The Nassau New York Amended and Restated Principal Underwriting Agreement is a legal document that governs the issuance of variable annuity contracts and life insurance policies by Nassau New York. This agreement outlines the terms and conditions under which these financial products are underwritten by the company. Under the Nassau New York Amended and Restated Principal Underwriting Agreement, several types of agreements can be found, each pertaining to specific aspects of variable annuity contracts and life insurance issuance. These agreements include: 1. Variable annuity underwriting agreement: This agreement defines the terms and conditions for underwriting variable annuity contracts. It covers aspects such as investment options, fees and charges, surrender periods, death benefits, and annuitization options. 2. Life insurance underwriting agreement: This agreement focuses on the underwriting process for life insurance policies. It includes guidelines for determining the insurability of applicants, premium rates, policy terms, death benefit options, and policy riders. 3. Reinsurance underwriting agreement: This type of agreement relates to the reinsurance of variable annuity contracts and life insurance policies issued by Nassau New York. It outlines the terms and conditions under which another insurance company assumes part or all of the insurance risk. 4. Amended and Restated underwriting agreement: This specialized agreement highlights any modifications or updates made to the original underwriting agreement and serves as an amended version with updated terms and conditions. The Nassau New York Amended and Restated Principal Underwriting Agreement is designed to ensure compliance with applicable laws and regulations governing the issuance of variable annuities and life insurance policies. It provides clarity and transparency for both parties involved, assuring policyholders that their insurance needs are met and setting guidelines for underwriters to follow. Keywords: Nassau New York, Amended and Restated Principal Underwriting Agreement, variable annuity contracts, life insurance, underwriting, investment options, fees and charges, surrender periods, death benefits, annuitization options, insurability, premium rates, policy terms, policy riders, reinsurance, compliance, transparency.

Nassau New York Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

How to fill out Nassau New York Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

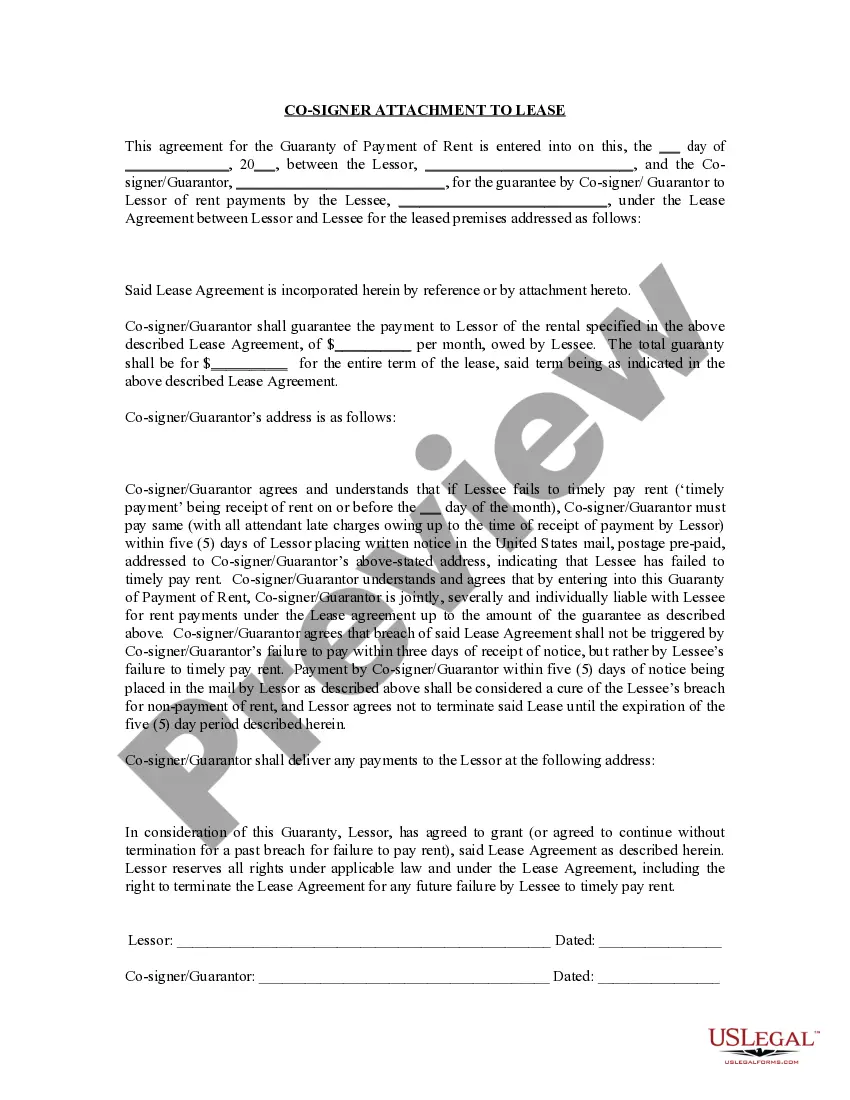

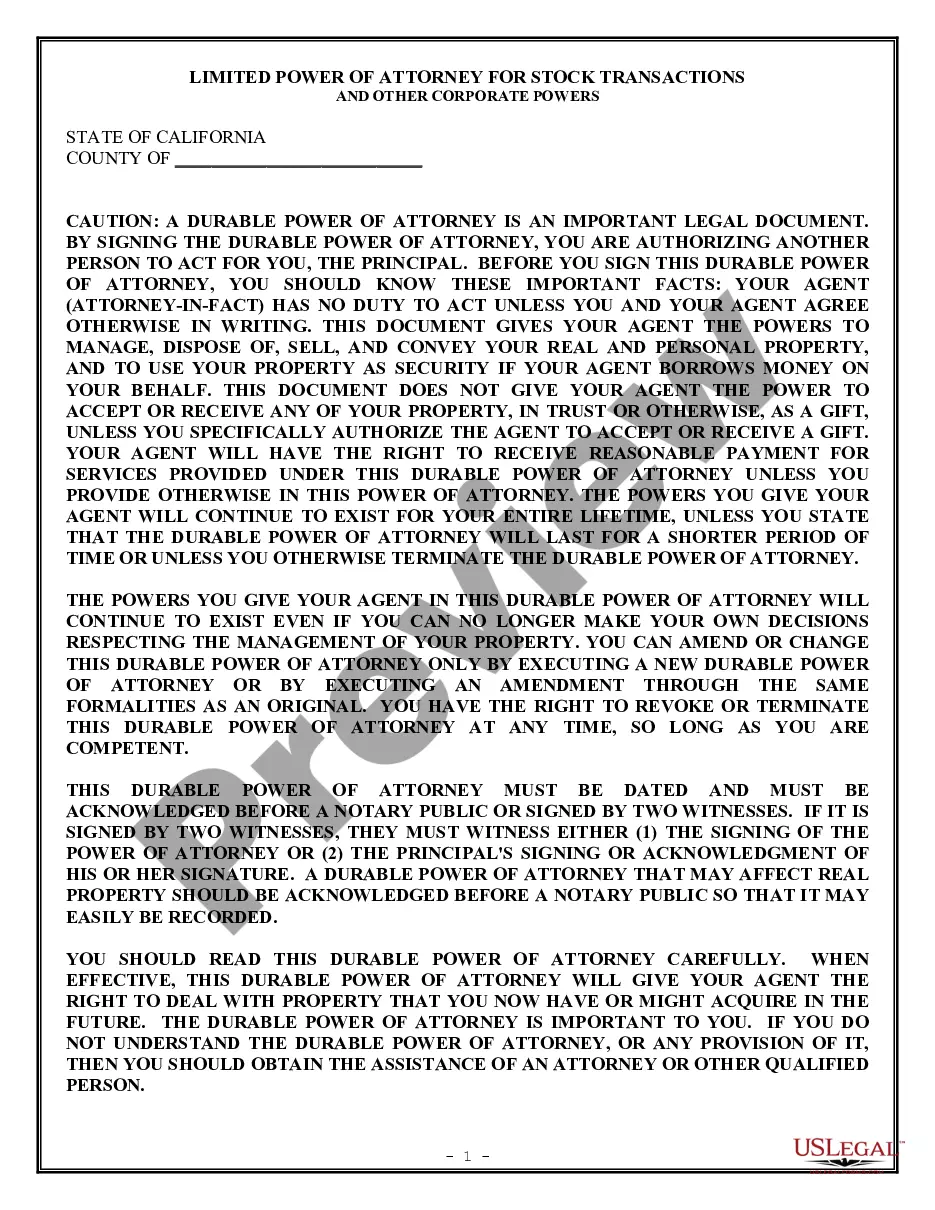

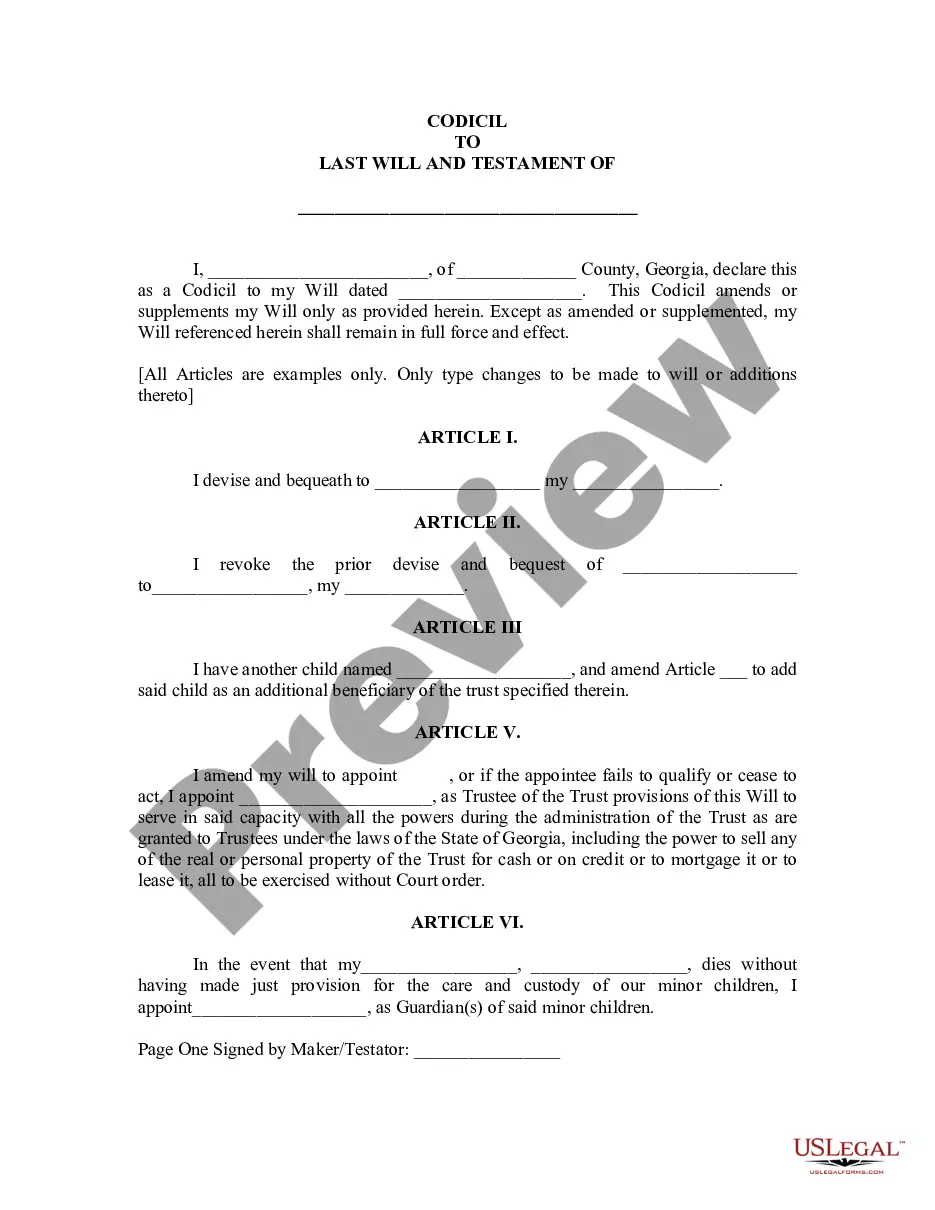

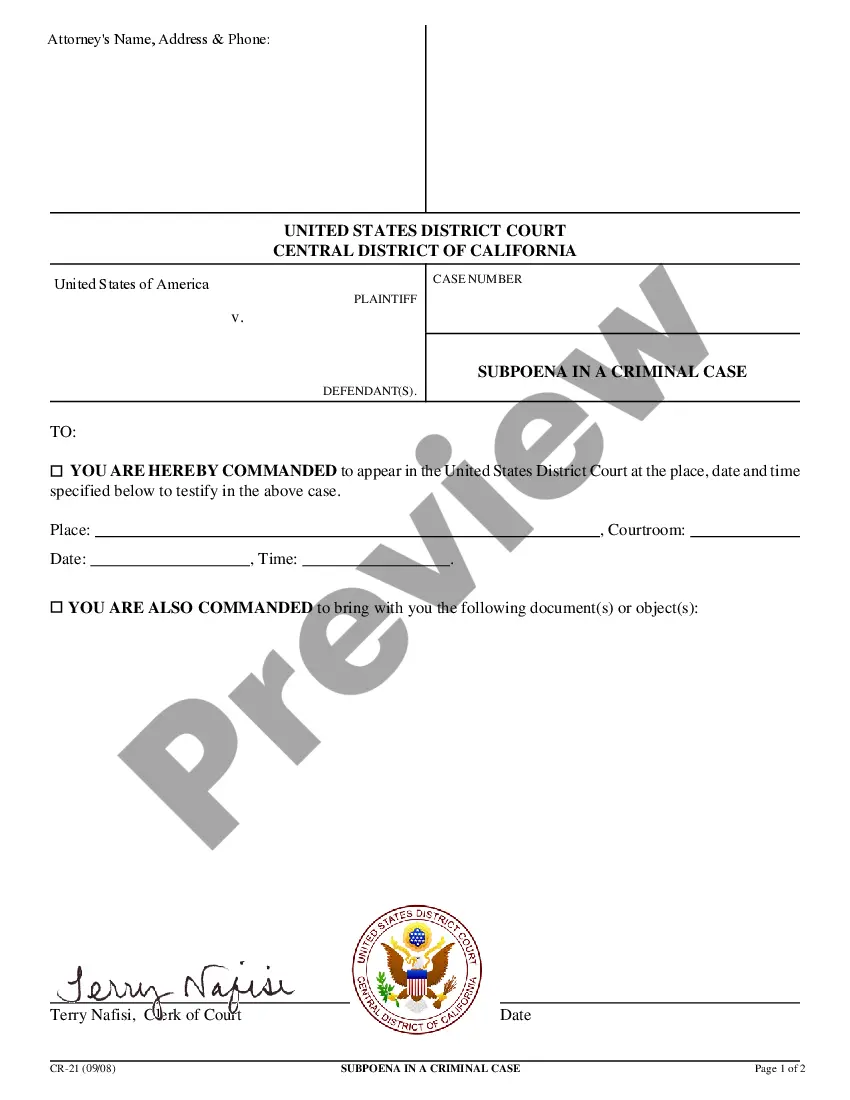

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Nassau Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Nassau Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!