Travis Texas Recapitalization Agreement is a financial agreement that involves the restructuring of a company's capital structure in the state of Texas. It encompasses various aspects of capital management, including debt restructuring, equity infusion, and changes in ownership. The purpose of this agreement is to enhance the financial stability and sustainability of a company by addressing its existing financial challenges. This can be achieved through strategies such as refinancing existing debts, reducing interest rates, modifying repayment terms, and injecting fresh capital into the business. There are different types of Travis Texas Recapitalization Agreements that can be implemented depending on the specific needs and circumstances of a company. Some common types include: 1. Debt-for-Equity Swap: In this type of agreement, a portion of the company's outstanding debt is converted into equity ownership. This helps to reduce the debt burden and strengthens the company's balance sheet. Creditors become shareholders and have a say in the company's decision-making processes. 2. Equity Infusion: This refers to the injection of fresh funds into the company in exchange for equity ownership. It can be done by existing shareholders, new investors, or a combination of both. The new capital improves the company's liquidity position and provides resources for growth and expansion. 3. Restructuring of Debt: This type of recapitalization agreement involves modifying the terms and conditions of existing debt obligations. It may include negotiations with creditors to extend repayment periods, reduce interest rates, or waive certain obligations. These reliefs the financial strain on the company and improves its ability to meet payment obligations. 4. Ownership Changes: Sometimes, recapitalization agreements involve changes in the ownership structure of a company. This could include the buyout of existing shareholders by new investors or the consolidation of multiple ownership stakes. Such changes in ownership can result in the infusion of fresh capital and strategic direction for the company's future growth. Overall, Travis Texas Recapitalization Agreement offers an opportunity for distressed companies to restructure their financial affairs and regain their financial strength. By implementing these agreements, businesses can navigate through challenging economic times, improve their profitability, and position themselves for long-term success.

Travis Texas Recapitalization Agreement

Description

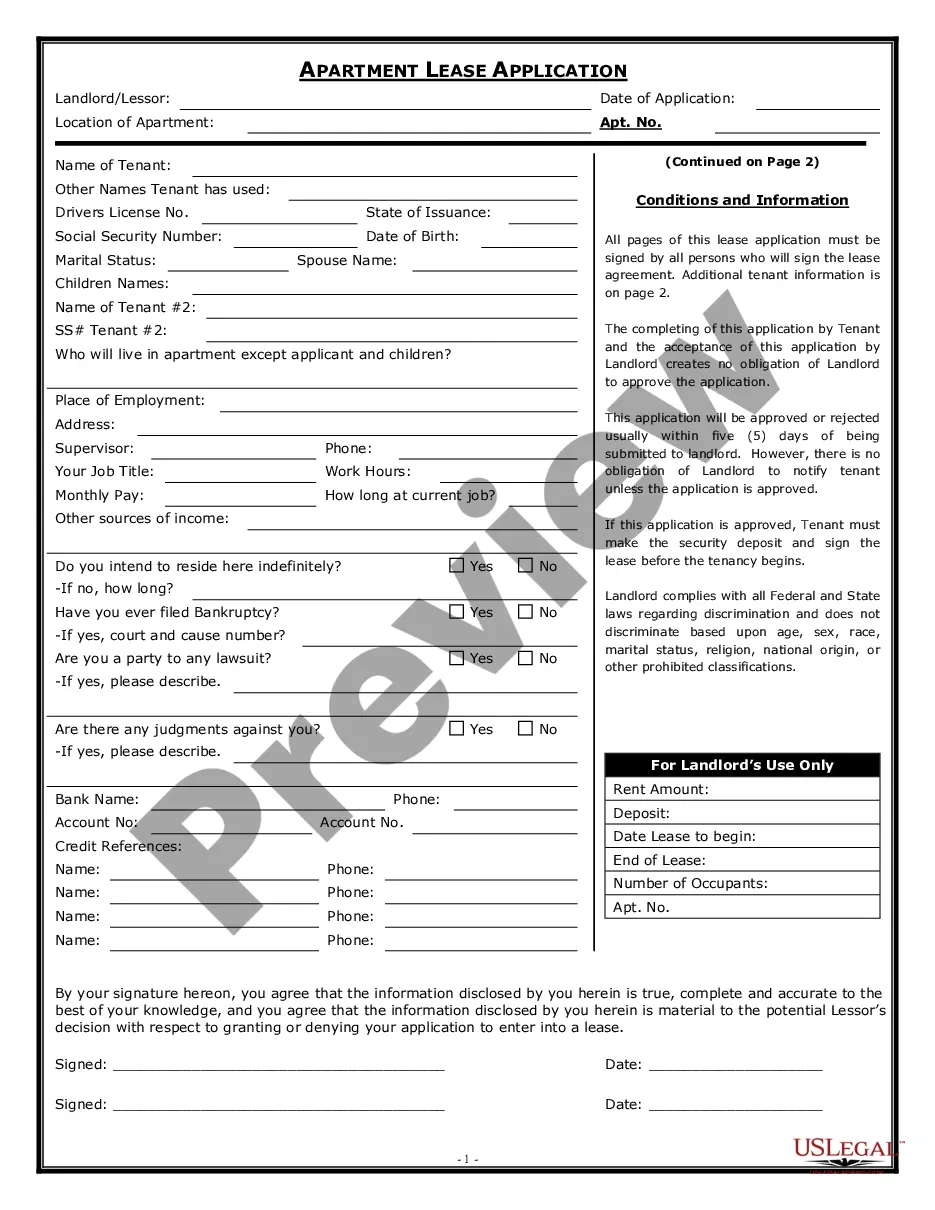

How to fill out Travis Texas Recapitalization Agreement?

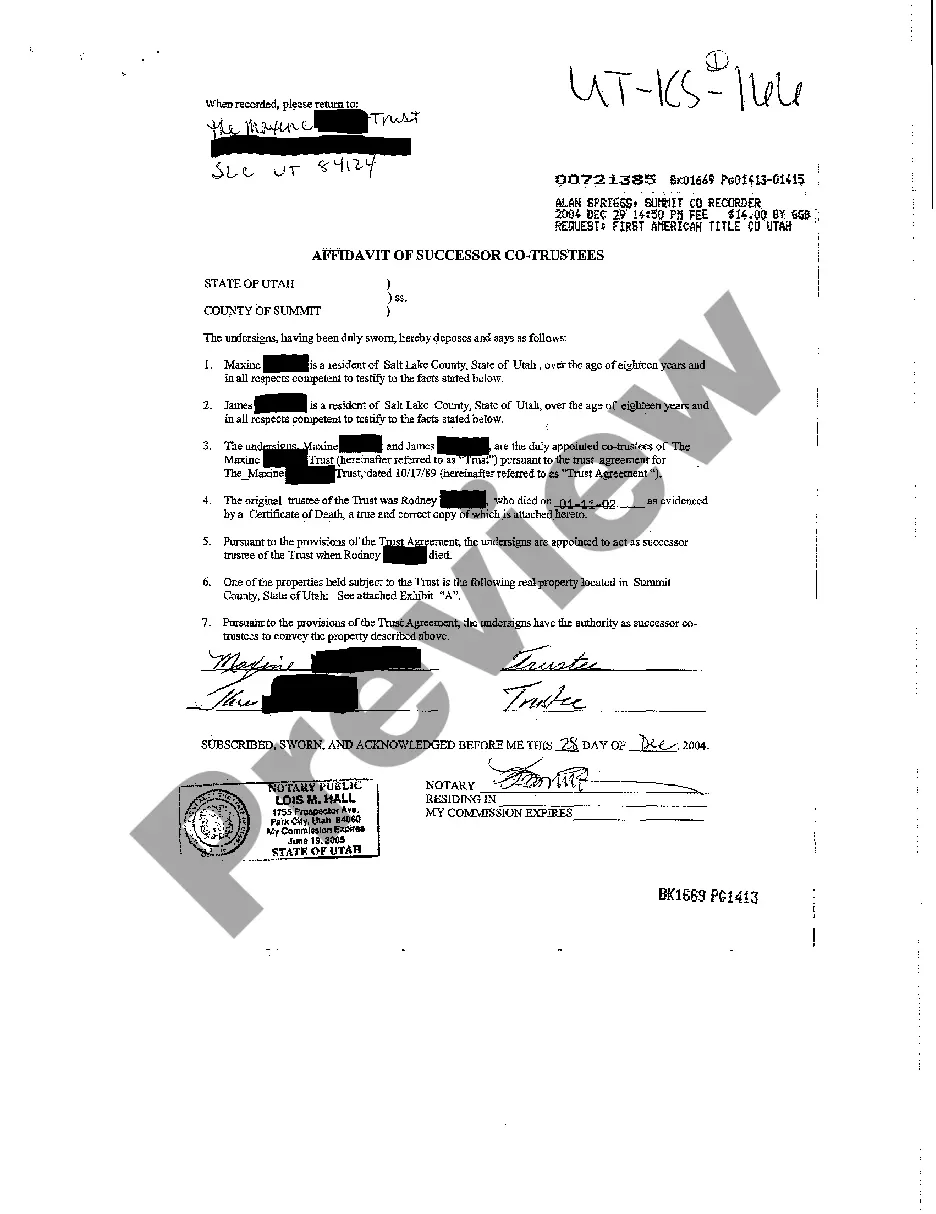

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Travis Recapitalization Agreement.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Travis Recapitalization Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Travis Recapitalization Agreement:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Travis Recapitalization Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!