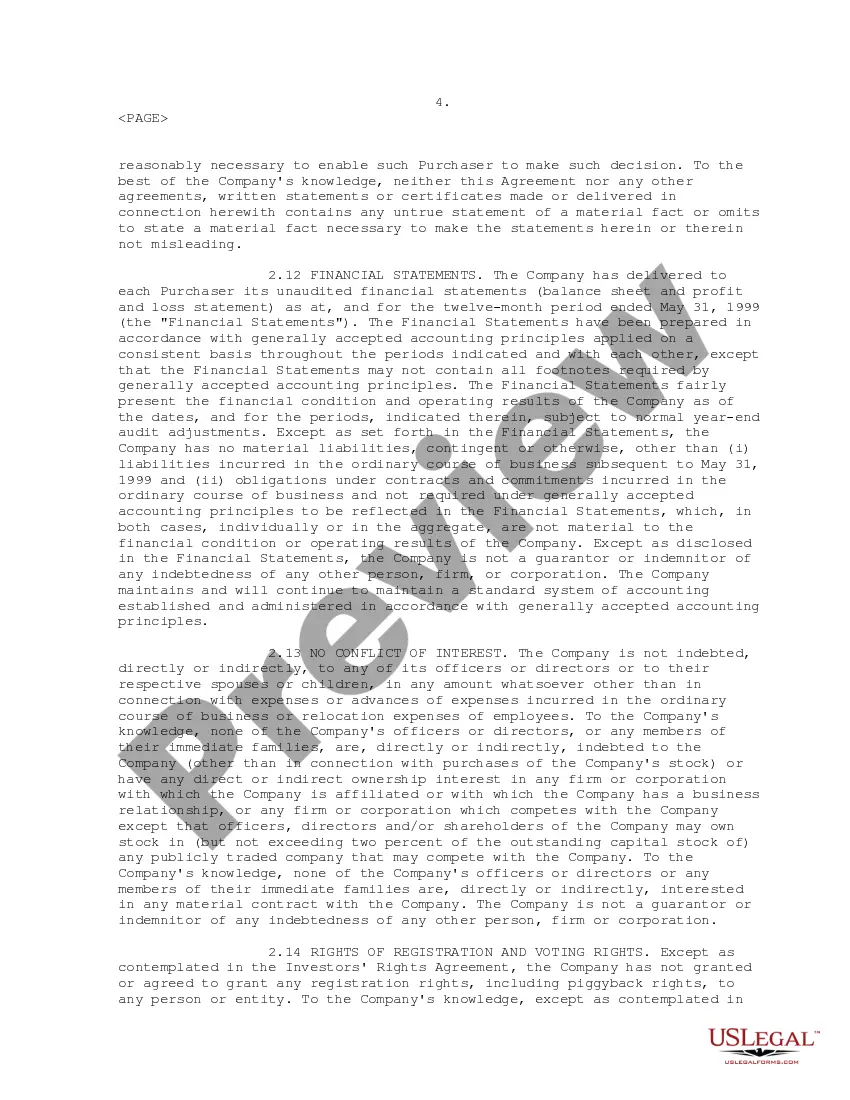

Nassau New York Sample Series B Preferred Stock Purchase Agreement is a legal contract that sets out the terms and conditions of purchasing Series B Preferred Stock between BirthdayExpress, Inc. (the "Company") and the Purchaser. This agreement outlines the key details related to the purchase of Series B Preferred Stock, including the number of shares, purchase price, voting rights, and dividend preferences. It also covers the restrictions on transferability, rights in the event of liquidation, conversion rights, and the rights of the Purchaser in case of default by the Company. The Nassau New York Sample Series B Preferred Stock Purchase Agreement aims to protect the interests of both the Company and the Purchaser. The Company benefits from raising capital through the sale of preferred stock, while the Purchaser gains potential financial returns and specific rights associated with the preferred stock. Key provisions of the agreement include: 1. Purchase of Series B Preferred Stock: The agreement describes the number of shares of Series B Preferred Stock the Purchaser will acquire and the applicable purchase price per share. 2. Voting Rights: It outlines the voting rights conferred upon the holder of Series B Preferred Stock, including the right to vote as a separate class or as part of the overall stockholder voting structure. 3. Dividend Preferences: The agreement covers the dividend preferences of the Series B Preferred Stock, which may include cumulative or non-cumulative dividends, and any applicable priority over common stock dividends. 4. Transfer Restrictions: It delineates the limitations on transferring or selling the Series B Preferred Stock, including any preemptive rights or rights of first refusal. 5. Liquidation Rights: The agreement specifies the rights of the holder of Series B Preferred Stock in the event of a liquidation, merger, or acquisition, including any liquidation preferences or participation rights. 6. Conversion Rights: It outlines the conditions and terms under which the Series B Preferred Stock can be converted into common stock, including any conversion price or conversion rate. 7. Defaults and Remedies: The agreement addresses the consequences and potential remedies if the Company defaults on its obligations, such as the right of the Purchaser to demand redemption or acceleration of the Series B Preferred Stock. Different types of Nassau New York Sample Series B Preferred Stock Purchase Agreements may exist based on specific variations in terms, rights, or preferences negotiated between BirthdayExpress, Inc. and the Purchaser. These variations could include changes in voting rights, liquidation preferences, or dividend provisions tailored to the needs and preferences of the parties involved.

Nassau New York Sample Series B Preferred Stock Purchase Agreement between BirthdayExpress, Inc. and Purchaser

Description

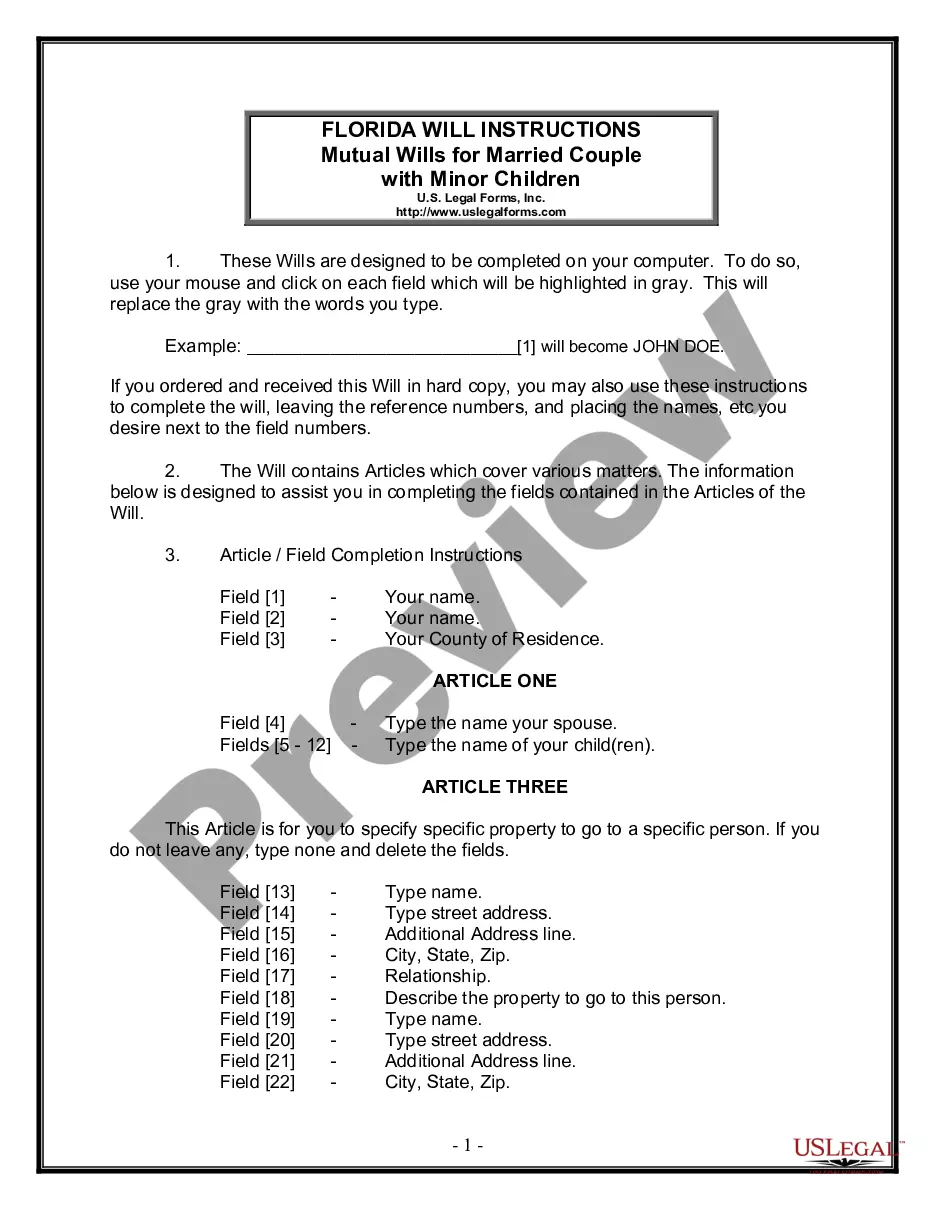

How to fill out Nassau New York Sample Series B Preferred Stock Purchase Agreement Between BirthdayExpress, Inc. And Purchaser?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Nassau Sample Series B Preferred Stock Purchase Agreement between BirthdayExpress, Inc. and Purchaser without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Nassau Sample Series B Preferred Stock Purchase Agreement between BirthdayExpress, Inc. and Purchaser on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Nassau Sample Series B Preferred Stock Purchase Agreement between BirthdayExpress, Inc. and Purchaser:

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!