The Phoenix Arizona Amended and Restated Principal Underwriting Agreement is a legal document that governs the issuance of variable annuity contracts and life insurance by the insurance company based in Phoenix, Arizona. This agreement outlines the terms and conditions under which these financial products are underwritten and sold to policyholders. The agreement contains various important provisions that protect the interests of both the insurance company and the policyholders. It establishes the responsibilities and obligations of each party involved in the underwriting process and sets forth the guidelines for the issuance and management of variable annuity contracts and life insurance policies. Some key aspects covered in the Phoenix Arizona Amended and Restated Principal Underwriting Agreement include: 1. Licensing and Compliance: This agreement ensures that the insurance company complies with all relevant state and federal laws, regulations, and licensing requirements in Phoenix, Arizona, to carry out the underwriting and issuance of variable annuity contracts and life insurance policies. 2. Risk Assessment and Approval: The underwriting agreement outlines the risk assessment process that the insurance company undertakes to determine the eligibility of applicants for variable annuity contracts and life insurance coverage. It establishes guidelines for evaluating the insurability of individuals and the risk associated with offering these financial products. 3. Compensation and Fees: The agreement specifies the compensation structure for the underwriters involved in the issuance of variable annuity contracts and life insurance policies. It defines the commission rates, fees, and other incentives payable to the underwriters for their services in generating and managing business. 4. Termination and Renewal: This agreement defines the circumstances under which the underwriting agreement can be terminated by either party. It also addresses the renewal process, including the conditions for extending the agreement's validity and the communication required for such renewals. 5. Disclosure and Representation: The agreement requires the insurance company to provide accurate and complete disclosure of all material information related to the variable annuity contracts and life insurance policies being offered for underwriting. This ensures that policyholders can make informed decisions about purchasing and maintaining their coverage. Different types of Phoenix Arizona Amended and Restated Principal Underwriting Agreements may exist based on specific product lines or target markets. Examples could include agreements focused on variable annuity contracts offered to retirees, life insurance policies for young families, or contracts tailored for high-net-worth individuals. Each specific agreement may have tailored clauses and provisions designed to address the unique characteristics and needs of the target market segment. In conclusion, the Phoenix Arizona Amended and Restated Principal Underwriting Agreement is a crucial legal document that governs the issuance of variable annuity contracts and life insurance by the insurance company. It ensures compliance with regulatory requirements, defines the underwriting process, outlines compensation structures, and establishes guidelines for disclosure and representation to protect the interests of both the company and policyholders.

Phoenix Arizona Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

How to fill out Phoenix Arizona Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

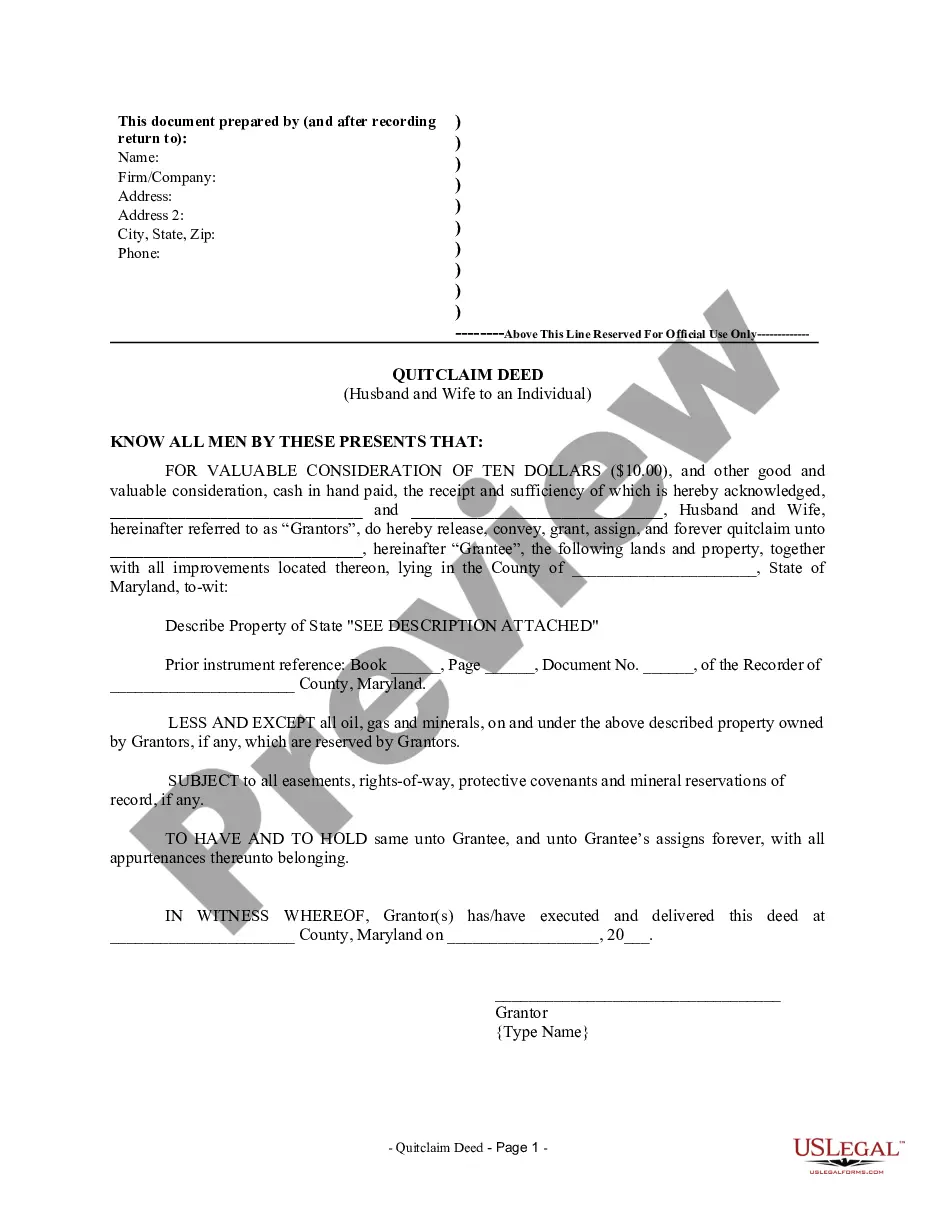

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Phoenix Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Phoenix Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Phoenix Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!