Suffolk New York Quick start Loan and Security Agreement is a legally binding document that outlines the terms and conditions of a financial arrangement between Silicon Valley Bank and print, Inc. In this agreement, Silicon Valley Bank provides print, Inc. with a quick start loan to support its business needs and expansion in Suffolk, New York. The loan amount, interest rate, repayment schedule, and other relevant financial terms are clearly stated in the agreement. The Suffolk New York Quick start Loan and Security Agreement serves as a protective measure for both parties involved. It ensures that print, Inc. receives the necessary funds to meet its financial requirements, while Silicon Valley Bank secures its investment by establishing the terms of repayment and collateral. This agreement also includes a security clause, where print, Inc. provides collateral to secure the loan. The collateral can be in the form of business assets, accounts receivable, or any other valuable assets that mitigate the bank's risk in case of default by print, Inc. It is essential to note that there may be different types of Suffolk New York Quick start Loan and Security Agreements, each tailored to specific situations or business needs. These variations could include: 1. Working Capital Loan Agreement: This type of agreement focuses on providing print, Inc. with funds specifically for its day-to-day operational expenses, such as inventory procurement, employee wages, and overhead costs. 2. Equipment Financing Agreement: This agreement is designed to finance the purchase or lease of equipment required by print, Inc. for its printing operations. It may include terms related to equipment specifications, maintenance, insurance, and possible renewal options. 3. Expansion Loan Agreement: When print, Inc. plans to expand its operations, this agreement can be utilized to secure financing for new facilities, machinery, or an increase in workforce. The terms will be customized to fit the unique requirements and goals of the expansion project. In conclusion, the Suffolk New York Quick start Loan and Security Agreement between Silicon Valley Bank and print, Inc. is a vital financial contract that provides print, Inc. with necessary funds while protecting the interests of both parties. Its various types cater to specific financial needs, such as working capital, equipment financing, and business expansion.

Suffolk New York Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

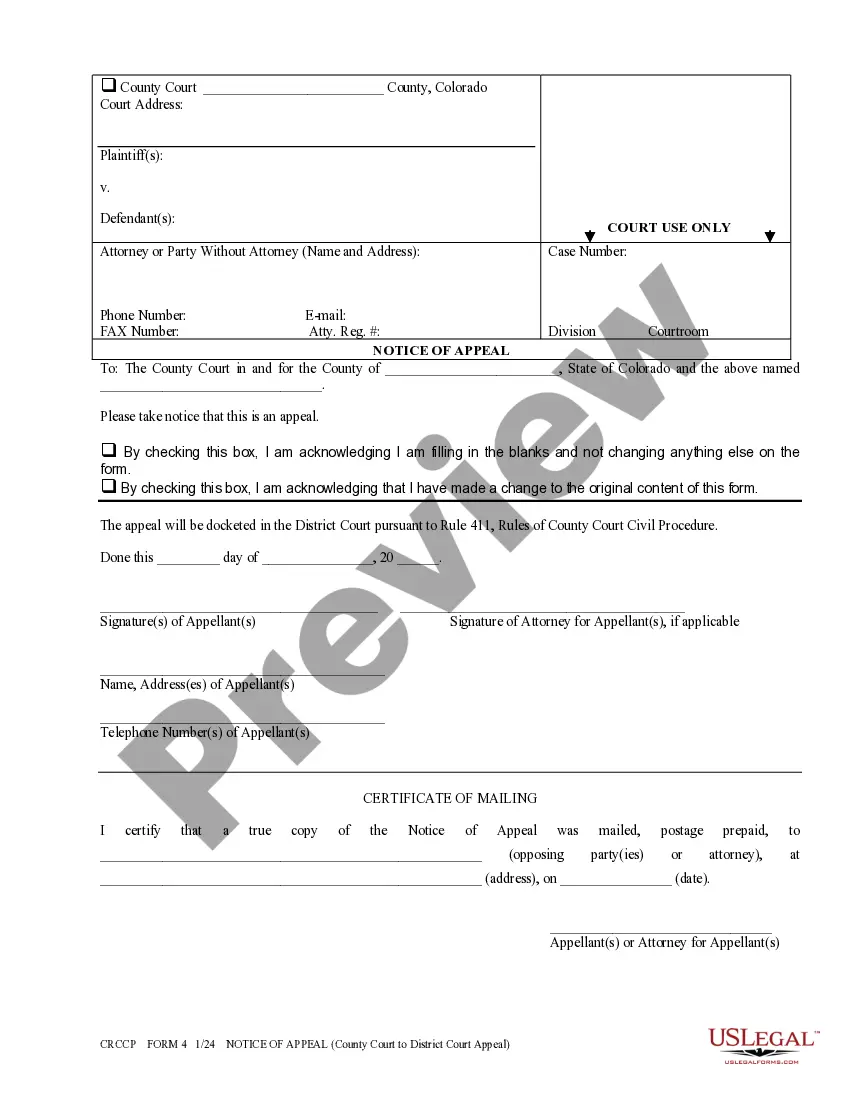

How to fill out Suffolk New York Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

Draftwing paperwork, like Suffolk Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc., to take care of your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for different cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Suffolk Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Suffolk Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.:

- Ensure that your document is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Suffolk Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

SVB serves the world's most innovative companies and their investors via commercial banking with Silicon Valley Bank, investment banking with SVB Leerink, private banking and wealth management with SVB Private Bank, and funds management and investment with SVB Capital.

Forbes' 13th annual look at America's Best Banks ranks SVB #15 out of the 100 largest publicly-traded banks based on growth, credit quality and profitability.

Our operations are subject to extensive regulation by federal and state regulatory agencies. As a bank holding company, SVB Financial is subject to the Federal Reserve Board's supervision, regulation, examination and reporting requirements under the Bank Holding Company Act of 1956 (BHC Act).

Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes. Give the duration or tenure of the loan and the termination date.

Silicon Valley Bank is an American commercial bank. SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits. It is a subsidiary of SVB Financial Group.

Servicing 15 U.S. states and multiple other countries, SVB boasts $75 billion in assets and almost $170 billion in deposits and investments. This bank for businesses has also been named by Forbes as among the best banks in America.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

Is SVB an SBA Lender? Yes, we are an approved SBA lender and are able to process PPP loan applications.

Usually, an IOU and a promissory note form are only signed by the borrower, although they may be signed by both parties. A loan agreement is a single document that contains all of the terms of the loan, and is signed by both parties.