San Diego, California Deposit Agreement: A Comprehensive Guide In San Diego, California, a deposit agreement is a legally binding contract that outlines the terms and conditions regarding the handling and return of deposits for various transactions. These agreements aim to protect the interests of both parties involved — the depositor and the receiver. One type of San Diego, California Deposit Agreement commonly used is the Rental Deposit Agreement. This agreement is signed between a tenant and a landlord/property owner. It specifies the amount of money deposited as security for any potential damages or unpaid rent during the lease period. Additionally, it lists the conditions for the return of the deposit, including deductions for repairs and cleaning if necessary. Another common type is the Escrow Deposit Agreement, which applies to real estate transactions. Here, a buyer deposits a certain amount of money into an escrow account as a sign of good faith to complete the purchase. This agreement sets forth the terms for the release of funds to the seller or returning them to the buyer if the transaction falls through. Moreover, San Diego, California Deposit Agreements may also pertain to personal banking services, such as Certificates of Deposit (CDs), where individuals deposit funds into an account for a fixed period, typically ranging from a few months to several years. These agreements specify the interest rate, term, and withdrawal terms associated with the deposit. Regardless of the type of deposit agreement, certain essential elements are typically included. These elements may involve: 1. Parties Involved: Clearly identifying the depositor and the receiver of the deposit, their contact details, and any other relevant information. 2. Deposit Amount: Stating the exact amount of money being deposited, along with any requirements for minimum deposit thresholds if applicable. 3. Purpose: Defining the purpose of the deposit, whether it is for rental security, real estate transactions, or banking services like CDs. 4. Terms and Conditions: Enumerating the terms regarding the handling, maintenance, and return of the deposit, including any deductions or penalties. 5. Dispute Resolution: Outlining the procedures for resolving any disputes that may arise during the deposit agreement's duration. 6. Governing Law: Specifying the legal jurisdiction that governs the deposit agreement and any additional provisions pertaining to California or San Diego statutes. San Diego, California Deposit Agreements serve as crucial documents to safeguard the interests of involved parties. Whether it is a rental deposit, escrow deposit, or CD, these agreements ensure transparency, fairness, and provide a clear understanding of the responsibilities of both parties.

San Diego California Deposit Agreement

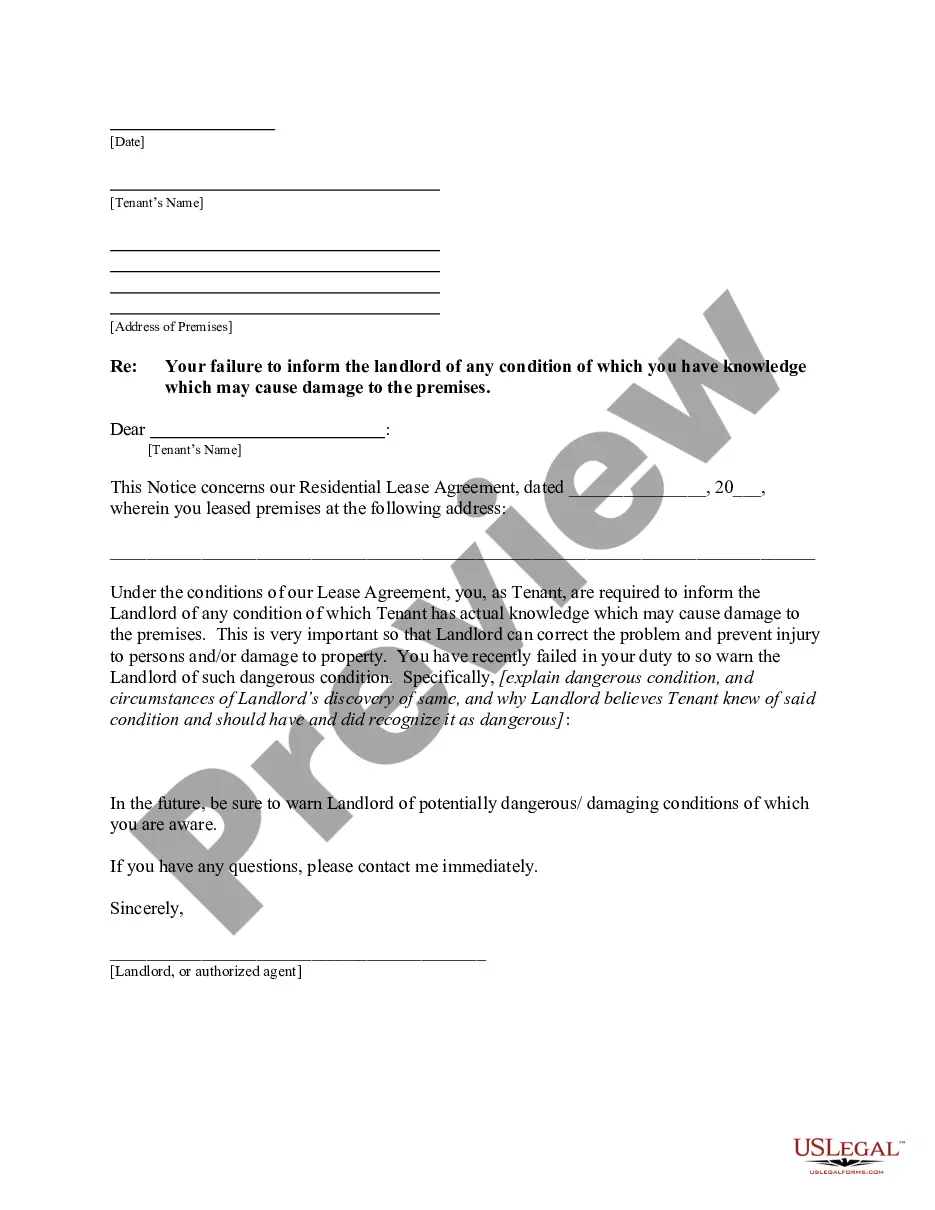

Description

How to fill out San Diego California Deposit Agreement?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business objective utilized in your region, including the San Diego Deposit Agreement.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the San Diego Deposit Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the San Diego Deposit Agreement:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Diego Deposit Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!