The Travis Texas Participation Agreement is a contractual arrangement between Variable Insurance Products Fund, III, and Lincoln Life and Annuity Company of New York. It outlines the terms and conditions of their collaboration, specifically related to investment products and services in the state of Texas. This agreement serves as a mechanism to enable Lincoln Life and Annuity Company of New York to offer variable insurance products to customers in Texas through the participation of Variable Insurance Products Fund, III. The agreement allows for the pooling of resources and expertise, ensuring a broader range of investment options for policyholders in the state. Under this agreement, Variable Insurance Products Fund, III acts as a financial vehicle that offers a variety of investment products, such as variable annuities and other variable insurance policies. By participating in this agreement, Lincoln Life and Annuity Company of New York gains access to these investment products to offer to its customers in Texas. The Travis Texas Participation Agreement sets forth the specific terms and conditions of the relationship between the two entities, including the responsibilities, obligations, and liabilities of each party. It governs the manner in which investment transactions are conducted and outlines the regulatory compliance requirements that need to be met. Regarding the different types of Travis Texas Participation Agreements, there can be variations based on the specific investment products being offered or the nature of the collaboration between Variable Insurance Products Fund, III, and Lincoln Life and Annuity Company of New York. Examples could include agreements specifically tailored for variable annuities or agreements with additional provisions for specific product offerings. Keywords: Travis Texas Participation Agreement, Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, investment products, variable insurance policies, variable annuities, pooling of resources, contractual arrangement, investment options, Texas, customer, collaboration, financial vehicle, terms and conditions, responsibilities, obligations, liabilities, investment transactions, regulatory compliance requirements.

Travis Texas Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

How to fill out Travis Texas Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

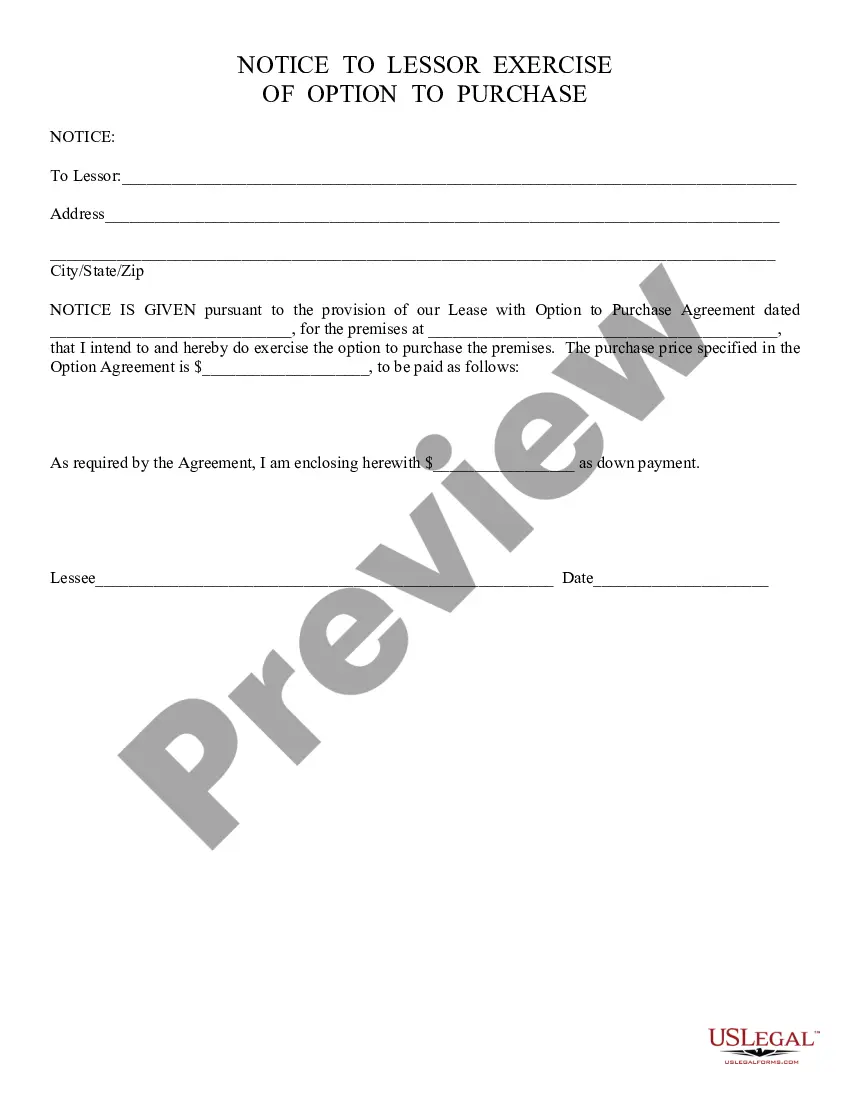

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Travis Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any activities related to document completion straightforward.

Here's how to purchase and download Travis Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Check the similar document templates or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Travis Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Travis Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an extremely complicated case, we advise getting a lawyer to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!

Form popularity

FAQ

An annuity is a financial product offered by insurance companies to provide investors with a steady income stream in retirement. Investors make a lump sum payment or a series of payments, and the annuity pays a specific amount back to them in regular distributions either immediately or at some point in the future.

An annuity provides steady, reliable monthly income for your entire life. And if you want that income to start now, or within a year from now, consider an immediate annuity. It's the simplest, most straightforward type of annuity you can buy. And you'll know from day one how much income you will receive.

Is an annuity a life insurance policy? No, an annuity is an investment product you purchase all at once that earns interest and, after a set time frame or when certain conditions are met, starts paying out. It may be offered by life insurance companies, but it's not technically a life insurance policy.

Annuities can provide a reliable income stream in retirement, but if you die too soon, you may not get your money's worth. Annuities often have high fees compared to mutual funds and other investments. You can customize an annuity to fit your needs, but you'll usually have to pay more or accept a lower monthly income.

Broker-dealers, wirehouses, insurance companies, and even some financial planners can sell a huge variety of investments, from stock options and bonds to annuities and commodities futures. But a registered investment advisor (RIA) sells none of these.

A life annuity is a financial product that features a predetermined periodic payout amount until the death of the annuitant. Annuitants pay premiums or make a lump-sum payment to secure a life annuity. Life annuities are commonly used to provide or supplement retirement income.

A registered index-linked annuity (RILA) is a tax-deferred long-term savings option that limits exposure to downside risk and provides the opportunity for growth. It offers more growth potential than a fixed-indexed annuity but less potential return and less risk than a variable annuity.

Pacific Life received high ratings from each, as A.M. Best ranked it at A+ (superior), Fitch and S&P each ranked it at AA- (very strong) and Moody's ranked it at A1 (good).

A variable annuity designed to help protect wealth through tax-efficient investing. Growth powered by tax deferral. Investments powered by excellence. Income powered by innovation. This is Lincoln Investor Advantage® RIA Class.

Annuities: Annuity commissions are generally built into the price of the contract. Commissions usually range anywhere from 1% to 10% of the entire contract amount, depending on the type of annuity. For example, fixed-indexed annuities generally earn advisors a 4% commission.