Los Angeles California Promissory Note and Pledge Agreement is a legal document that outlines the terms and conditions of a loan and the grant of a security interest in shares of a company's common stock. This agreement serves as a binding contract between the parties involved, ensuring the repayment of the loan and protection of the lender's investment. Keywords: Los Angeles California, Promissory Note, Pledge Agreement, loan, grant, security interest, shares, company's common stock. 1. Type 1: Traditional Promissory Note and Pledge Agreement: This type of agreement is the most common and straightforward form. It includes provisions for the borrower to promise repayment of the loan amount within a specified timeframe and grants the lender a security interest in the shares of the company's common stock. The agreement also establishes the terms of interest, payment schedule, default remedies, and the consequences for any breach of the agreement. 2. Type 2: Fixed Interest Rate Promissory Note and Pledge Agreement: This variant of the agreement specifies a predetermined fixed interest rate for the loan. It provides clarity to both parties, ensuring that the borrower knows the exact interest obligations for the duration of the agreement. This type helps mitigate any potential disputes regarding interest rate fluctuations, providing stability and predictability. 3. Type 3: Variable Interest Rate Promissory Note and Pledge Agreement: In this type, the interest rate on the loan is subject to change based on certain predefined factors such as market conditions or fluctuations in a specific financial index. The agreement sets out the formula for calculating interest, which can lead to varying repayment amounts throughout the loan term. This type may be suitable for borrowers and lenders who prefer flexible repayment terms tied to market changes. 4. Type 4: Convertible Promissory Note and Pledge Agreement: This form of agreement includes a conversion feature allowing the lender to convert the outstanding loan amount into equity shares of the company's common stock at a predetermined conversion ratio. This provision provides an option for the lender to convert the debt into ownership of the company's shares, giving them an opportunity to benefit from potential appreciation in the future. 5. Type 5: Senior Secured Promissory Note and Pledge Agreement: This variation caters to lenders who desire a higher level of security. It includes additional provisions to grant the lender a senior position over other creditors in case of default. It prioritizes the repayment of the loan amount and interest, ensuring that the lender has a first claim on the proceeds from the pledged shares of the company's common stock. In summary, Los Angeles California Promissory Note and Pledge Agreement encompass various types of agreements that cover different loan and security interest scenarios, providing a legal framework to protect the interests of both borrowers and lenders involved in transactions related to shares of a company's common stock.

Los Angeles California Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock

Description

How to fill out Los Angeles California Promissory Note And Pledge Agreement Regarding Loan And Grant Of Security Interest In Shares Of The Company's Common Stock?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life situation, locating a Los Angeles Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Los Angeles Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Los Angeles Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock:

- Examine the content of the page you’re on.

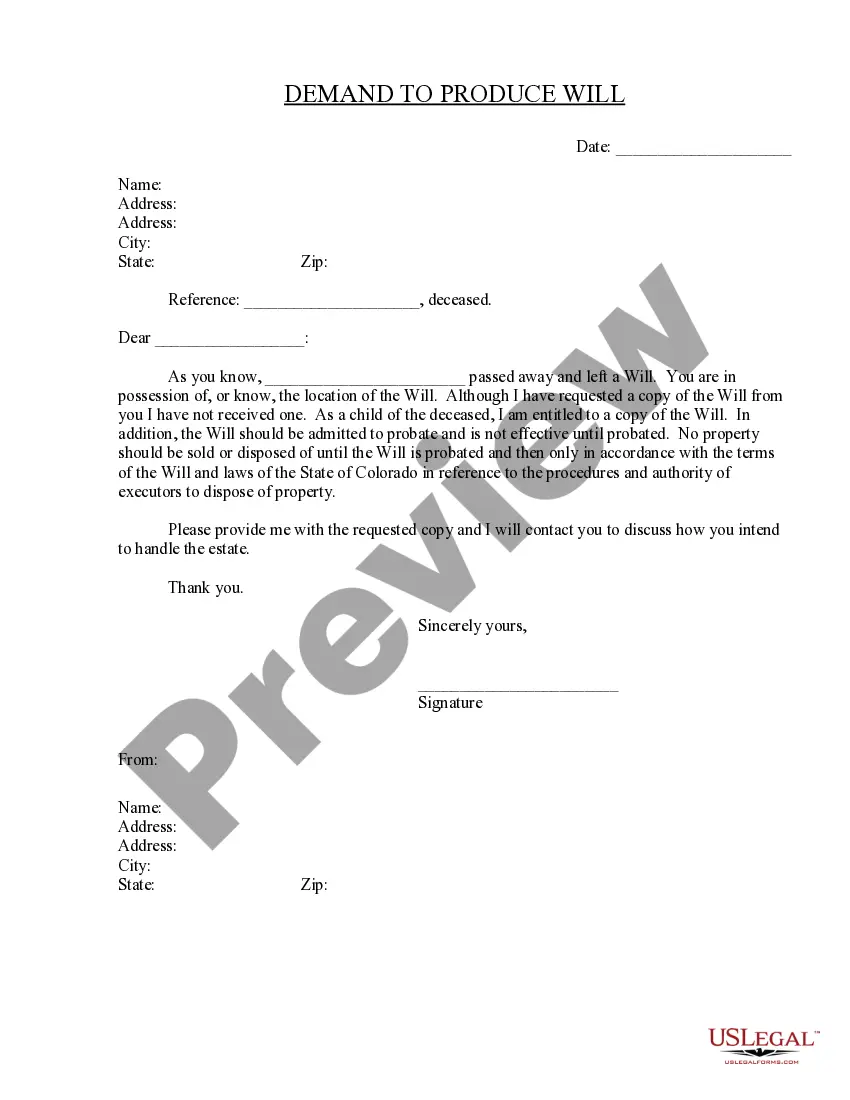

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Los Angeles Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!