A Chicago Illinois Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York is a specific legal contract that outlines the terms and conditions for participation in an investment fund offered by Lincoln Life and Annuity Company of New York (LLANO) within the state of Illinois. This agreement is designed to establish a clear understanding between the participating investor and LLANO regarding their rights, obligations, and responsibilities. The purpose of the agreement is to provide individuals with the opportunity to invest in a variable insurance products fund offered by LLANO in Chicago, Illinois. Variable insurance products are investment options that allow policyholders to allocate their premiums among different investment options, typically comprising mutual funds. By signing the Chicago Illinois Participation Agreement, investors agree to contribute a certain amount of money or assets to the variable insurance products fund. The agreement will specify the types of assets that can be contributed, such as cash, stocks, or bonds. The terms also outline the process for allocating these contributions among various investment options within the fund. The agreement will detail the fees and expenses associated with participation in the fund, including any management fees, administrative costs, or sales charges that may be applicable. It will also highlight any potential risks and provide a disclaimer specifying that the investor assumes the risk of potential investment losses. Moreover, the participation agreement will establish the duration of the investment and any limitations on withdrawals or transfers of funds. This ensures that both LLANO and the investor have a clear understanding of the time commitment and liquidity options associated with the investment. In addition to the standard Chicago Illinois Participation Agreement, there may be variations or different types of participation agreements offered by LLANO for specific investment options or investor categories. These variations could include agreements tailored for different risk appetites, investment strategies, or target markets. Some common variations may encompass options like equity funds, bond funds, balanced funds, or target-date funds. It is essential for individuals considering participation in a variable insurance products fund with LLANO to review the participation agreement thoroughly, seeking legal or financial advice if necessary, to ensure a comprehensive understanding of the terms and conditions they are entering into. This will enable investors to make informed decisions based on their financial goals, risk tolerance, and investment preferences.

Chicago Illinois Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

How to fill out Chicago Illinois Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Chicago Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York without professional assistance.

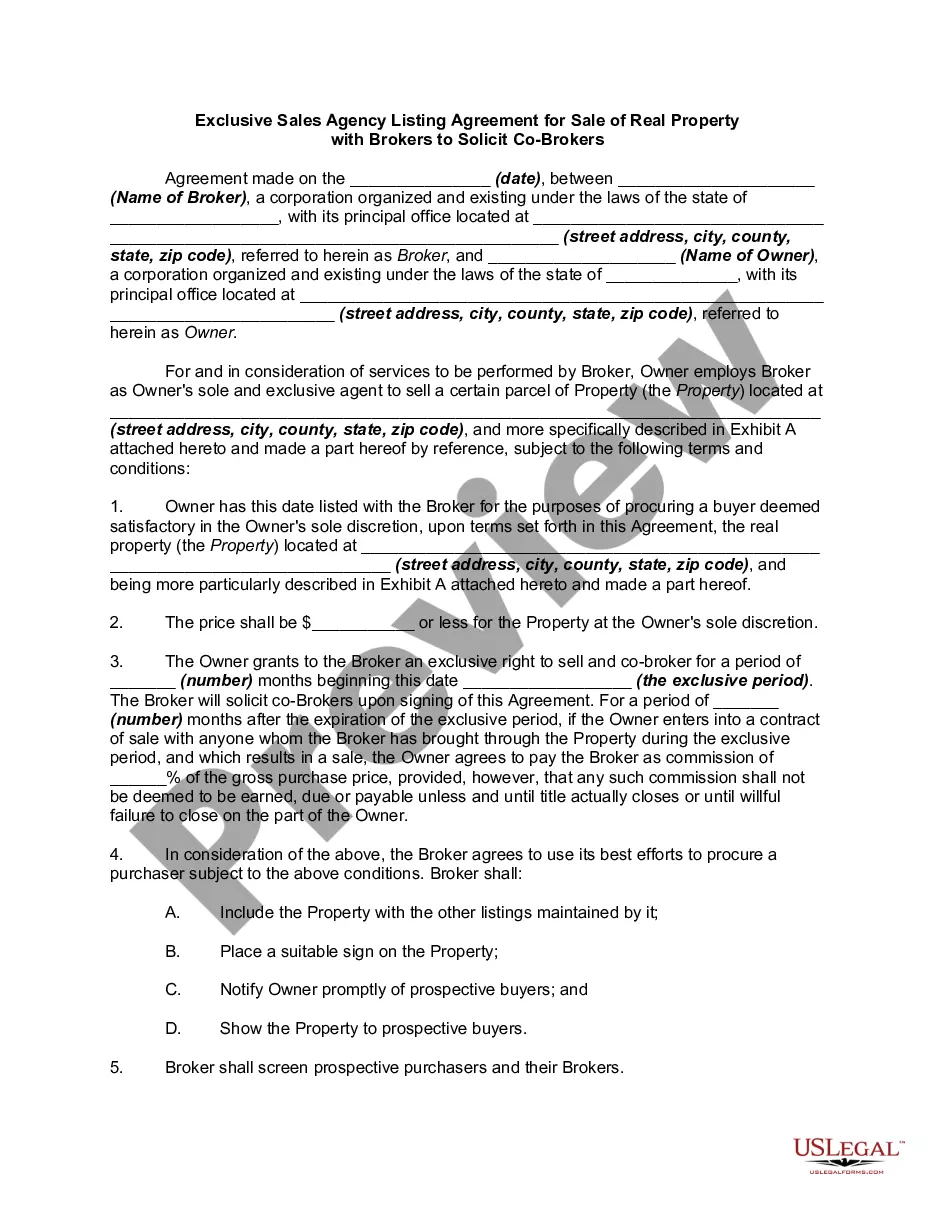

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Chicago Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Chicago Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!