Fulton Georgia Recapitalization Agreement is a financial arrangement that aims to restructure the existing debt obligations and provide additional capital to the local government of Fulton County, Georgia. This agreement is designed to improve the financial position of the county and facilitate economic growth and development. The Fulton Georgia Recapitalization Agreement involves a thorough evaluation of the county's financial situation, including its outstanding debts, revenue sources, and expenditure patterns. The agreement may consist of a comprehensive debt refinancing plan, which aims to replace existing high-interest debts with new loans at lower interest rates. This allows the county to reduce its interest expenses and allocate more funds towards public services and infrastructure investment. In some cases, the Fulton Georgia Recapitalization Agreement may also involve the issuance of new bonds or securities to generate additional capital for the county. These new funds can be used for various purposes, such as improving public infrastructure, investing in education and healthcare, or supporting small businesses and job creation initiatives. It is important to note that the Fulton Georgia Recapitalization Agreement can have different types or variations based on the specific needs and goals of the county. Some possible types include: 1. Debt Restructuring Agreement: This type focuses primarily on renegotiating the repayment terms of existing debts, such as extending the maturity dates, reducing interest rates, or changing the payment structure, to alleviate the financial burden. 2. Public-Private Partnership (PPP) Agreement: This type involves collaboration between the government and private entities, wherein the private sector provides capital or resources in exchange for certain rights to develop or operate public infrastructure projects or services. This can be beneficial in cases where the county needs significant investment in infrastructure but lacks sufficient funds. 3. Revenue Bond Agreement: In this type, the county issues' revenue bonds that are backed by specific revenue-generating projects or assets. These bonds are repaid using the income generated by these projects, such as tolls from a highway or fees from a designated facility. This agreement enables the county to fund projects without relying solely on tax revenues. Overall, the Fulton Georgia Recapitalization Agreement serves as a strategic financial tool to bolster the fiscal position of Fulton County, Georgia. By restructuring debt and injecting additional capital into the county's coffers, it seeks to enhance economic stability, promote development, and better allocate resources for the benefit of the residents and businesses within the county.

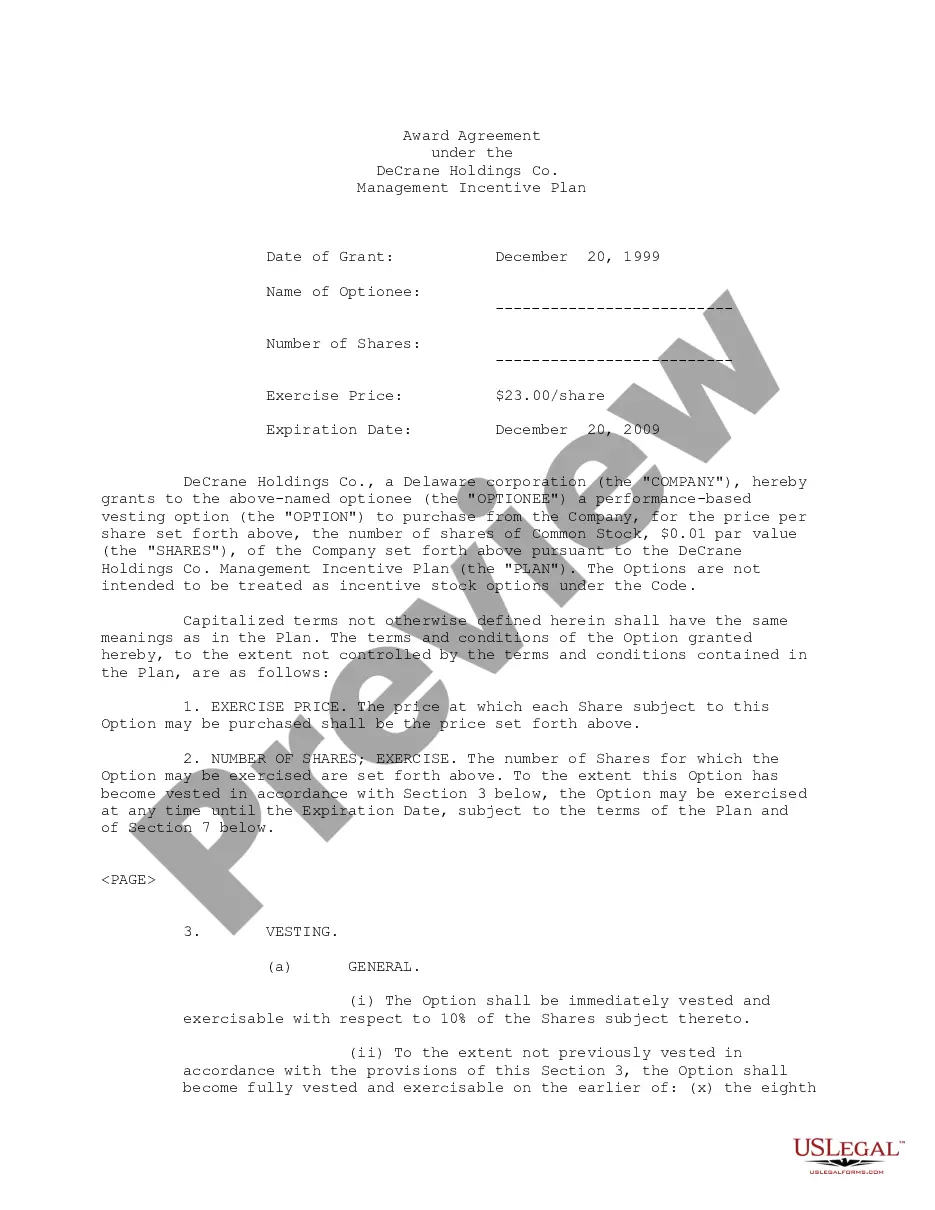

Fulton Georgia Recapitalization Agreement

Description

How to fill out Fulton Georgia Recapitalization Agreement?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Fulton Recapitalization Agreement without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Fulton Recapitalization Agreement by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Fulton Recapitalization Agreement:

- Look through the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!