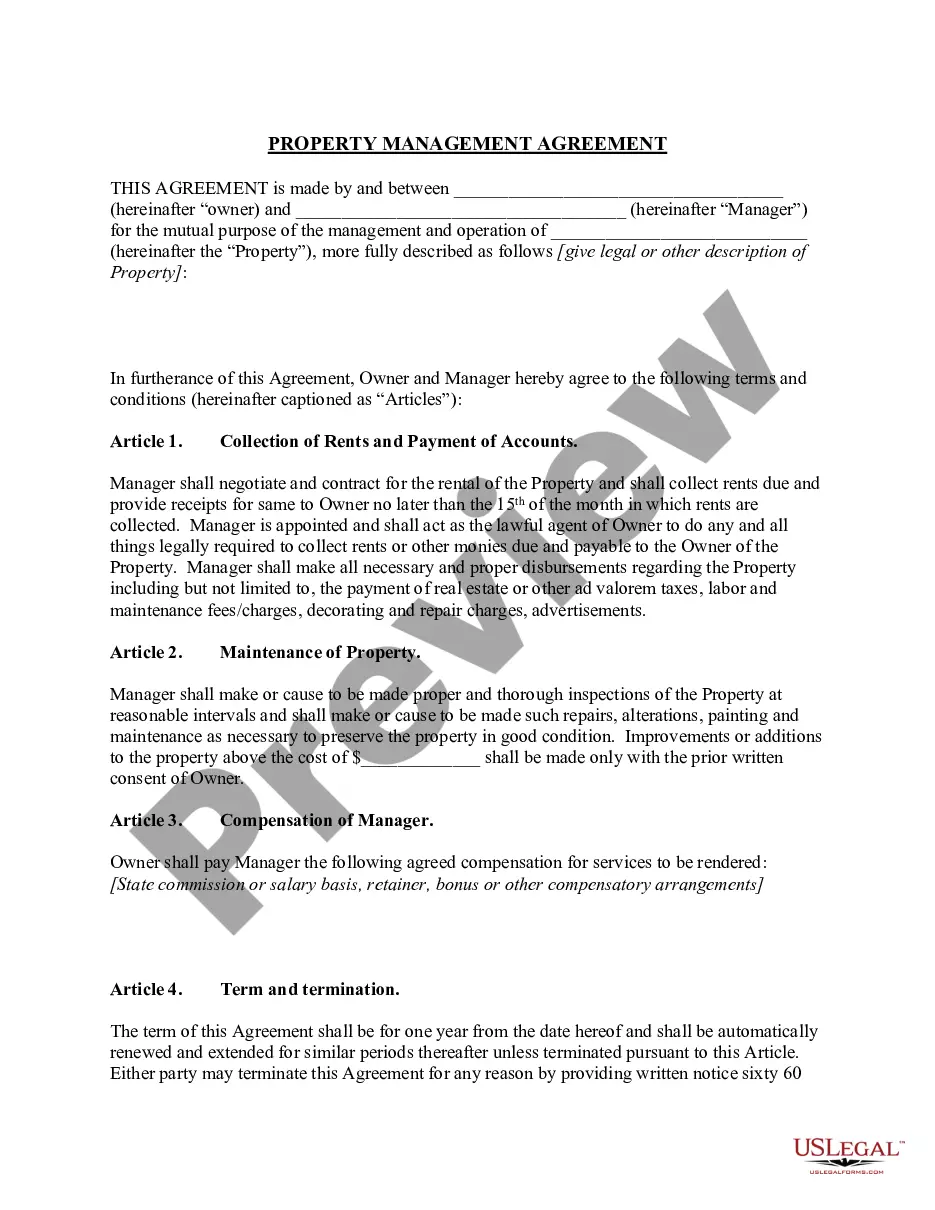

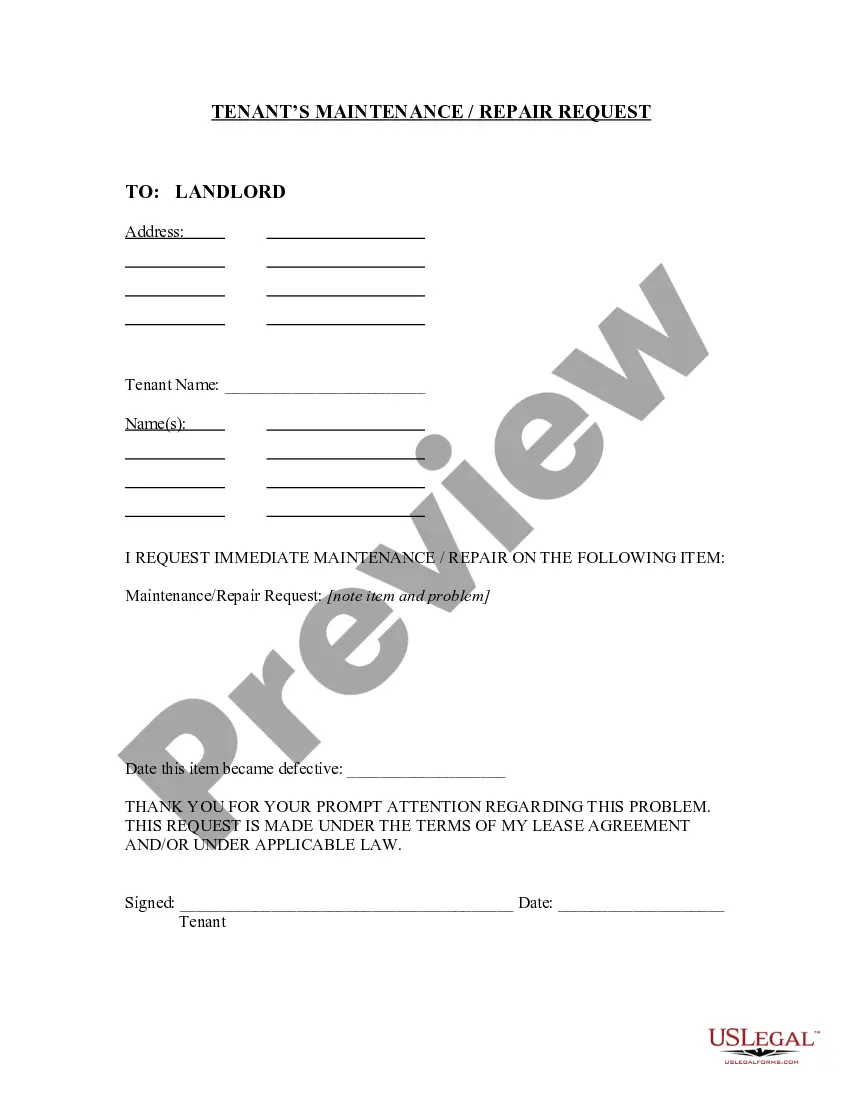

Fairfax Virginia Recapitalization Agreement is a financial contract that involves the restructuring of a company's capital structure in the city of Fairfax, Virginia. It revolves around the process of injecting new funds into a business to improve its financial position, stability, and growth prospects. This agreement aims to enhance the company's ability to manage debt, attract new investors, and adapt to changing market conditions. Keywords: 1. Fairfax Virginia: This refers to the location of the recapitalization agreement, specifically within Fairfax, Virginia. 2. Recapitalization Agreement: The contract that outlines the terms, conditions, and procedures of the recapitalization process. 3. Capital Structure: Refers to the way a company finances its operations, including debt, equity, and other forms of capital. 4. Restructuring: The act of making changes to a company's financial and operational framework to improve efficiency and profitability. 5. Financial Position: The assessment of a company's financial health, including its assets, liabilities, and overall net worth. 6. Stability: The ability of a business to sustain its operations and withstand economic fluctuations and challenges. 7. Growth Prospects: The potential for a company to expand its operations and increase its profitability in the future. 8. Debt Management: The process of efficiently managing and restructuring a company's existing debt obligations. 9. Attracting Investors: The ability of a recapitalized company to draw the attention and investment of new stakeholders. 10. Market Conditions: The prevailing economic and industry factors, such as competition, customer demand, and regulatory changes, that affect a company's performance. Different Types of Fairfax Virginia Recapitalization Agreement: While the Fairfax Virginia Recapitalization Agreement generally involves the restructuring of a company's capital, there can be different approaches or types of recapitalization agreements based on the specific objectives and circumstances. Examples include: 1. Debt-for-Equity Swap: In this type, a company converts its debt obligations into equity ownership, reducing its financial burden. 2. Share Buyback: The company repurchases its own shares from investors, often using surplus cash or borrowed funds, to increase shareholder value and control. 3. Mezzanine Financing: A hybrid form of debt and equity financing, allowing a company to raise funds while offering investors potential equity upside. These types of recapitalization agreements can have various combinations and structures, depending on the company's goals and the financial expertise of involved parties.

Fairfax Virginia Recapitalization Agreement

Description

How to fill out Fairfax Virginia Recapitalization Agreement?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Fairfax Recapitalization Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Fairfax Recapitalization Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Recapitalization Agreement:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Fairfax Recapitalization Agreement and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!