The Maricopa Arizona Deposit Agreement is a legal document that outlines the terms and conditions between a depositor and a financial institution in Maricopa, Arizona. It serves as a contract and provides important information regarding the deposit of funds, interest rates, fees, and other related details. In Maricopa, Arizona, there are primarily two types of Deposit Agreements offered by financial institutions: checking account agreements and savings account agreements. 1. Maricopa Arizona Checking Account Agreement: This type of deposit agreement is designed for individuals or businesses who want a convenient way to manage their day-to-day banking needs. The agreement outlines the terms related to cash deposits, check clearance, debit card usage, online banking, and other services offered by the bank. It also specifies any fees associated with maintaining the account, such as monthly maintenance fees, ATM surcharges, or overdraft charges. 2. Maricopa Arizona Savings Account Agreement: A savings account deposit agreement is created for individuals who wish to save money while earning interest. The agreement provides details on the interest rate, minimum deposit requirement, frequency of interest payments, and any penalties for early withdrawal. Additionally, it may include information on additional services that the financial institution offers to enhance savings, such as automatic transfers or the option to link the savings account to a checking account for overdraft protection. Both checking and savings account agreements may also include clauses related to account closures, dormant account fees, account statements, fraud prevention, and dispute resolution procedures. These agreements are usually provided to customers when opening a new account or can be obtained by requesting a copy from the financial institution. When considering a Maricopa Arizona Deposit Agreement, it is important for individuals or businesses to carefully review the terms and conditions to understand their rights and obligations. Comparing different deposit agreements from various banks can help customers choose the one that best fits their needs and financial goals. Additionally, seeking professional advice or guidance from qualified financial experts can assist in making informed decisions regarding deposit agreements in Maricopa, Arizona.

Fssresearch Maricopa Gov

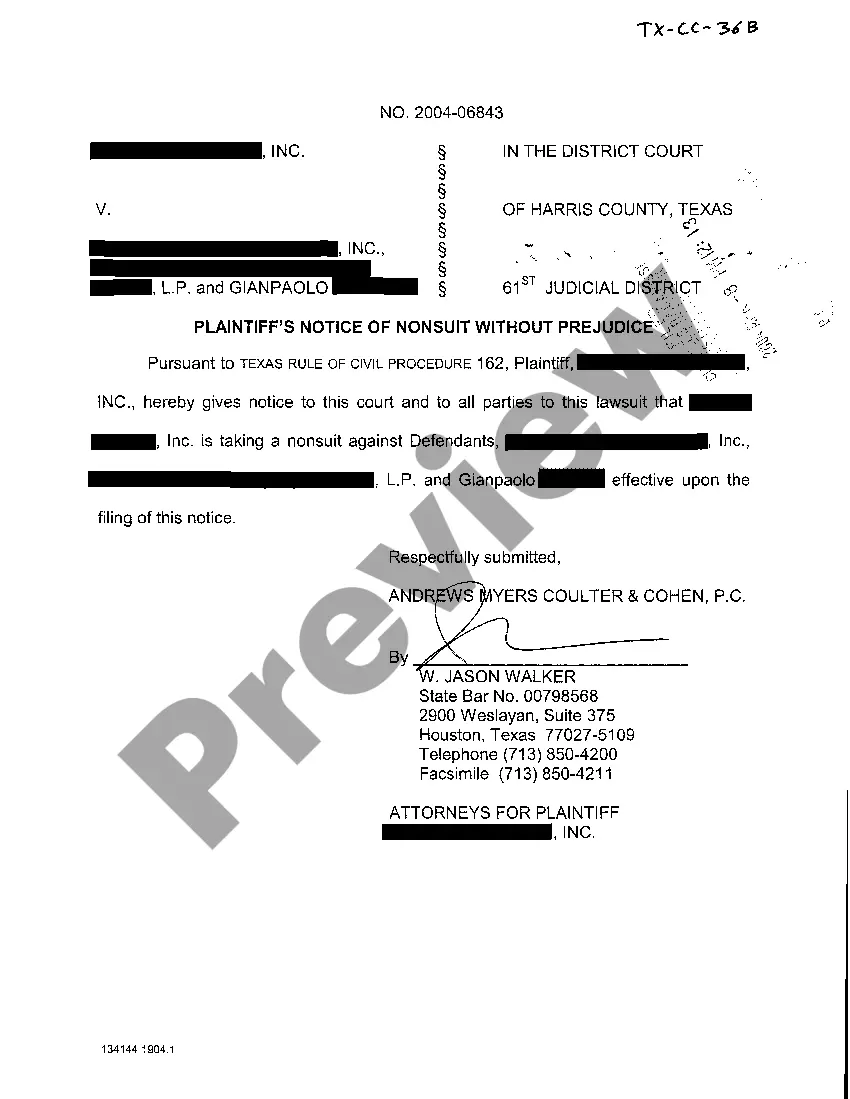

Description

How to fill out Maricopa Arizona Deposit Agreement?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Maricopa Deposit Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Deposit Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Deposit Agreement:

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!