The Orange California Stock Exchange Agreement and Plan of Reorganization is a legal document that outlines the terms and conditions of a merger or acquisition between Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and their respective stockholders. This agreement facilitates the combination of these entities, allowing them to pool their resources and consolidate their operations in order to achieve growth and enhance shareholder value. This agreement provides a detailed framework for the merger, including the exchange ratio, which determines the number of shares of the acquiring company's stock that will be received by the target company's stockholders in exchange for their shares. The agreement also outlines the process for determining the value of the companies involved, as well as the composition of the board of directors and management team of the newly merged entity. One type of Orange California Stock Exchange Agreement and Plan of Reorganization by Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders is a horizontal merger, where two companies in the same industry combine their operations to achieve economies of scale and market dominance. This type of merger allows the companies to eliminate duplication, improve efficiency, and increase market share. Another type is a vertical merger, where companies operating at different stages of the supply chain or in complementary sectors merge to enhance their competitiveness and create synergies. This type of merger enables companies to achieve cost savings, gain access to new markets, and expand their product offerings. Additionally, there may be a conglomerate merger, where unrelated businesses merge to diversify their operations and reduce risk. This type of merger allows companies to benefit from cross-selling opportunities, economies of scope, and improved financial stability. The Orange California Stock Exchange Agreement and Plan of Reorganization by Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders serves as a legally binding document that ensures all parties involved in the merger are protected and their rights and interests are adequately addressed. It also provides a roadmap for the successful integration of the two entities, outlining the steps and timeline for the consolidation of operations, systems, and personnel. Overall, the Orange California Stock Exchange Agreement and Plan of Reorganization represents a strategic move by the companies involved to strengthen their position in the market, achieve growth, and maximize shareholder value through a carefully negotiated and executed merger or acquisition.

Orange California Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders

Description

How to fill out Orange California Stock Exchange Agreement And Plan Of Reorganization By Jenkon International, Inc., Multimedia K.I.D. Intelligence In Education, Ltd., And Stockholders?

Creating forms, like Orange Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders, to manage your legal matters is a tough and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for different cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Orange Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Orange Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders:

- Ensure that your form is specific to your state/county since the regulations for writing legal documents may differ from one state another.

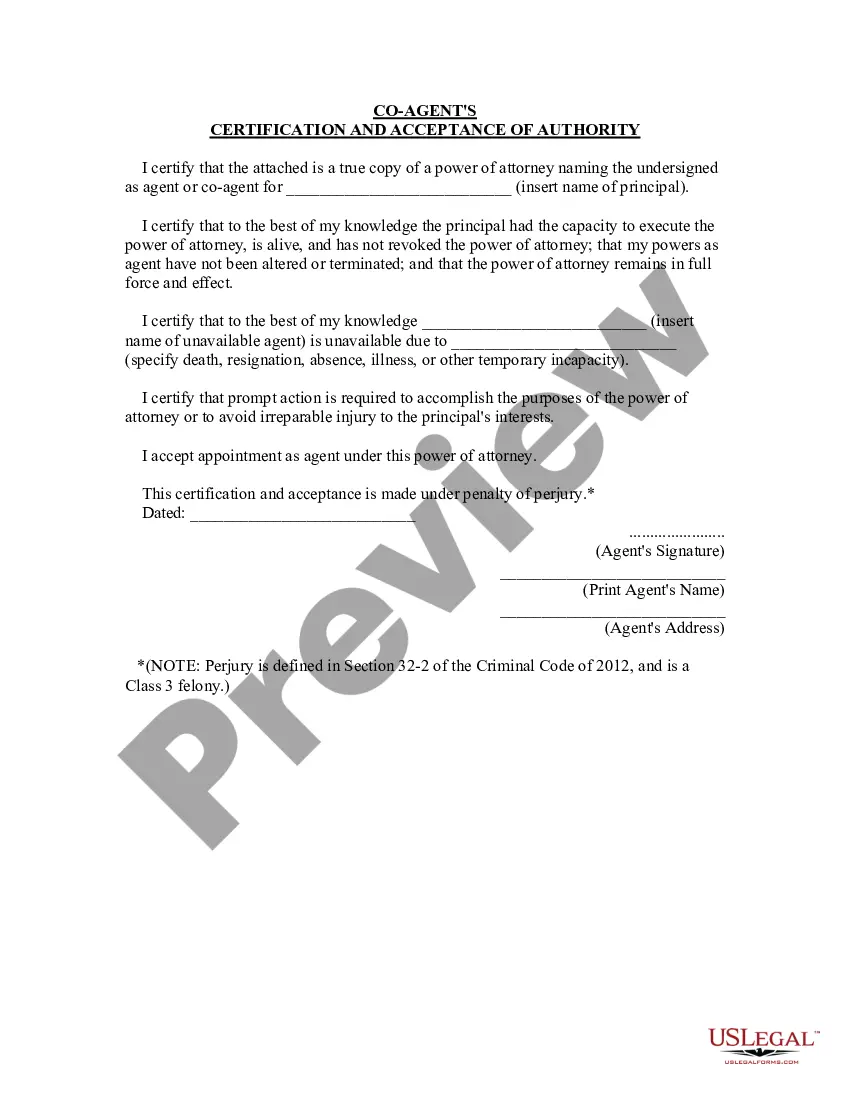

- Discover more information about the form by previewing it or going through a quick description. If the Orange Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!