The Wayne Michigan Amended and Restated Principal Underwriting Agreement is a legal document that outlines the terms and conditions for the issuance of variable annuity contracts and life insurance products in Wayne, Michigan. This agreement is a crucial component of the underwriting process, as it governs the relationship between the insurance company and the underwriters or investment firms involved in the issuance. Keywords: Wayne Michigan, Amended and Restated Principal Underwriting Agreement, variable annuity contracts, life insurance, underwriting process, insurance company, underwriters, investment firms. The Wayne Michigan Amended and Restated Principal Underwriting Agreement provides a detailed framework for the sale and distribution of variable annuity contracts and life insurance policies in Wayne, Michigan. It establishes the rights and obligations of the insurance company and the underwriters during the underwriting process, ensuring compliance with applicable laws and regulations. Under this agreement, the insurance company specifies the terms and conditions under which the variable annuity contracts and life insurance policies can be issued. It lays out provisions regarding the pricing, minimum funding requirements, surrender charges, death benefits, and other important features associated with the products. The agreement defines the roles and responsibilities of the underwriters, including their obligations to perform due diligence, assess risks, and market the variable annuity contracts and life insurance policies. It outlines the compensation structure for the underwriters, including commissions or fees they are entitled to receive for their services. Additionally, the Wayne Michigan Amended and Restated Principal Underwriting Agreement may include provisions for the termination or amendment of the agreement, as well as mechanisms for dispute resolution between the insurance company and the underwriters. Different types of Wayne Michigan Amended and Restated Principal Underwriting Agreements may exist depending on various factors, such as the insurance company involved, the specific products being underwritten, and any unique state or regional requirements. Some potential variations may include agreements specific to certain insurance companies, agreements tailored to variable annuity contracts versus life insurance policies, or agreements amended to comply with updated regulatory guidelines. In summary, the Wayne Michigan Amended and Restated Principal Underwriting Agreement plays a crucial role in facilitating the issuance of variable annuity contracts and life insurance policies in Wayne, Michigan. It establishes the expectations, rights, and responsibilities of the insurance company and underwriters, ensuring a smooth and compliant underwriting process.

Wayne Michigan Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

How to fill out Wayne Michigan Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Wayne Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Wayne Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Wayne Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance:

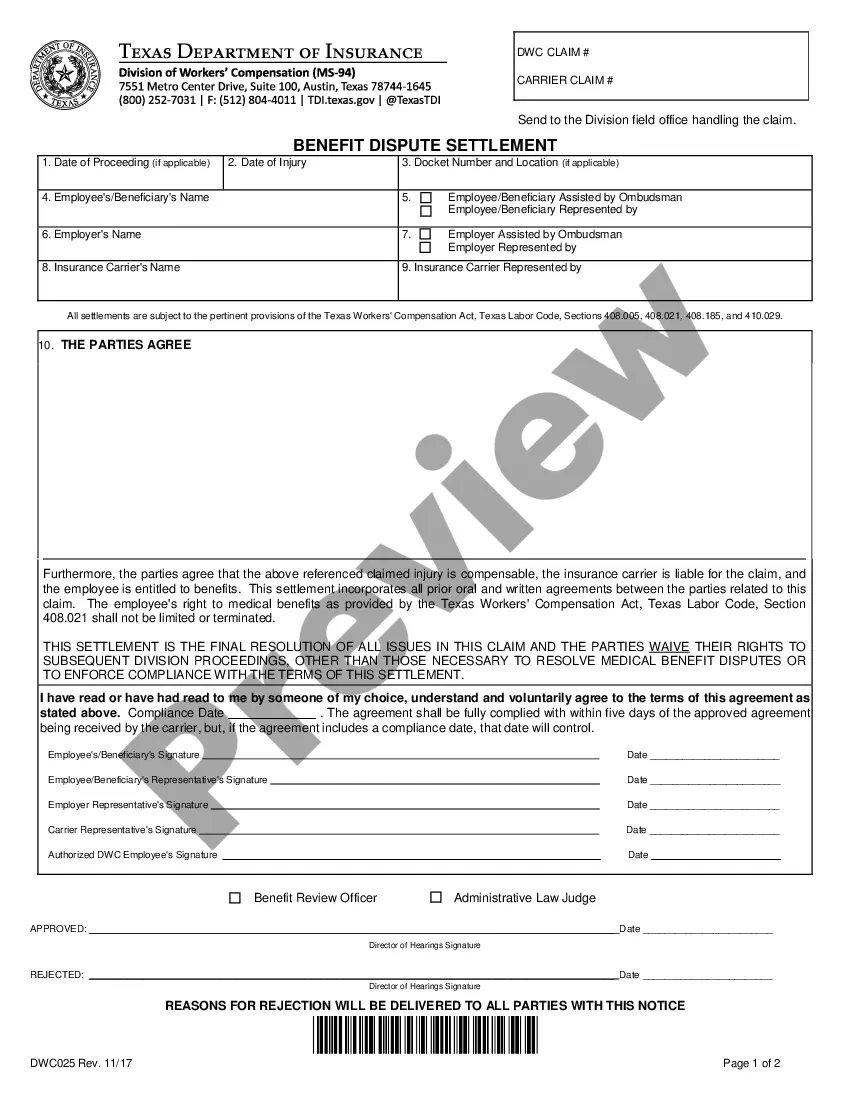

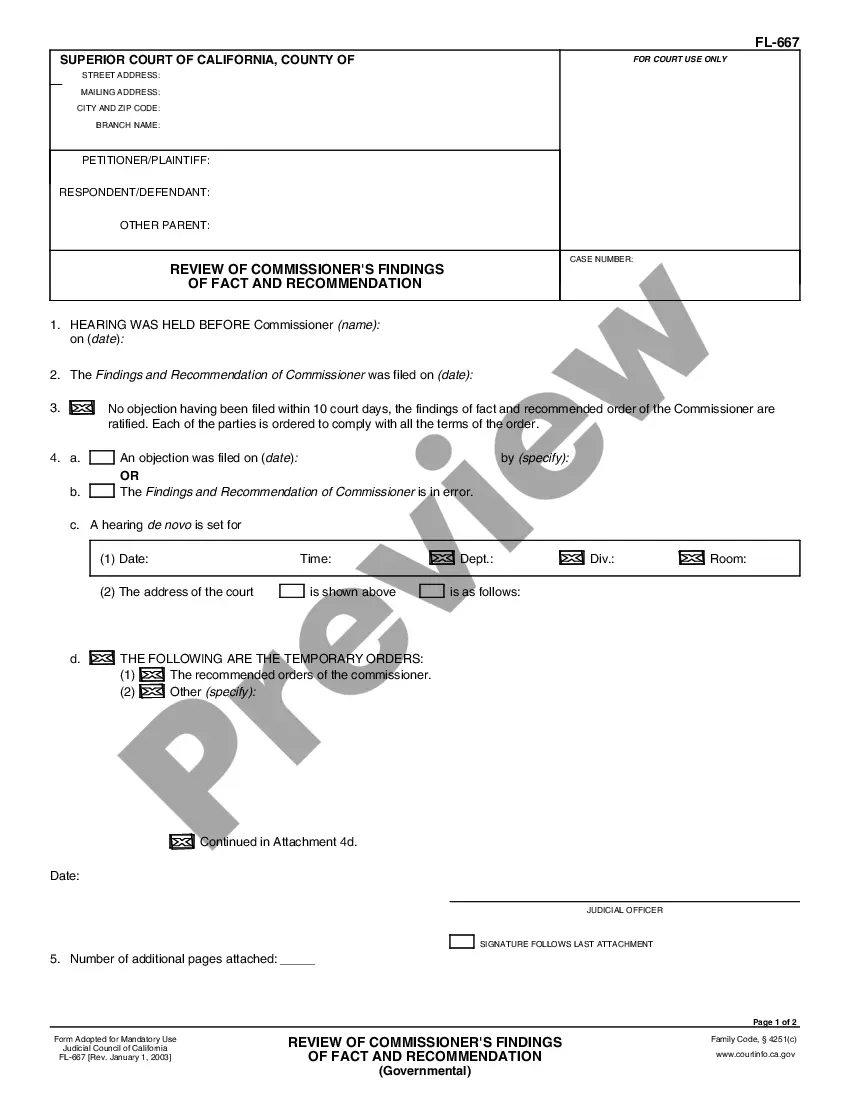

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!