Montgomery, Maryland is a vibrant city located in Montgomery County, Maryland. It is known for its rich history, diverse culture, and thriving economy. With a population of over 1 million people, Montgomery offers a wide range of attractions and amenities for residents and visitors alike. As for the Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets, it is a legally binding document that outlines the terms and conditions of the transaction. This agreement serves as a framework for the transfer of assets and ensures that both parties are protected throughout the process. Key elements of the Montgomery Maryland Sample Asset Purchase Agreement may include: 1. Definitions: This section defines important terms used throughout the agreement to provide clarity and avoid ambiguity. 2. Purchase and Sale: This section outlines the assets being sold, their respective values, and the agreed-upon purchase price. 3. Representations and Warranties: Both parties provide assurances that they have the legal capacity to enter into the agreement and that the assets being sold are owned by the seller and are free from any encumbrances or liabilities. 4. Closing Conditions: This section details the requirements and conditions that need to be fulfilled before the transaction can be completed, such as obtaining necessary regulatory approvals or third-party consents. 5. Indemnification: The agreement may include provisions for indemnification, where one party agrees to compensate the other for any losses, liabilities, or damages arising from breaches of the agreement or misrepresentations. 6. Confidentiality: To protect sensitive information, a confidentiality clause may be included, preventing either party from disclosing or using confidential information obtained during the transaction. 7. Governing Law and Dispute Resolution: This section determines the jurisdiction and laws that will govern the agreement and outlines the process for resolving any disputes arising from the agreement. While there can be different variations or types of Asset Purchase Agreements based on specific circumstances and industries, the general structure and key components mentioned above remain consistent. These agreements play a crucial role in facilitating the smooth transfer of assets while protecting the rights and interests of both parties involved. In conclusion, Montgomery, Maryland, presents a dynamic setting for business transactions, and the Montgomery Maryland Sample Asset Purchase Agreement is a vital legal document that guides the sale and purchase of assets between MPI of Northern Florida and Venturi Technologies, Inc. Understanding the elements and importance of such agreements is crucial to ensuring a successful transaction.

Montgomery Maryland Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample

Description

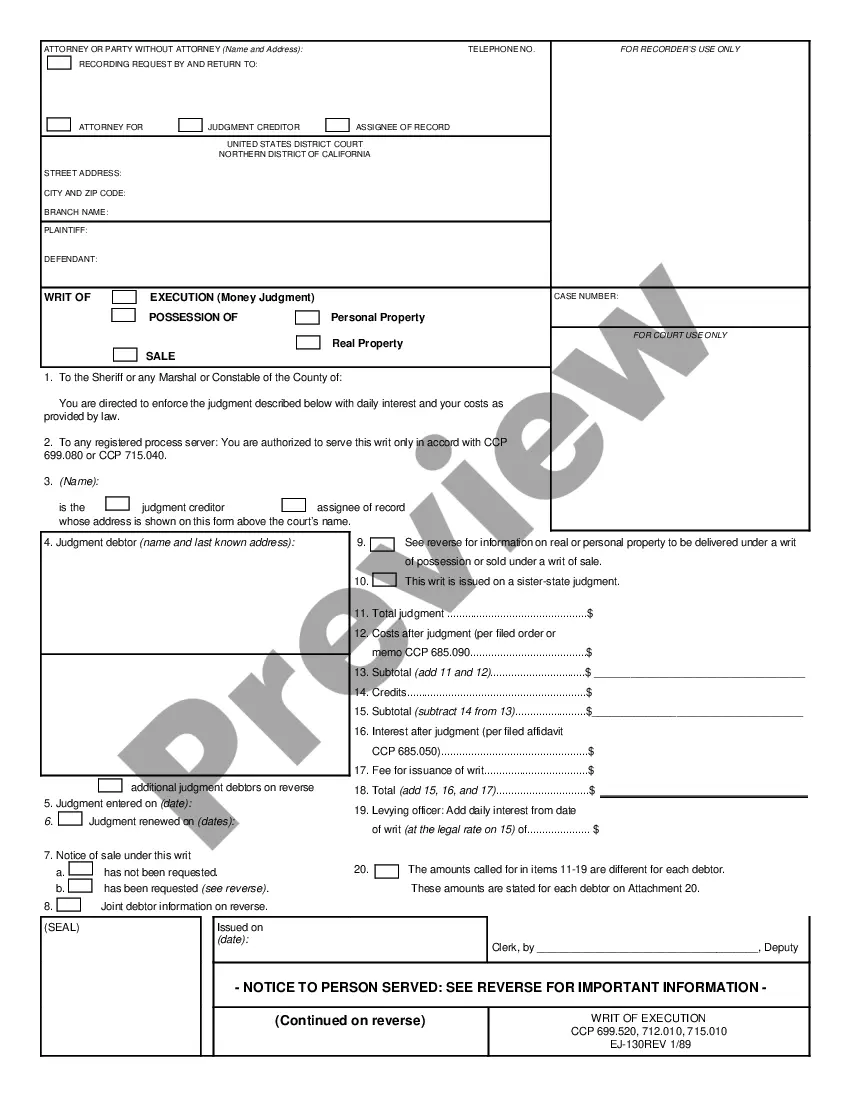

How to fill out Montgomery Maryland Sample Asset Purchase Agreement Between MPI Of Northern Florida And Venturi Technologies, Inc. Regarding The Sale And Purchase Of Assets - Sample?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Montgomery Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Montgomery Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Montgomery Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample:

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

What Happens With Liabilities in an Asset Purchase. In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Asset transaction means a transaction or series of transactions in which a conduit acquires a direct or indirect ownership or security interest in an asset pool in connection with issuing a short-term securitized product; Sample 1.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

In making an asset sale, the seller remains as the legal owner of the entity. At the same time, the buyer purchases individual assets of the company, such as equipment, licenses, goodwill, customer lists, and inventory.