The Hennepin Minnesota Stock Option Agreement of Interwar, Inc. is a legal document that outlines the terms and conditions regarding stock options bestowed upon employees or shareholders within the company. This agreement is specific to the state of Minnesota, particularly Hennepin County, where Interwar, Inc. is based. The purpose of the Hennepin Minnesota Stock Option Agreement is to provide eligible individuals with the opportunity to purchase company stock at a predetermined price, known as the exercise price, over a certain period. This stock option plan serves as an incentive for employees and shareholders to align their interests and performance with the success of Interwar, Inc. There are several types of stock option agreements that can be established under the Hennepin Minnesota jurisdiction. These include: 1. Incentive Stock Options (SOS): These options are exclusively offered to employees and have distinct tax advantages. SOS must comply with specific Internal Revenue Service (IRS) regulations, such as length of ownership and exercise before expiration. 2. Non-Qualified Stock Options (Nests): Non-qualified stock options are available to employees, consultants, directors, and other individuals connected to Interwar, Inc. Nests do not meet IRS requirements for preferential tax treatment but provide flexibility in terms of exercise dates and prices. 3. Restricted Stock Units (RSS): Although not technically stock options, RSS are frequently included in stock option agreements. RSS grant employees the right to receive company shares at a future date, typically upon meeting specified vesting conditions. Once vested, the RSS convert into actual shares of stock. The Hennepin Minnesota Stock Option Agreement of Interwar, Inc. generally includes key provisions such as the grant date, exercise price, vesting schedule, expiration date, and any restrictions or conditions that may apply. It also specifies the number of shares subject to the stock option and outlines the process for exercise, including payment methods and timing. Ensuring compliance with state and federal regulations, the Hennepin Minnesota Stock Option Agreement of Interwar, Inc. protects the interests of both Interwar, Inc. and individuals granted stock options under the agreement. It fosters shared success, fostering a strong commitment to the growth and prosperity of the company.

Hennepin Minnesota Stock Option Agreement of Intraware, Inc.

Description

How to fill out Hennepin Minnesota Stock Option Agreement Of Intraware, Inc.?

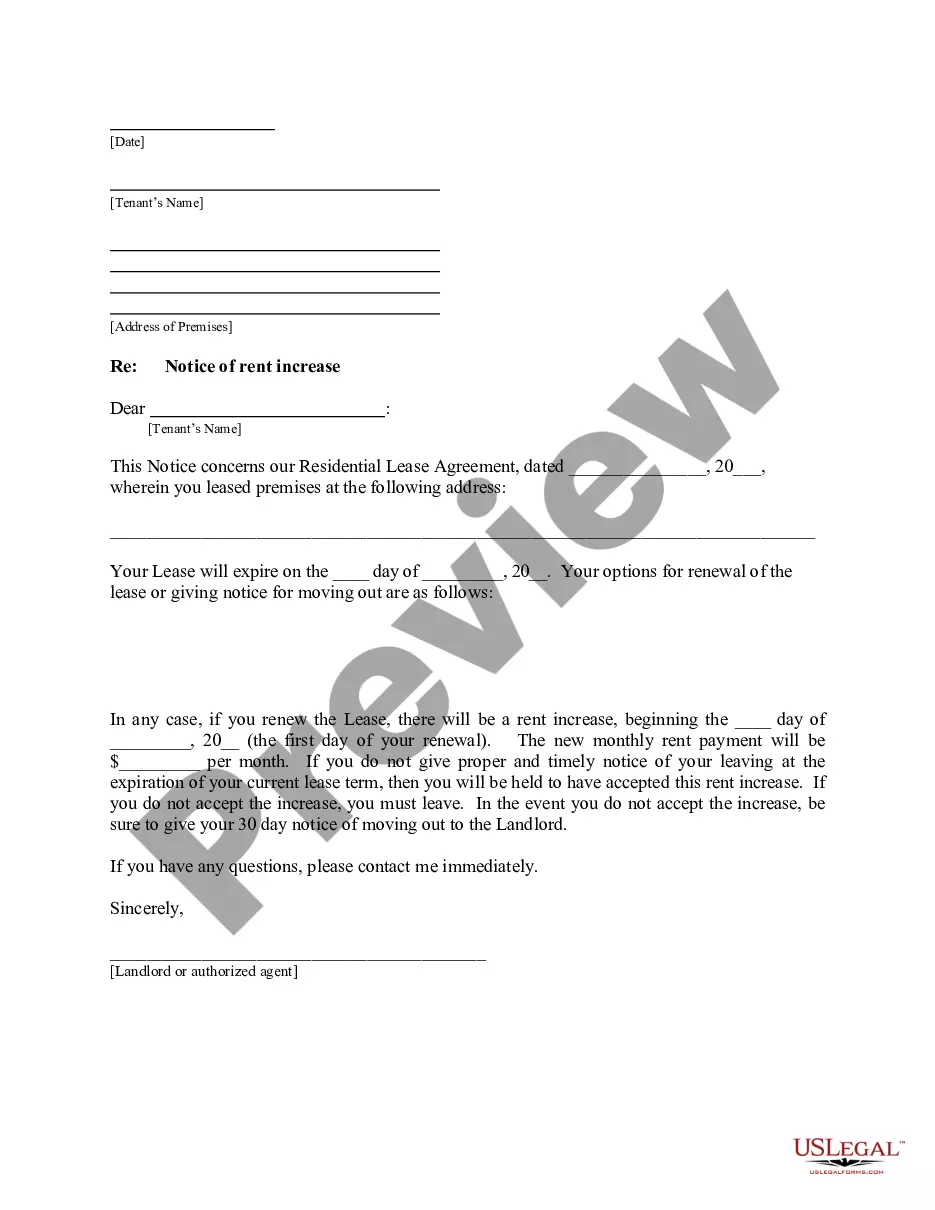

Creating documents, like Hennepin Stock Option Agreement of Intraware, Inc., to manage your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for different cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Hennepin Stock Option Agreement of Intraware, Inc. form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Hennepin Stock Option Agreement of Intraware, Inc.:

- Ensure that your form is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Hennepin Stock Option Agreement of Intraware, Inc. isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our website and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

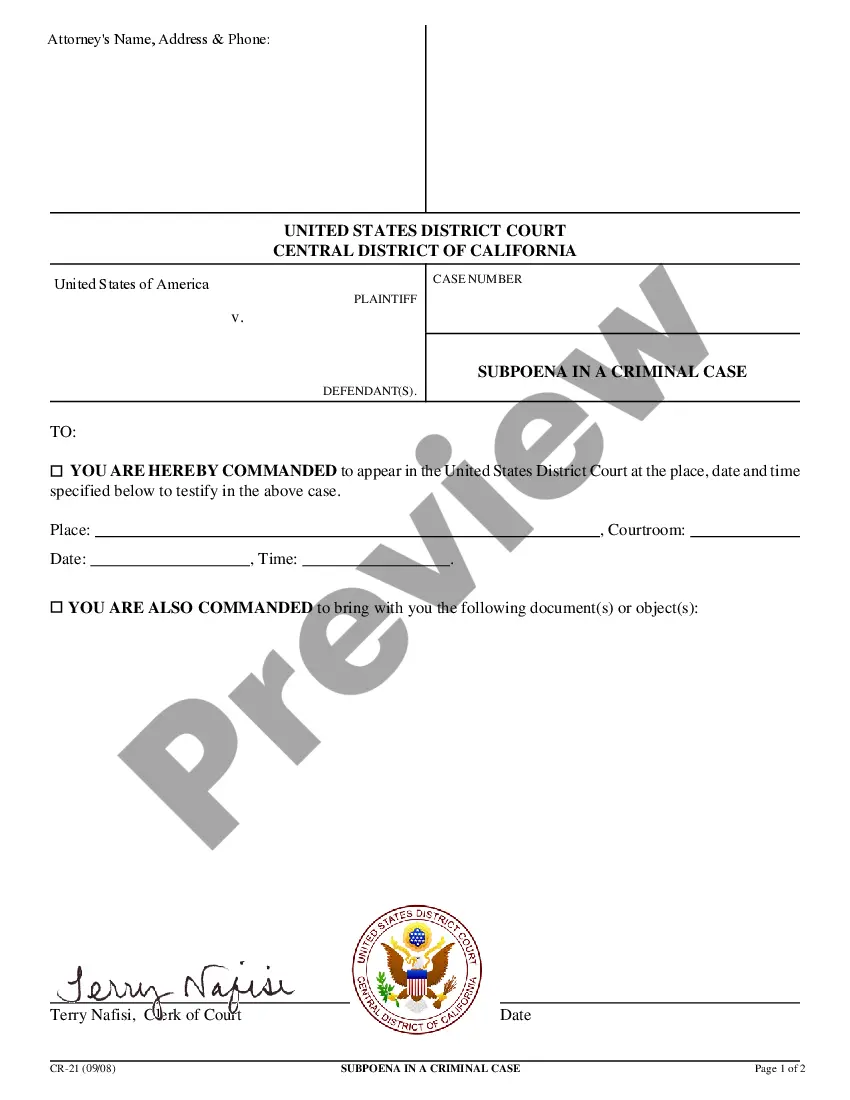

These options come in the form of regular call options and give the employee the right to buy the company's stock at a specified price for a finite period of time. Terms of ESOs will be fully spelled out for an employee in an employee stock options agreement.

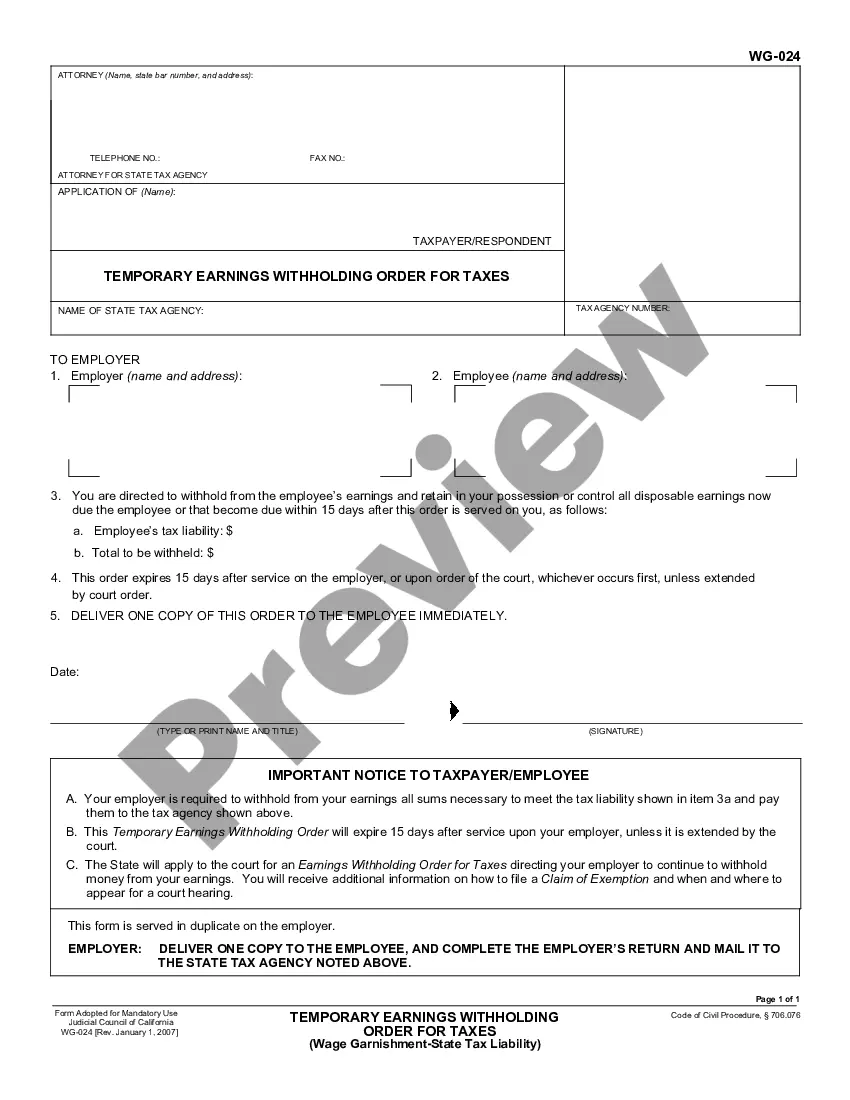

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25. He pays $150 for the option. On the option's expiration date, ABC stock shares are selling for $35.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation.

With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.

An option agreement is where a prospective buyer enters into an agreement with a landowner for the right to buy their land/property, often paying the landowner a sum of money as an option fee. The prospective buyer then has the option (within a period defined within the agreement) to buy the land/property.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

If you're accepting a market level salary for your position, and are offered employee stock options, you should certainly accept them. After all, you have nothing to lose.

Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company. Stock options are the right to purchase shares in a company, usually over a period and according to a vesting schedule.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.