Los Angeles California Amended and Restated Principal Underwriting Agreement is a legally binding document that governs the issuance of variable annuity contracts and life insurance in the city of Los Angeles. This agreement sets forth the terms and conditions under which the underwriters operate and facilitate the distribution of these financial products in the market. The purpose of this agreement is to provide clarity and establish a transparent framework for the underwriting process. It outlines the roles, responsibilities, and obligations of the involved parties, including the underwriters, insurance companies, and regulators. The agreement covers various aspects of the underwriting process, including the determination of contract terms, risk assessment, distribution channels, and compliance with applicable laws and regulations. Keywords: Los Angeles California, Amended and Restated Principal Underwriting Agreement, issuance, variable annuity contracts, life insurance, underwriters, distribution, financial products, roles, responsibilities, obligations, contract terms, risk assessment, compliance, regulations. Different types of Los Angeles California Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance can include: 1. Individual Variable Annuity Underwriting Agreement: This agreement governs the issuance of variable annuity contracts to individual policyholders. It outlines specific terms and conditions, such as contract features, payment options, surrender charges, death benefits, and investment options. 2. Group Variable Annuity Underwriting Agreement: This agreement focuses on the issuance of variable annuity contracts to members of a group or organization. It covers the unique requirements and provisions related to group insurance, including eligibility criteria, contribution limits, and coordination with employer-sponsored retirement plans. 3. Life Insurance Underwriting Agreement: This separate agreement pertains specifically to the underwriting of life insurance policies, including term life, whole life, and universal life insurance. It addresses the assessment of mortality risks, medical underwriting, policy conversion options, and beneficiary designation. It's important to note that while these types of agreements may have specific variations within the Los Angeles California market, the primary purpose and content surrounding the underwriting of variable annuity contracts and life insurance remain consistent across all variations.

Los Angeles California Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

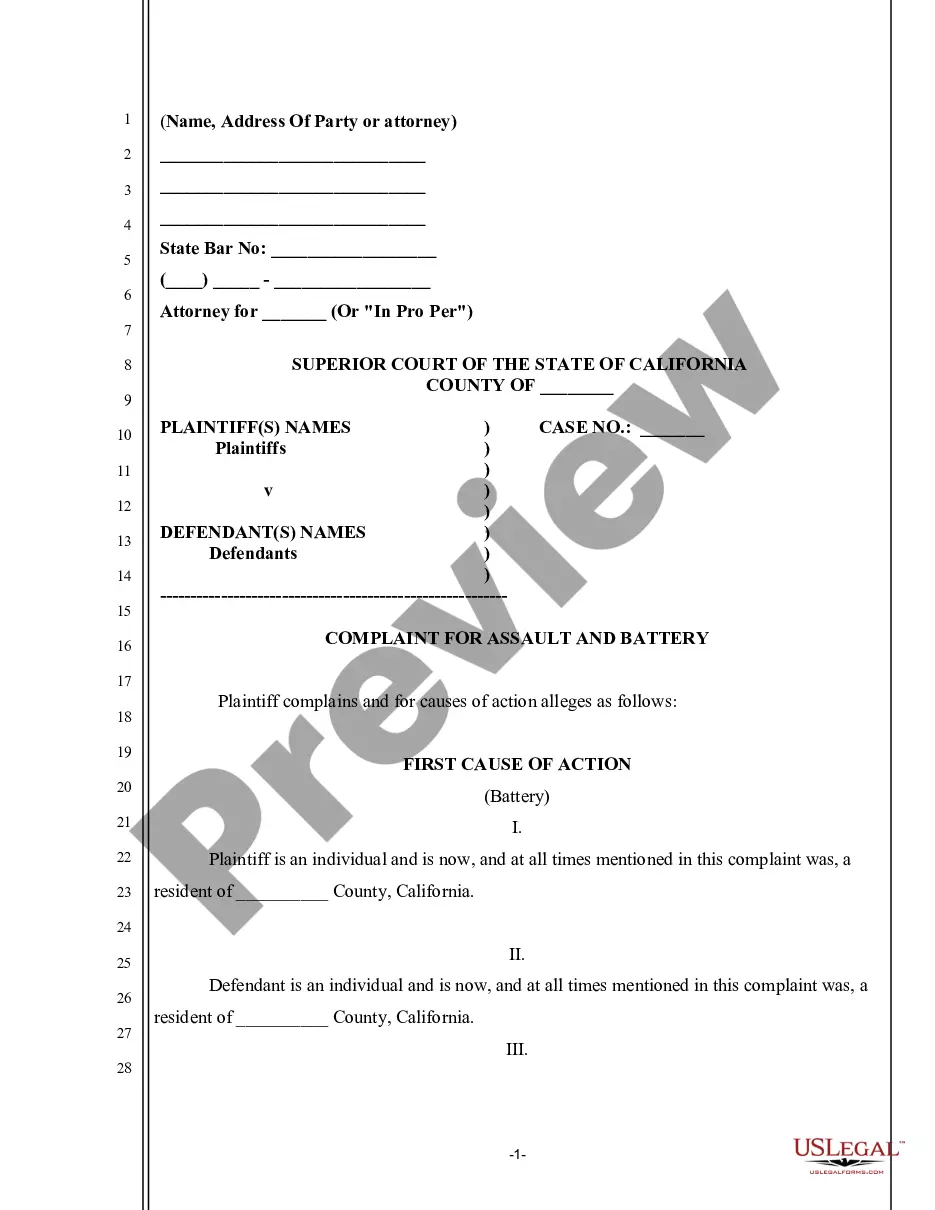

How to fill out Los Angeles California Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Los Angeles Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Los Angeles Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

Variable annuities are securities registered with the Securities and Exchange Commission (SEC), and sales of variable insurance products are regulated by the SEC and FINRA.

The new rule permits variable annuity and variable life insurance contracts to use a summary prospectus to provide disclosures to investors. A summary prospectus is a concise, reader-friendly summary of key facts about the contract.

Variable annuity prospectuses contain important information about the annuity contract, including fees, expenses, risks, investment options, and other important information. For more information, please read the prospectus carefully.

FINRA has jurisdiction over the investment professionals and firms that sell variable life and variable universal life products. Insurance products often are developed to meet specific objectives.

Fixed annuities are regulated by state insurance commissioners.

And variable annuities are also governed at the federal level by the Securities and Exchange Commission and the Financial Industry Regulatory Authority. Elaine Silvestrini is an advocate for financial literacy who worked for more than 25 years in journalism before joining Annuity.org as a financial writer.

If an insurance agent offers products that are considered securities?such as variable annuity contracts or variable life insurance policies?the agent must also be licensed as a registered representative and comply with FINRA rules.

Fixed annuities are considered exempt from the registration and prospectus requirements of the Securities Act of 1933.

A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The variable annuity's value is based on the performance of underlying investment portfolios.

Deferred variable annuities are hybrid investments containing securities and insurance features. Their sales are regulated both by FINRA and the Securities and Exchange Commission (SEC). These annuities offer investors choices among a number of complex contract features and options.