Mecklenburg North Carolina Stock Option Agreement of Interwar, Inc., refers to a legally binding document that outlines the terms and conditions regarding stock options offered to employees or executives of Interwar, Inc. based in Mecklenburg County, North Carolina. These agreements provide the opportunity for individuals to purchase company stocks at a set price within a specified time frame. There are various types of Mecklenburg North Carolina Stock Option Agreements of Interwar, Inc., such as: 1. Employee Stock Options: This agreement is offered to employees of Interwar, Inc., granting them the right to purchase a specific number of company stocks at a predetermined price, often referred to as the exercise price or strike price. 2. Executive Stock Options: These agreements are typically provided to high-level executives or officers of the company, allowing them to buy a predetermined number of stocks at a fixed price. Executive stock options often come with additional terms or benefits tailored to the individual's role and contribution to the company. 3. Performance-based Stock Options: Interwar, Inc. may also offer performance-based stock options, tying the availability or quantity of stocks to specific performance goals or milestones achieved by the employee. Such agreements incentivize employees to work towards achieving predetermined targets to enjoy the benefits of stock ownership. 4. Non-Qualified Stock Options (SOS): These stock options do not meet the requirements for special tax treatment under the U.S. Internal Revenue Code. SOS are more flexible in terms of offering a higher degree of control and liquidity to the employees but are subject to income tax upon exercise. 5. Incentive Stock Options (SOS): SOS are stock options that qualify for favorable tax treatment by the Internal Revenue Service (IRS). Employees granted SOS may receive certain tax advantages by holding the stocks for a specific period and meeting specified conditions. It is important to note that the Mecklenburg North Carolina Stock Option Agreement of Interwar, Inc. will contain detailed information regarding stock vesting schedules, expiration dates, exercise periods, conditions for stock transfer, the impact of termination or resignation on stock options, and any potential restrictions or requirements associated with the stock option plan. Interwar, Inc. advises individuals seeking a Mecklenburg North Carolina Stock Option Agreement to consult with their legal or financial advisors to fully understand the terms and implications of the agreement before making any decisions regarding stock options.

Mecklenburg North Carolina Stock Option Agreement of Intraware, Inc.

Description

How to fill out Mecklenburg North Carolina Stock Option Agreement Of Intraware, Inc.?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Mecklenburg Stock Option Agreement of Intraware, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Stock Option Agreement of Intraware, Inc. from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Mecklenburg Stock Option Agreement of Intraware, Inc.:

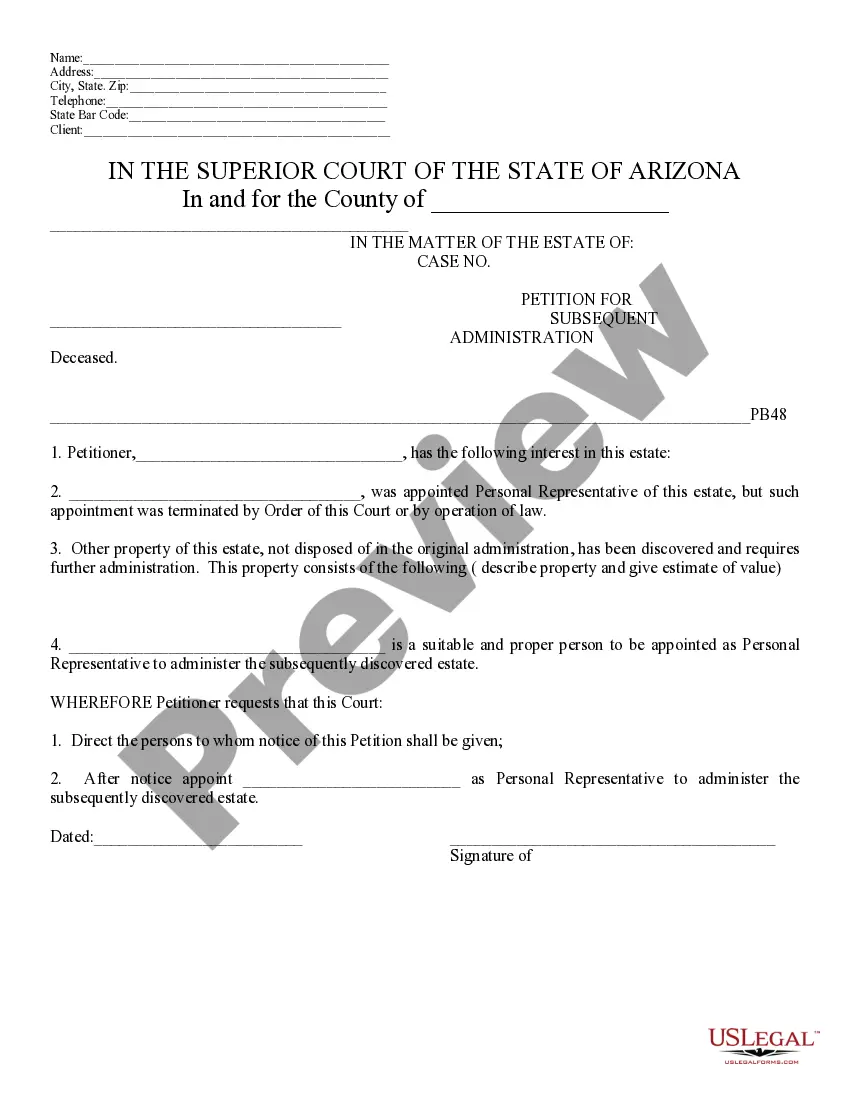

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!