San Diego California is a vibrant city located in the southwestern corner of the United States. Known for its sunny weather, beautiful beaches, and diverse culture, San Diego attracts millions of tourists every year. The city offers a plethora of attractions, including world-class restaurants, exciting nightlife, and numerous outdoor activities. In terms of business developments, a noteworthy plan of merger has been proposed between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce. This merger plan aims to combine the strengths and resources of these prominent financial institutions to create a more robust and customer-focused banking entity. The San Diego California Plan of Merger revolves around the strategic combination of Cowling Ban corporation, the parent company of Cowling Bank, with Northern Bank of Commerce. The merger aims to leverage the individual strengths of each bank, resulting in enhanced financial offerings, improved customer service, and increased operational efficiency. This Plan of Merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce is set to benefit various stakeholders, including shareholders, customers, and employees. The merger will potentially create a stronger financial institution with a broader geographic reach, enabling it to serve a more extensive customer base. By merging their resources, expertise, and networks, the merged entity will have the opportunity to expand their product offerings, such as loans, mortgages, and investment services, to better meet the evolving needs of customers in San Diego and beyond. Additionally, the merger will likely result in streamlined operations, leading to improved cost-efficiency and value creation for shareholders. It is essential to note that while the San Diego California Plan of Merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce is presented here as a hypothetical scenario, mergers and acquisitions are common in the banking industry. Different types of mergers can include horizontal mergers (combining companies in the same industry), vertical mergers (integrating businesses along the supply chain), or conglomerate mergers (combining unrelated businesses). Each type brings unique advantages and challenges based on the specific objectives of the merger. Ultimately, the San Diego California Plan of Merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce, if it were to occur, would likely lead to a more robust banking institution capable of delivering enhanced financial services to the San Diego community and beyond.

San Diego California Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce

Description

How to fill out San Diego California Plan Of Merger Between Cowlitz Bancorporation, Cowlitz Bank And Northern Bank Of Commerce?

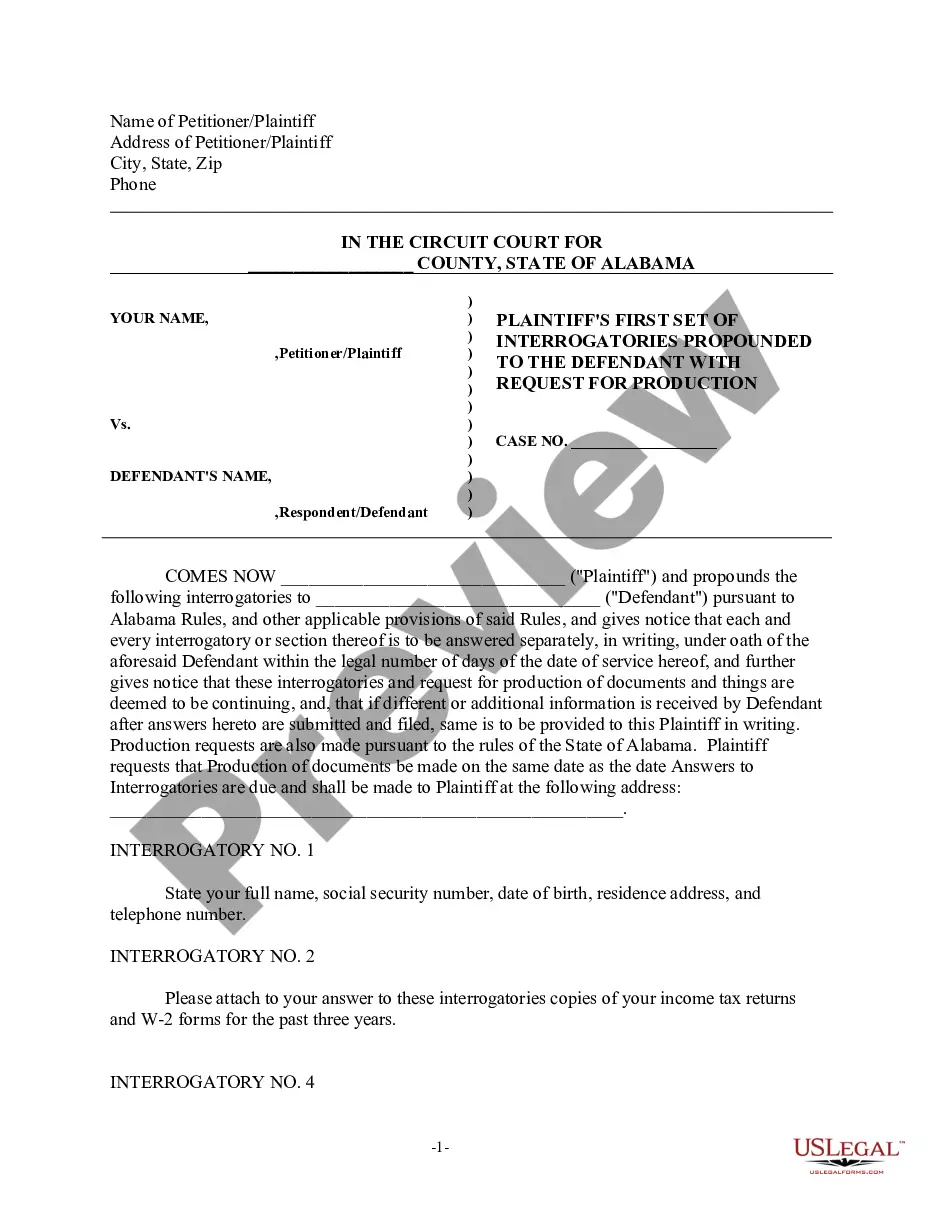

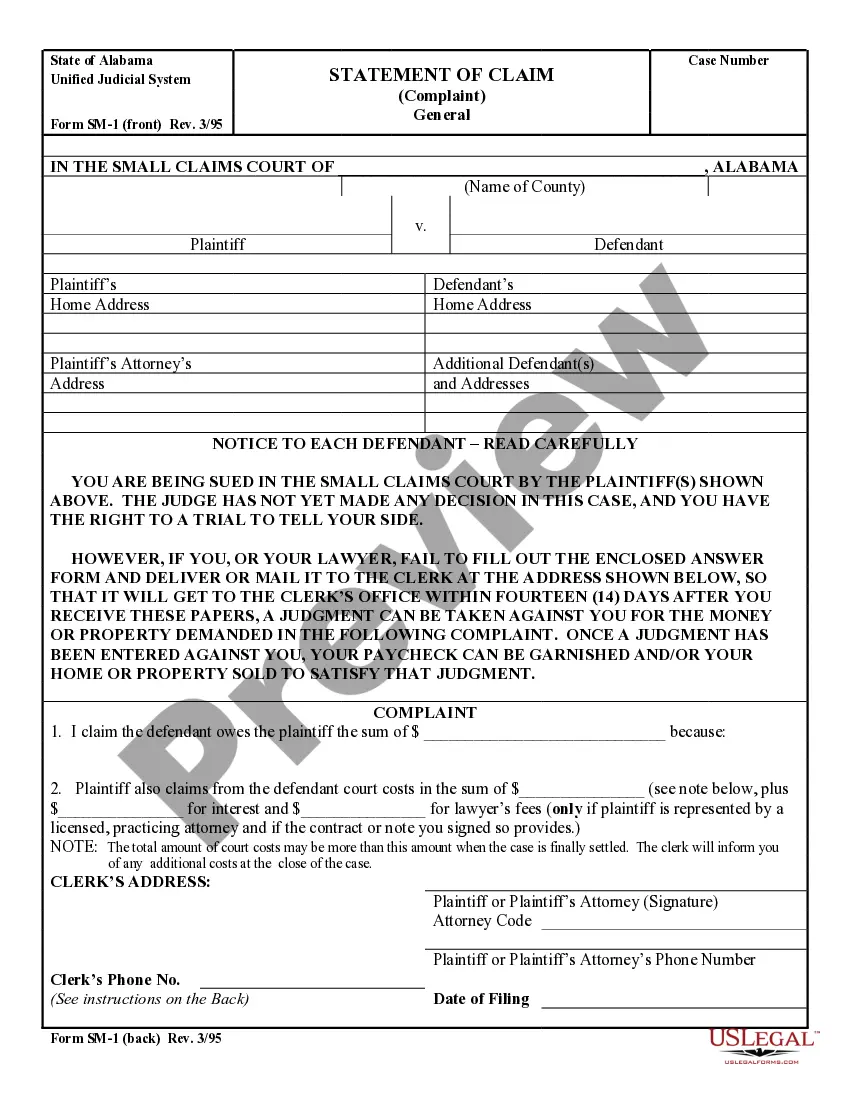

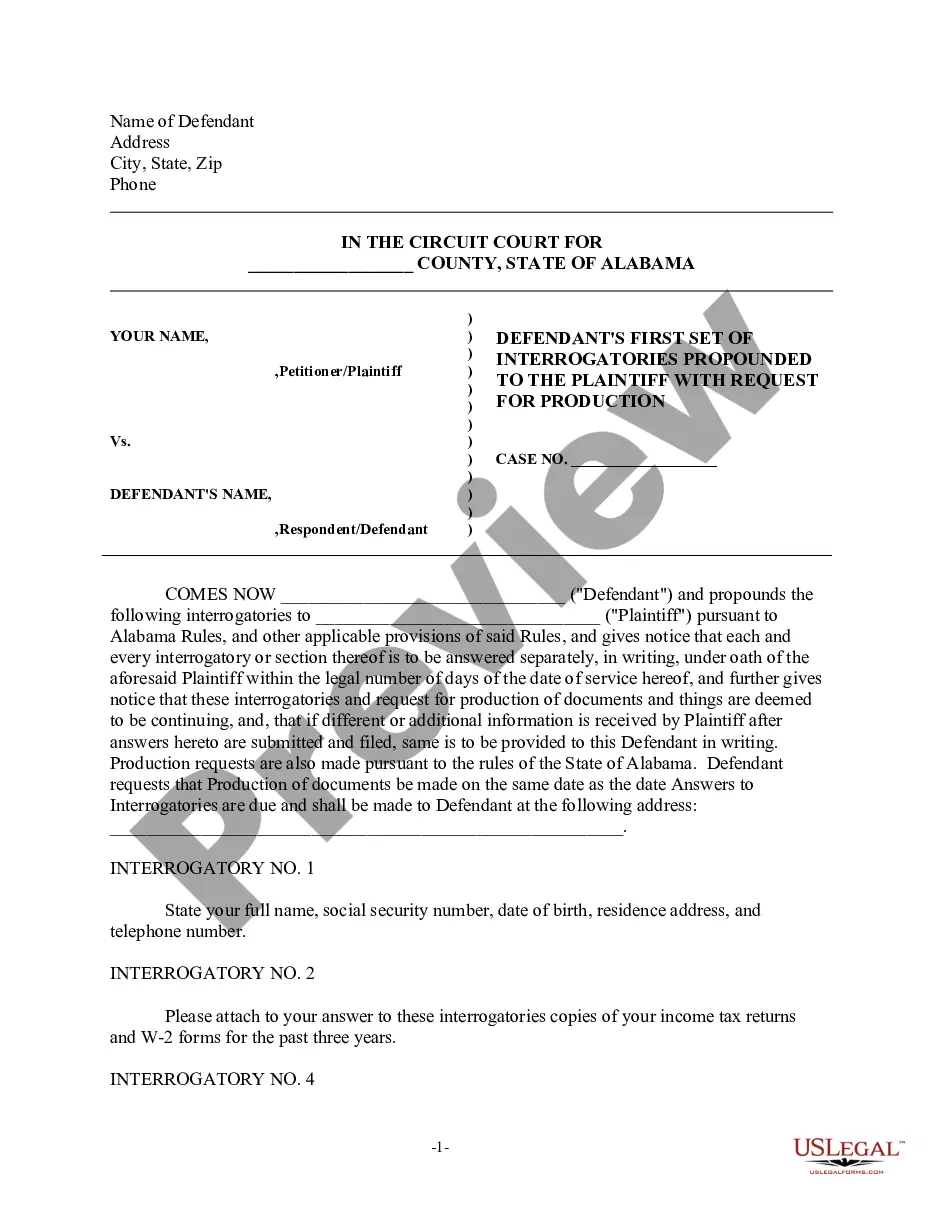

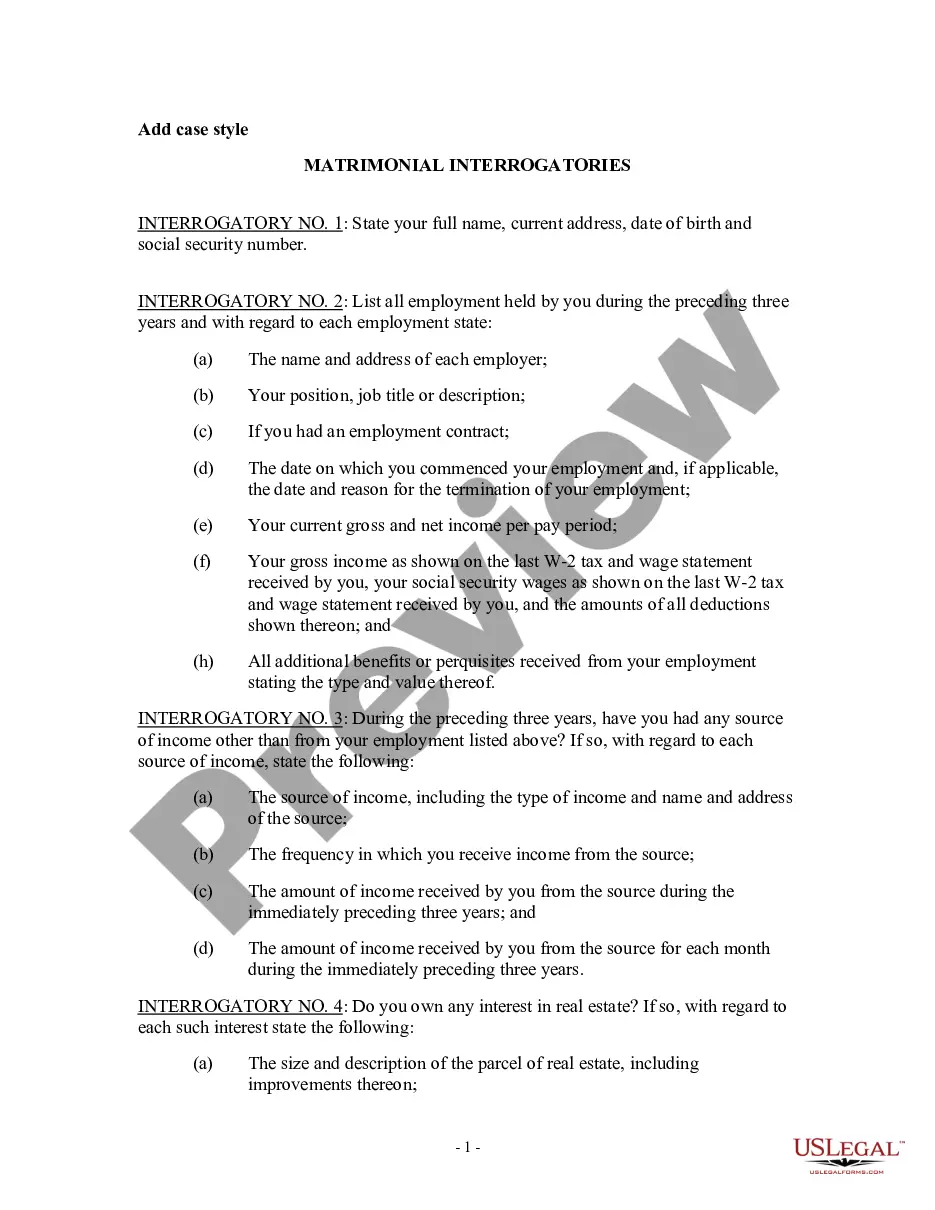

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a San Diego Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the San Diego Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your San Diego Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!