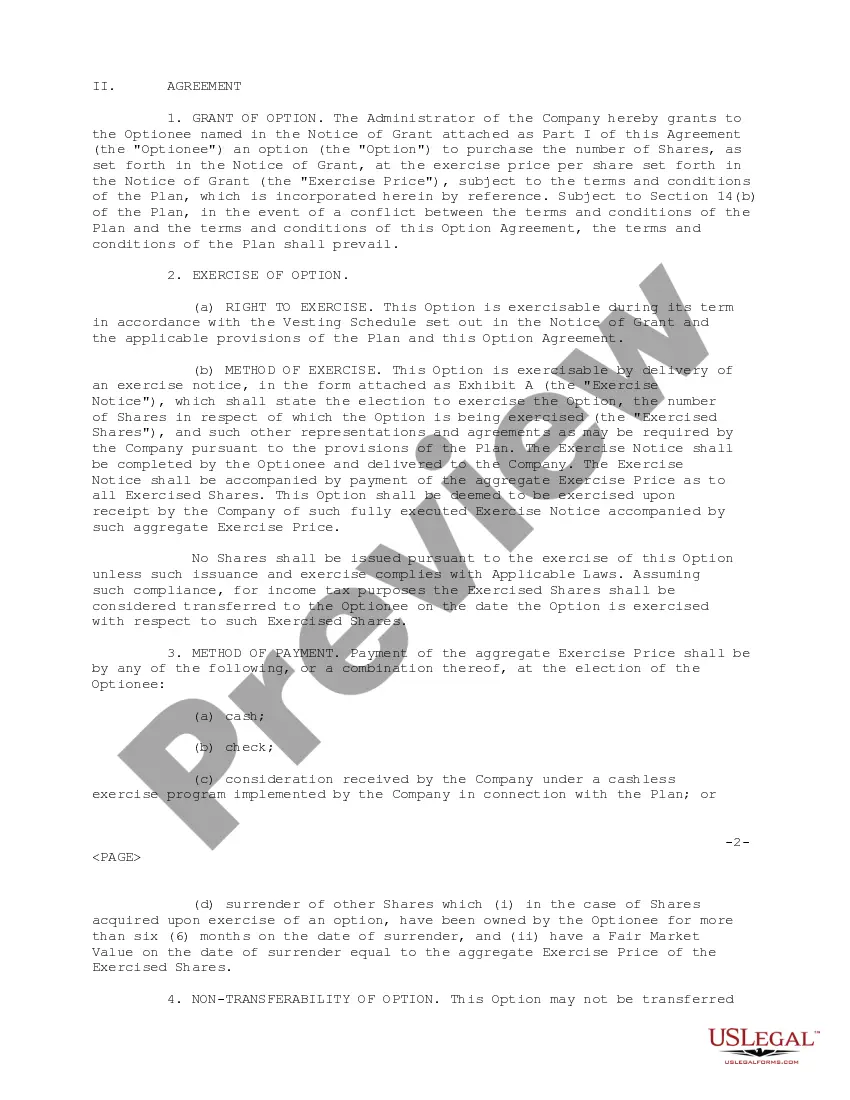

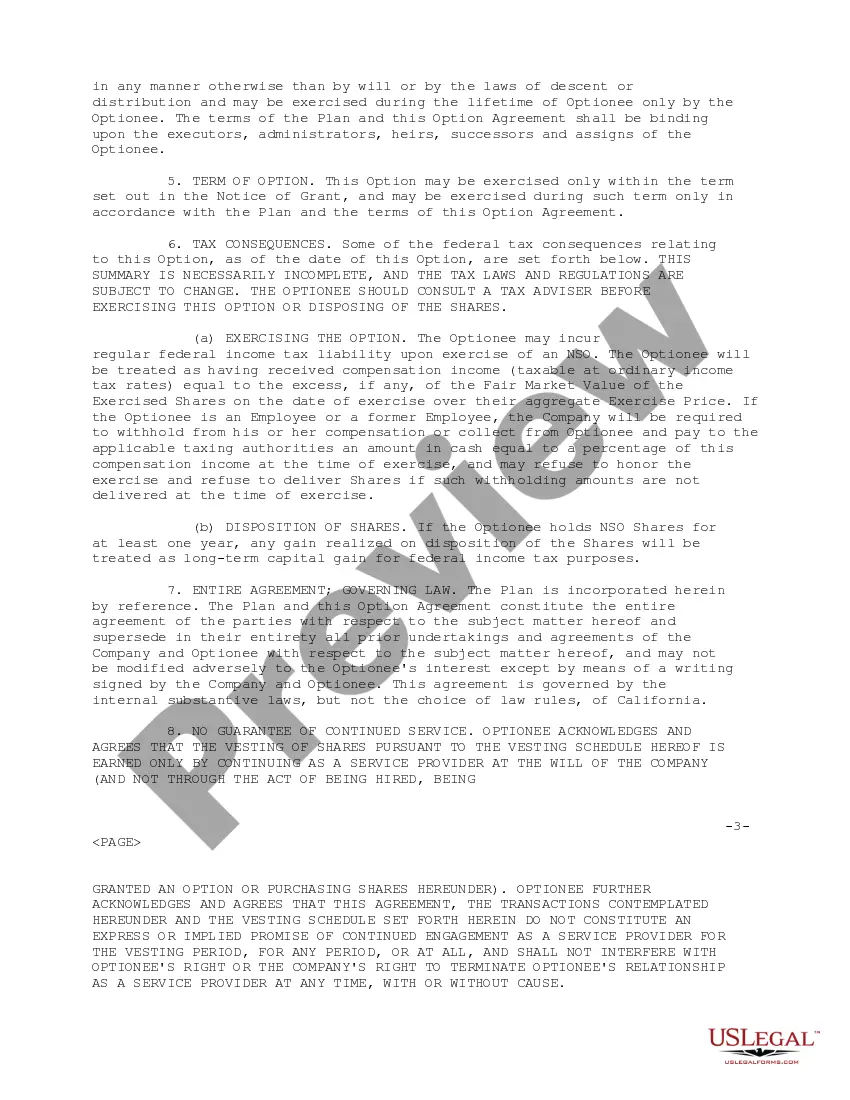

Maricopa, Arizona Stock Option Agreement of Interwar, Inc.: A Comprehensive Guide The Maricopa, Arizona Stock Option Agreement of Interwar, Inc. is a legally binding document that outlines the terms and conditions surrounding stock options offered by Interwar, Inc., a leading software company based in Maricopa, Arizona. This agreement provides detailed information on the terms, rights, and obligations associated with stock options granted to employees, executives, or other stakeholders of Interwar, Inc. Interwar, Inc. may offer various types of stock option agreements in Maricopa, Arizona, catering to different groups of individuals. Some notable types include: 1. Employee Stock Option Agreement: This agreement is designed specifically for employees of Interwar, Inc., as a part of their compensation package. It specifies the number of shares, exercise price, vesting period, and other terms related to the stock options granted to employees. 2. Executive Stock Option Agreement: This type of agreement is tailored for top-level executives or key management personnel of Interwar, Inc. Usually, executives receive a more extensive stock option package, which may include different terms and conditions compared to regular employees' agreements. The agreement may also incorporate additional provisions related to performance targets or ownership restrictions. 3. Consultant Stock Option Agreement: Interwar, Inc. may enter into agreements with consultants or contractors, granting them stock options as a form of remuneration. These agreements define the terms and conditions unique to non-employee stakeholders, such as the scope of services, the duration of the agreement, and the implications of termination. Key terms and provisions of the Maricopa, Arizona Stock Option Agreement may include: 1. Grant Date: The date when the stock options are officially granted to the individual. 2. Vesting Schedule: The timeline or criteria upon which the stock options become exercisable. Vesting schedules often span over several years, incentivizing individuals to remain with Interwar, Inc. 3. Exercise Price: The price at which the stock options can be exercised and converted into actual shares. 4. Expiration Date: The last date the stock options can be exercised before they expire, typically 10 years from the grant date. 5. Acceleration Clauses: Certain events like a change in control or acquisition of Interwar, Inc. may trigger an acceleration of vesting, allowing individuals to exercise their stock options before the usual vesting period elapses. 6. Tax Implications: The agreement may include provisions specifying the tax treatment of stock options, such as the timing and type of tax liability. 7. Transferability: The agreement may outline whether stock options can be transferred or assigned to others, subject to Interwar, Inc.'s approval. It is important to note that the details and provisions of the Maricopa, Arizona Stock Option Agreement may vary depending on the specific agreement, individuals involved, and corporate policies of Interwar, Inc. Therefore, it is essential for all parties to carefully review and understand the agreement before accepting or exercising any stock options, as it governs the rights and responsibilities in relation to the company's stocks.

Maricopa Arizona Stock Option Agreement of Intraware, Inc.

Description

How to fill out Maricopa Arizona Stock Option Agreement Of Intraware, Inc.?

If you need to find a trustworthy legal form supplier to obtain the Maricopa Stock Option Agreement of Intraware, Inc., consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it easy to locate and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to search or browse Maricopa Stock Option Agreement of Intraware, Inc., either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Maricopa Stock Option Agreement of Intraware, Inc. template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or execute the Maricopa Stock Option Agreement of Intraware, Inc. - all from the convenience of your sofa.

Sign up for US Legal Forms now!