Broward Florida Deposit Agreement: A Comprehensive Overview of Deposit Agreements in Broward County Introduction: A Broward Florida Deposit Agreement is a legal document that outlines the terms and conditions between a depositor and a financial institution located in Broward County, Florida. This agreement governs the relationship between the depositor and the bank, detailing how the deposited funds will be handled, the rights and responsibilities of both parties, and any associated fees or charges. Broward County, Florida, being a major financial hub, offers different types of deposit agreements tailored to meet the unique needs of various individuals and businesses. Types of Broward Florida Deposit Agreements: 1. Savings Account Deposit Agreement: This type of deposit agreement is designed for individuals who wish to securely store their funds in a savings account while earning a competitive interest rate. The agreement defines the minimum balance requirements, interest rates, withdrawal limitations, and any penalties associated with early withdrawals. 2. Checking Account Deposit Agreement: Targeted towards individuals and businesses, a checking account deposit agreement allows easy access to deposited funds for everyday transactions. The agreement specifies check clearing processes, minimum balance requirements, possible overdraft fees, and other relevant terms related to check writing and account management. 3. Certificate of Deposit (CD) Agreement: A CD is a deposit agreement that offers a fixed interest rate for a specified period, usually ranging from a few months to several years. This agreement requires the depositor to keep the funds untouched until the maturity date to earn the full interest. The CD agreement outlines the terms, interest rates, penalties for early withdrawal, and automatic renewal options. 4. Business Deposit Agreement: Tailored to meet the needs of business entities, this agreement includes provisions for business-related banking services, such as merchant services, remote deposit capture, business savings accounts, and tailored cash management solutions. It encompasses specific terms related to business transactions, multiple signatories, unique banking requirements, and potential fees. Key Elements of Broward Florida Deposit Agreements: 1. Account Ownership: Defines the ownership and beneficiaries associated with the deposit account, including joint accounts, payable-on-death (POD) accounts, and trust accounts. 2. Deposit Terms: Outlines the minimum deposit requirement, allowable account balances, interest rates (if applicable), and any limitations or restrictions associated with the account. 3. Withdrawal Terms: Specifies the methods and limitations for withdrawing funds, including ATM withdrawals, ACH transfers, and in-person withdrawals. It also covers overdraft protection options and associated fees, if any. 4. Fee Schedule: Details the fees and charges related to the account, including monthly maintenance fees, overdraft fees, wire transfer fees, stop payment fees, and other potential charges. 5. Account Closure: Outlines the procedures for closing the account, including necessary documentation and any penalties that may apply. 6. Dispute Resolution: Provides the process for resolving any disputes arising from the agreement, including mediation or arbitration options. Conclusion: A Broward Florida Deposit Agreement is an essential document that governs the legal relationship between a depositor and a financial institution in Broward County. By understanding the specific terms and conditions outlined in the agreement, depositors can confidently manage their accounts, ensuring their funds are secure while enjoying the benefits and convenience offered by the various types of deposit agreements available in Broward County.

Broward Florida Deposit Agreement

Description

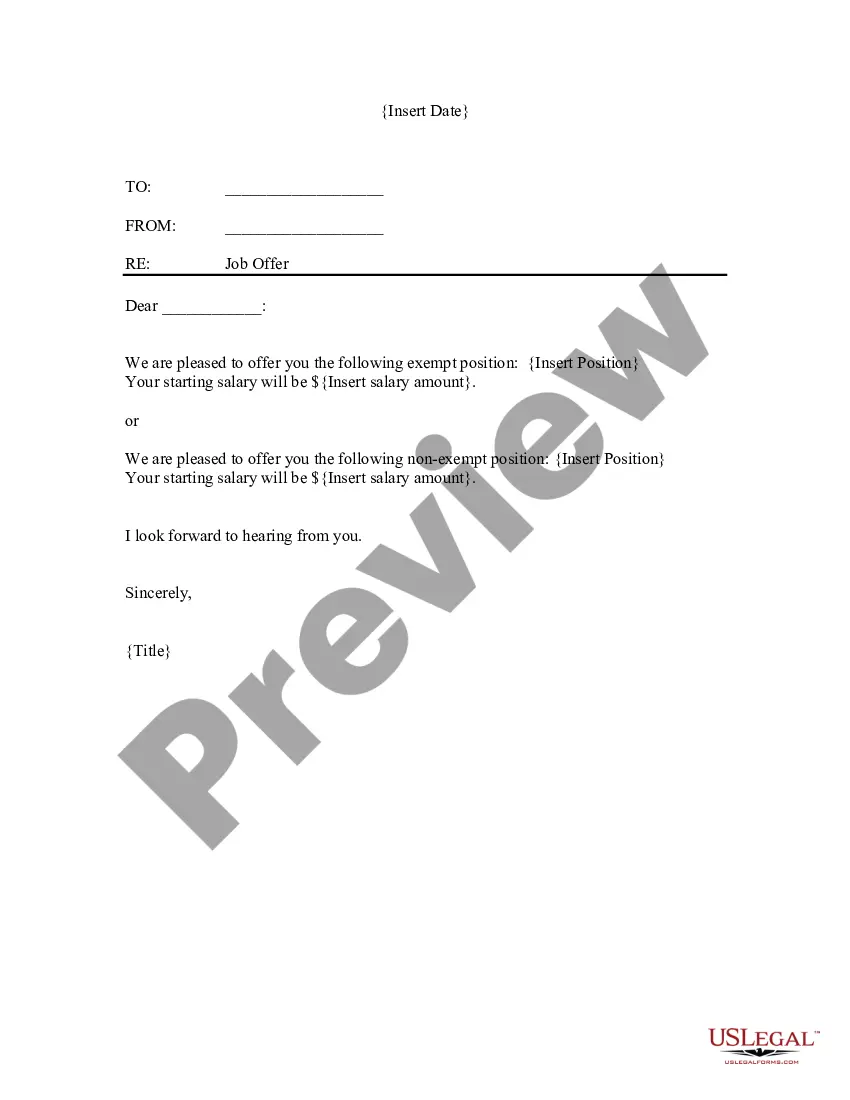

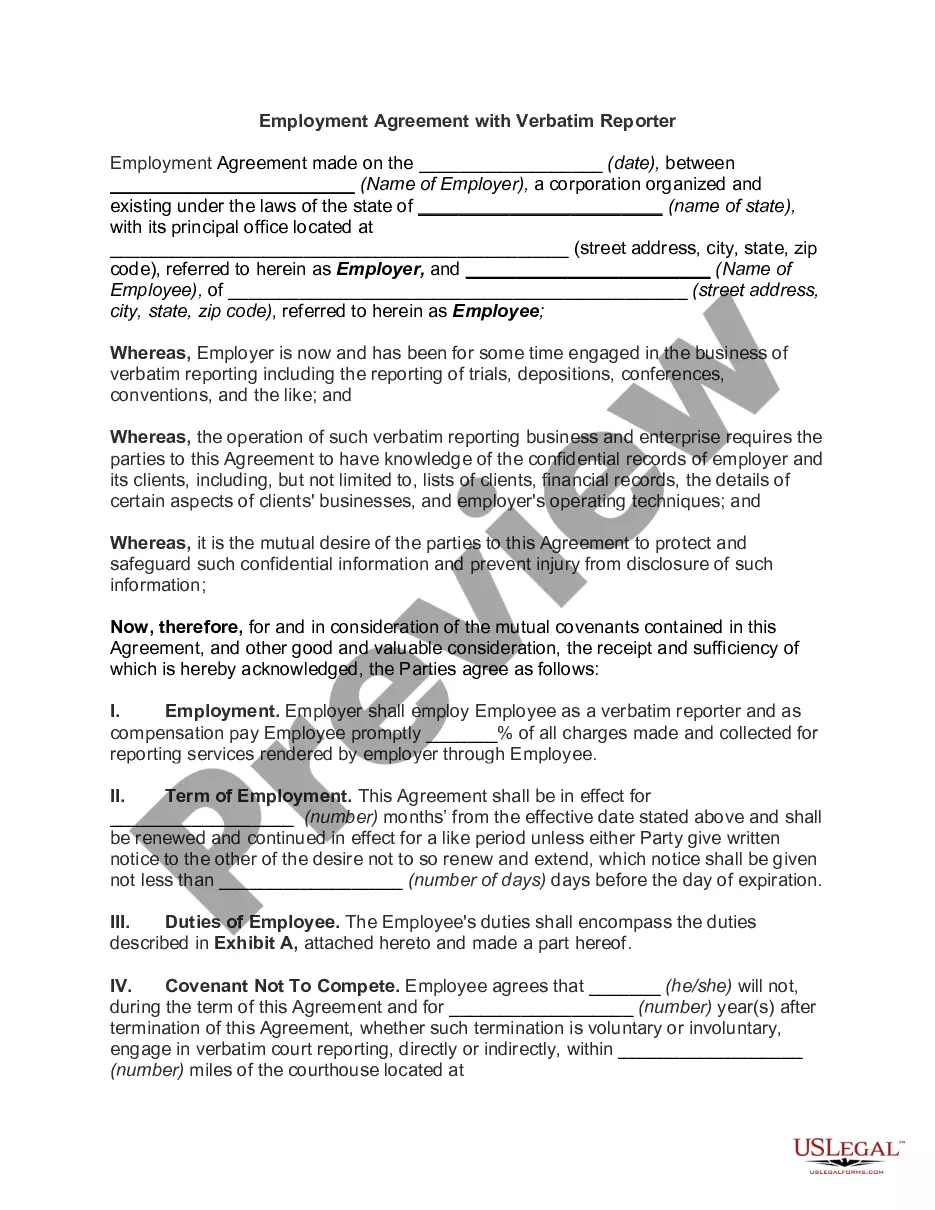

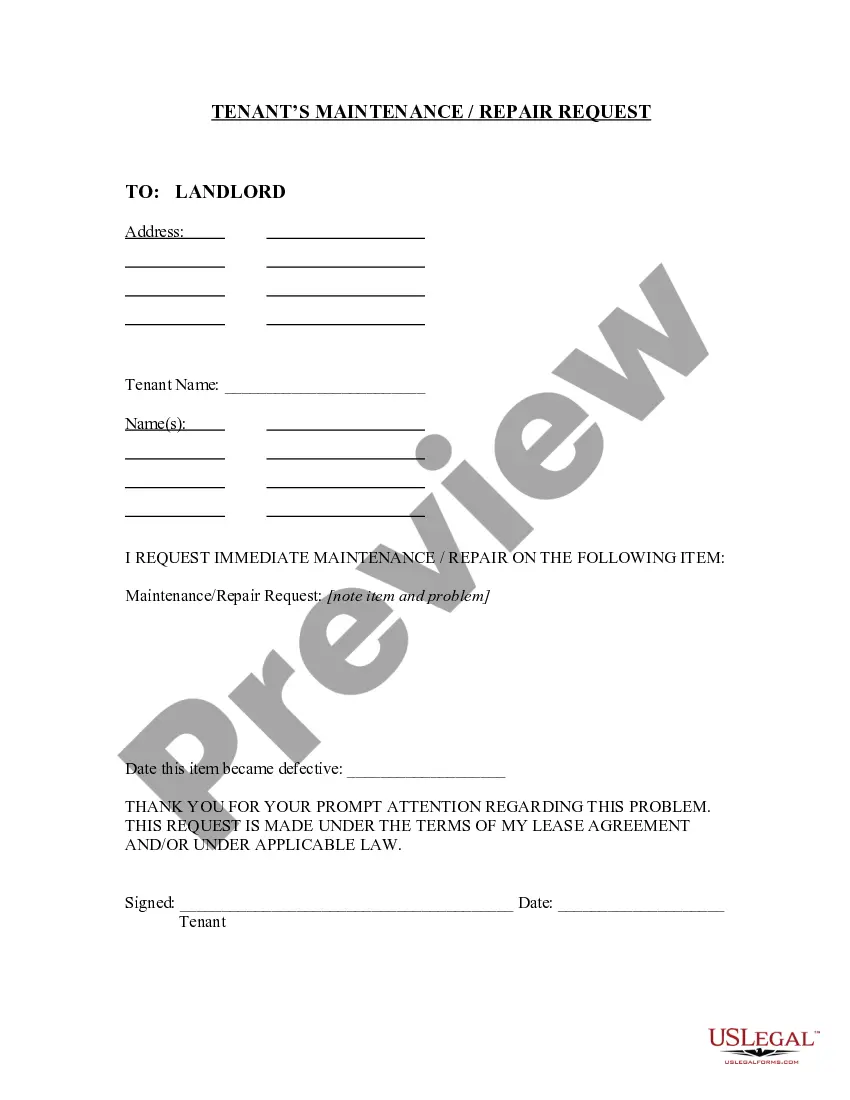

How to fill out Broward Florida Deposit Agreement?

If you need to get a trustworthy legal form provider to find the Broward Deposit Agreement, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to find and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Broward Deposit Agreement, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Broward Deposit Agreement template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Broward Deposit Agreement - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

To attach a lien, the creditor must record the judgment with the county recorder in any Florida county where the debtor owns real estate now or may own real estate in future. For liens on personal property, the creditor files the judgment with the Florida Department of State.

BROWARD COUNTY, Fla. The federal moratorium on residential evictions for COVID-related non-payment of rent ended on Saturday and the Broward Sheriff's Office will now begin serving eviction orders throughout the county.

CAN I BE EVICTED during the COVID-19 crisis in Broward County? A landlord cannot legally evict a tenant without a court order. It is illegal for your landlord to lock you out, turn off utilities like electric or water, remove the front door, or take other steps to force you to move.

Consumer File a Written Complaint. eMail consumer@broward.org200b Report in person at Government Center West, 1 N. University Drive, Plantation, FL 33324. Call the Broward County Call Center at 311 or 954-831-4000 (AM to 5PM, Monday through Friday)

VALID FORMS OF PAYMENT Cash, Cashier's Check, Bank Official Check, Money Order, Attorney Trust Account check, or American Express, MasterCard or Visa credit cards. (Proper identification is required when paying in person by credit card.) NO PERSONAL CHECKS ARE ACCEPTED.

Step 3: File the lien claim with the Broward County Clerk's Office. Your lien claim must follow all Broward County requirements including the appropriate margins and pay all fees.

Contact Captain Warnell Phillips or call the Central Broward District Office non-emergency number at 954-321-4800. See crime in your area.

How Long is the Process with Broward County Eviction Lawyers? Broward has a large population of Tenants. As a result, there are significant number of Evictions. Despite the amount, it takes 4 to 5 weeks.

There are also 2,260 pending evictions in Broward County. In Miami-Dade County, there are 7,019 pending evictions. For well over a year, residential evictions were halted as long as renters cooperated with their landlord and filed paperwork.

Are there any special eviction protections for Florida renters during the COVID-19 emergency? The national CDC eviction moratorium ended on August 26, 2021. Please reach out to legal services if you are worried about eviction. Florida's statewide eviction protections have expired.