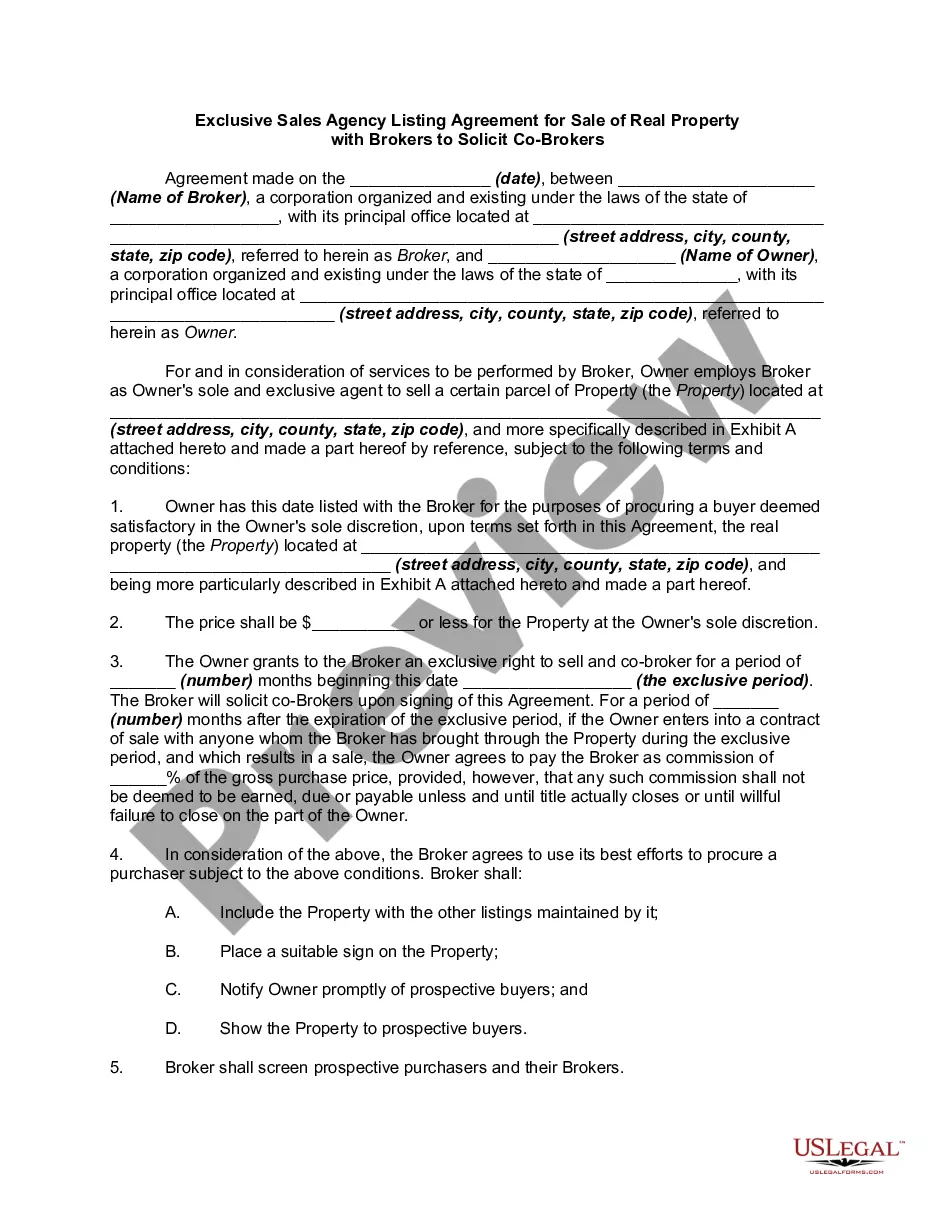

Chicago Illinois Promissory Note and Pledge Agreement is a legal document pertaining to a loan transaction in which a borrower agrees to repay a lender with interest over a specified period. In addition, this agreement grants the lender a security interest in shares of the borrower's common stock to secure the loan. The agreement outlines the terms and conditions of the loan, the repayment schedule, and the rights and obligations of both parties involved. The following are different types of Chicago Illinois Promissory Note and Pledge Agreements related to loans and security interest in shares of a company's common stock: 1. Chicago Illinois Secured Promissory Note and Pledge Agreement: This type of agreement includes provisions that ensure the loan is secured with the borrower's shares of common stock. It details the rights of the lender in the event of a default or non-payment by the borrower. 2. Chicago Illinois Convertible Promissory Note and Pledge Agreement: This agreement has provisions allowing the lender to convert the loan into shares of the company's common stock at a later date. It outlines the terms of conversion, including conversion ratio and conditions. 3. Chicago Illinois Subordinated Promissory Note and Pledge Agreement: In this agreement, the borrower pledges its common stock as security, but the security interest is subordinate to existing or future debts of the company. This means that if the borrower defaults, the lender with the first security interest will be repaid before the lender of the subordinated note. 4. Chicago Illinois Equity Line of Credit Promissory Note and Pledge Agreement: This type of agreement establishes a revolving line of credit with the borrower's common stock serving as collateral. The borrower can draw funds up to the agreed limit, and the lender can enforce its security interest if the borrower fails to repay or breaches the terms. 5. Chicago Illinois Cross-Collateralized Promissory Note and Pledge Agreement: This agreement secures the loan with multiple types of collateral, including the borrower's shares of common stock. It provides the lender with rights to enforce its security interest across all pledged assets in the event of a default. Chicago Illinois Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock offer legal protection to lenders while ensuring borrowers uphold their repayment obligations. These agreements provide security and define the rights and responsibilities of both parties involved in the loan transaction.

Chicago Illinois Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock

Description

How to fill out Chicago Illinois Promissory Note And Pledge Agreement Regarding Loan And Grant Of Security Interest In Shares Of The Company's Common Stock?

Do you need to quickly draft a legally-binding Chicago Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock or maybe any other document to handle your personal or corporate affairs? You can go with two options: hire a legal advisor to draft a legal paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific document templates, including Chicago Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Chicago Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Chicago Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!