The Kings New York Plan of Merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce is a strategic initiative aimed at consolidating the strengths and resources of these three financial institutions. This merger plan presents a detailed outline of how these entities will combine their operations and assets to enhance their market position and deliver enhanced value to their stakeholders. Keywords: Kings New York Plan of Merger, Cowling Ban corporation, Cowling Bank, Northern Bank of Commerce, consolidation, financial institutions, strategic initiative, resources, market position, stakeholders, enhanced value. 1. Overview of the Kings New York Plan of Merger: The Kings New York Plan of Merger outlines a comprehensive strategy for combining Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce into a single entity. This merger aims to leverage the strengths of each institution to create a more competitive and robust financial organization. 2. Synergies and Benefits: The Kings New York Plan of Merger emphasizes the synergy and benefits that will arise from combining the resources and expertise of these three financial institutions. This consolidation will enable the merged entity to offer a wider range of financial products and services and provide a more comprehensive banking experience to customers. 3. Operational Integration: The Plan of Merger covers the operational integration aspects, including the rationalization of processes, systems, and staff to ensure a smooth transition. It highlights the efforts to minimize disruptions to customers and employees while streamlining operations for increased efficiency. 4. Enhanced Market Position: By merging Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce, the Kings New York Plan of Merger seeks to strengthen the market position of the combined entity. The merger will provide the opportunity to expand customer reach, penetrate new markets, and capitalize on the synergistic benefits derived from increased scale and scope. 5. Regulatory and Legal Compliance: The Plan of Merger carefully addresses the regulatory and legal considerations associated with the consolidation. It outlines the processes and procedures required to obtain necessary approvals from regulatory authorities, ensuring full compliance and adherence to legal frameworks. 6. Shareholder Value: The Kings New York Plan of Merger places significant importance on maximizing shareholder value. It outlines the expected financial benefits resulting from the merger, such as increased profitability, cost savings, and potential capital appreciation, thereby ensuring the shareholders' long-term interests are well-supported. Types of Kings New York Plan of Merger: 1. Basic Merger: This type of merger involves the combination of Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce into one entity, eliminating redundancies and creating a stronger and more efficient financial institution. 2. Acquisition Merger: In an acquisition merger, one entity takes over the other entities involved in the merger. In the Kings New York Plan of Merger, it could be Cowling Ban corporation or Northern Bank of Commerce acquiring Cowling Bank, leading to a consolidated and strengthened organization. 3. Subsidiary Merger: A subsidiary merger involves one entity merging with a subsidiary or division of another entity. In the Kings New York Plan of Merger, it could be Cowling Bank or Northern Bank of Commerce merging with a subsidiary of Cowling Ban corporation or vice versa, creating an integrated subsidiary with enhanced capabilities. Overall, the Kings New York Plan of Merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce represents a strategic move to consolidate their strengths, increase market competitiveness, and deliver superior value to customers and shareholders.

Kings New York Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce

Description

How to fill out Kings New York Plan Of Merger Between Cowlitz Bancorporation, Cowlitz Bank And Northern Bank Of Commerce?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Kings Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Kings Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce from the My Forms tab.

For new users, it's necessary to make several more steps to get the Kings Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce:

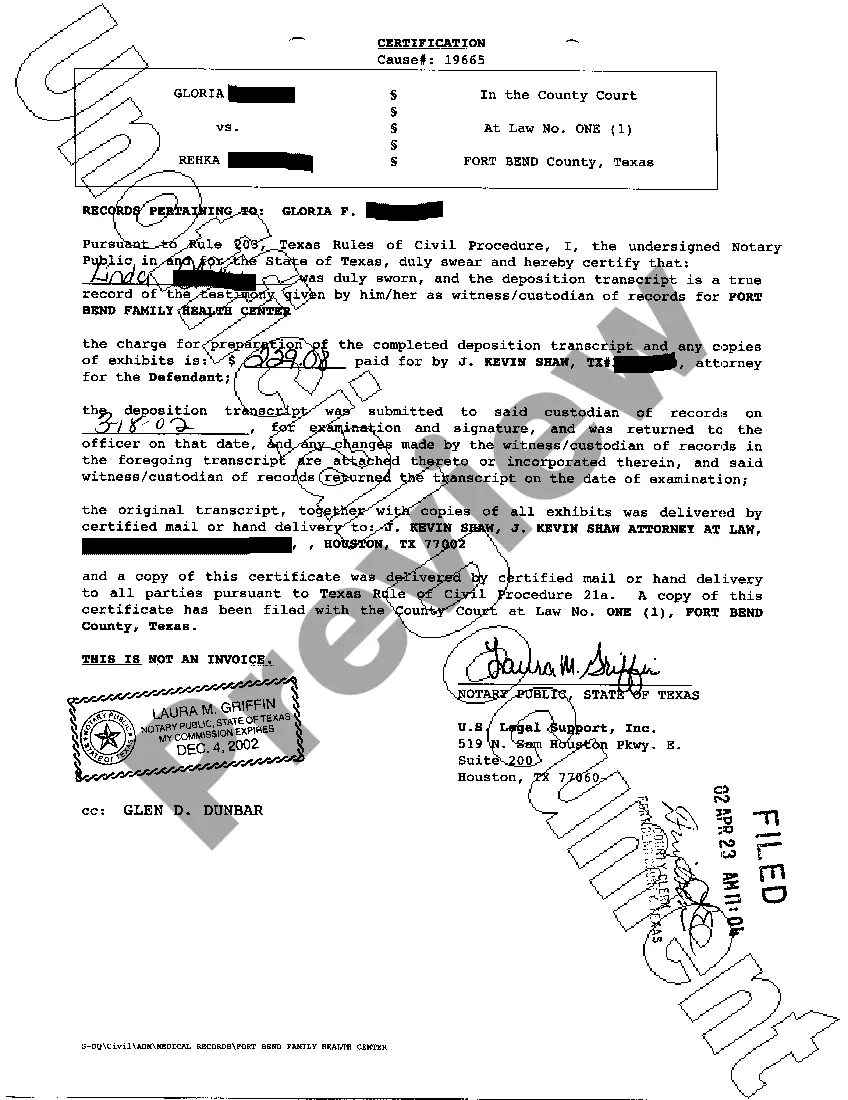

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!