Orange California Recapitalization Agreement refers to a financial arrangement that involves the restructuring and adjustment of a company's capital structure in Orange, California. This agreement is designed to provide a solution for companies facing financial challenges or seeking new avenues for growth. It typically involves the infusion of additional capital, debt restructuring, and ownership or management changes. One type of Orange California Recapitalization Agreement is debt recapitalization. This involves converting a company's existing debt obligations into new forms of debt, such as bonds or loans, with revised terms and conditions. The purpose is to reduce interest rates, extend repayment periods, or modify payment terms, providing the company with improved cash flow and financial stability. Another type of Orange California Recapitalization Agreement is equity recapitalization. In this case, the company's ownership structure is modified, and new equity investors are brought in to infuse fresh capital into the business. Existing shareholders may be diluted, while new stakeholders gain control or influence over the company's operations. Equity recapitalization aims to enhance the company's financial position and fund expansion plans. Moreover, a hybrid recapitalization agreement may be implemented in Orange, California. This agreement combines aspects of both debt and equity recapitalization. It includes restructuring debt obligations while also attracting new equity investors. The goal is to strike a balance between reducing debt burdens and injecting fresh capital to support the company's growth and viability. Orange California Recapitalization Agreements often involve negotiations between the company's management, existing stakeholders, potential investors, and financial institutions. The terms and conditions of the agreement, including capital infusion, debt conversion or restructuring, and ownership changes, are determined through these discussions. Legal and financial experts typically guide the parties involved in complying with relevant regulations and making informed decisions. Overall, Orange California Recapitalization Agreements provide struggling companies with an opportunity to overcome financial challenges, restructure their capital, and pursue sustainable growth. By accessing new capital resources and optimizing their financial structures, companies can enhance their competitiveness, improve their operational capabilities, and position themselves for long-term success in the dynamic business landscape of Orange, California.

Orange California Recapitalization Agreement

Description

How to fill out Orange California Recapitalization Agreement?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Orange Recapitalization Agreement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any activities related to document execution simple.

Here's how to locate and download Orange Recapitalization Agreement.

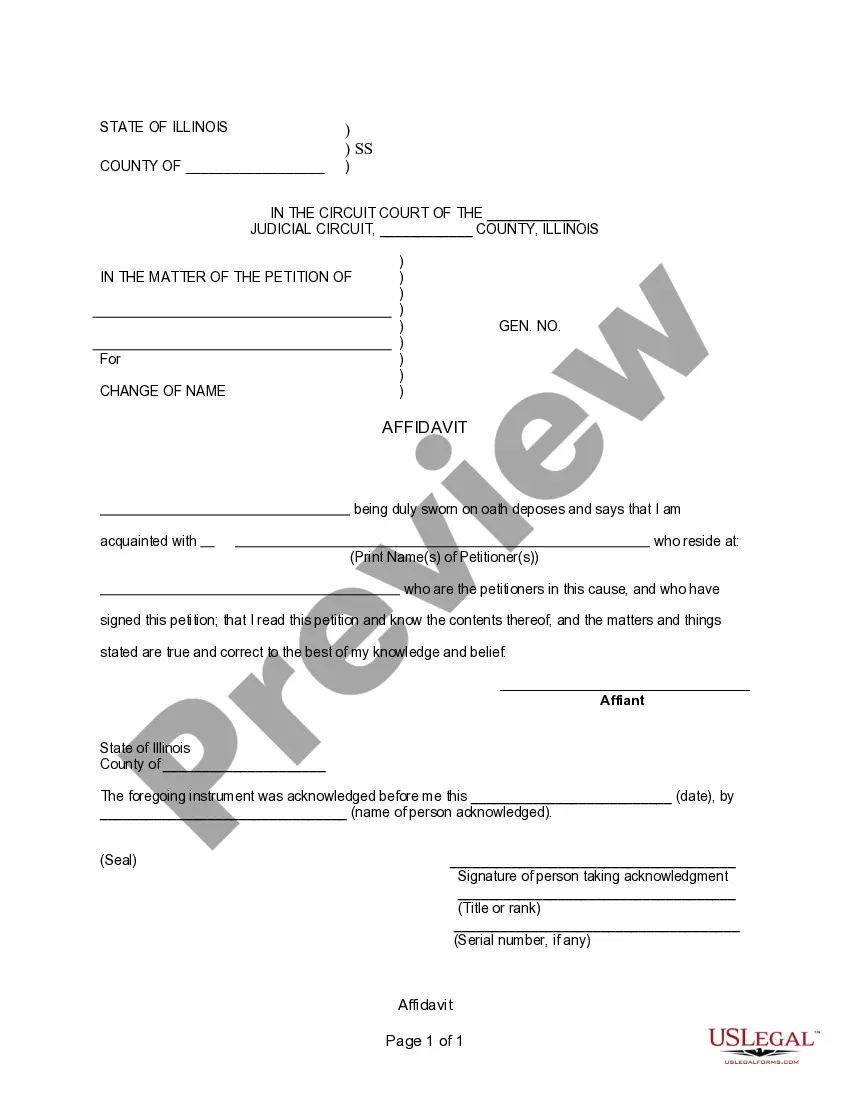

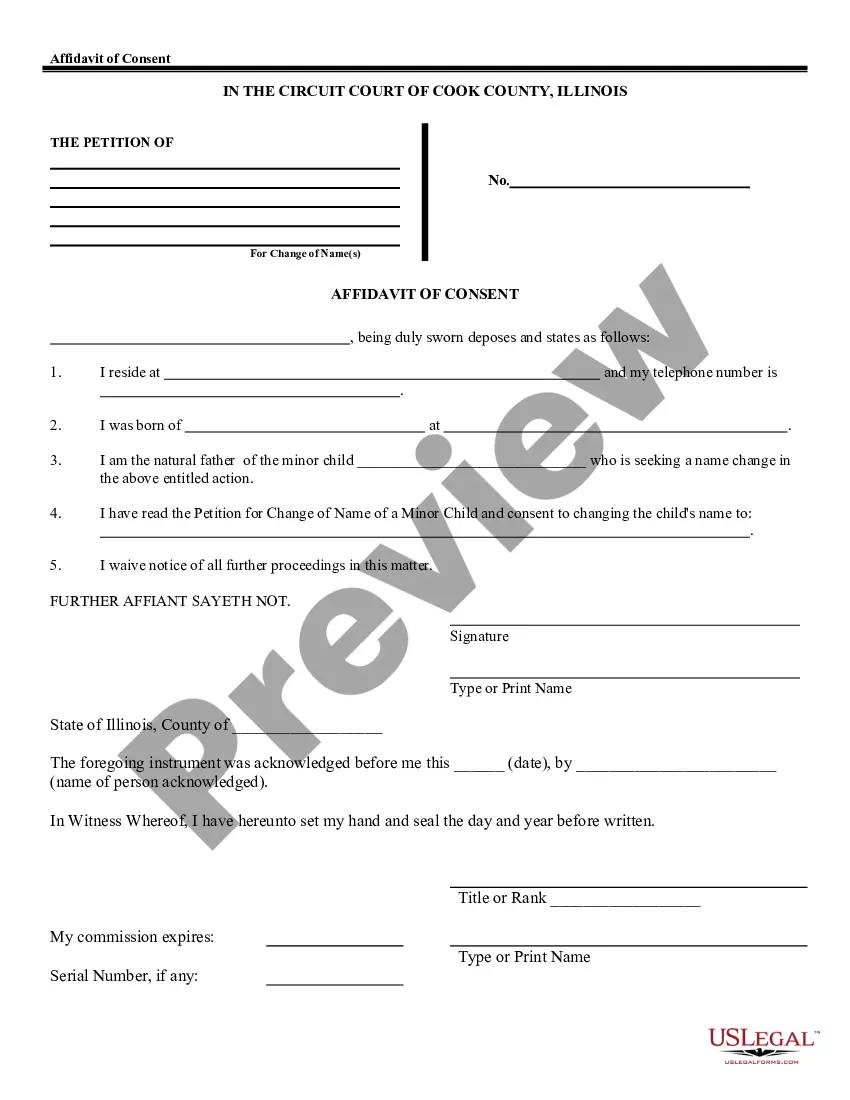

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the related document templates or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Orange Recapitalization Agreement.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Orange Recapitalization Agreement, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you need to deal with an exceptionally difficult case, we recommend getting an attorney to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!